Amid shifting geopolitical tensions and the need to revitalise its economy, Germany is preparing for a massive fiscal stimulus that will allocate up to $1 trillion in defence and infrastructure spending over the next 12 years. This spending plan will require borrowing beyond Germany’s debt ceiling, although emergency spending is exempt from these limits. The package includes significant funding for the repair of critical infrastructure, such as bridges and roads, as well as investments in climate change initiatives. While the full impact of this spending is yet to unfold, we outline key elements in our model that could drive a higher-than-expected forecast, particularly due to changes in government spending.

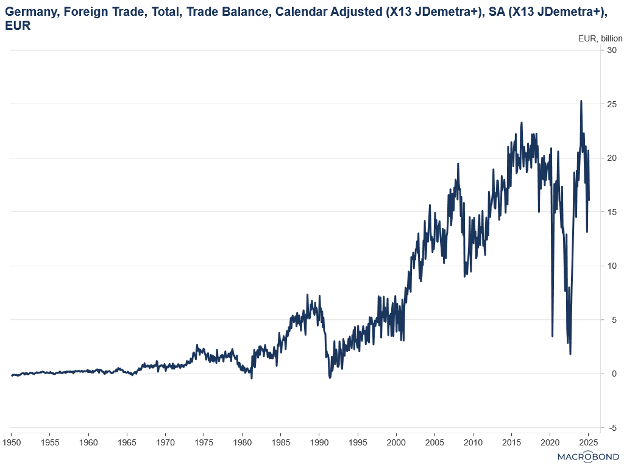

Germany’s economy is largely driven by exports, but in recent years, external demand has weakened due to geopolitical instability and uncertainty. These challenges have led to a steady decline in Germany’s trade balance, coinciding with weaker industrial production, which dropped 1.49% YoY in February 2025 (Figure 1).

Figure 1

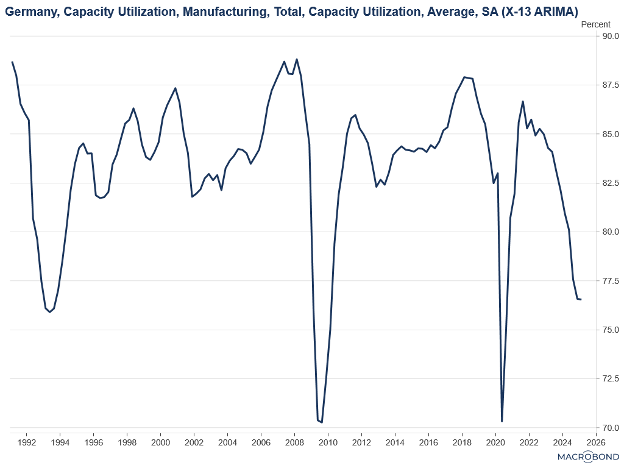

The defense package will take effect at a vulnerable time for German manufacturing. Lower demand has forced firms to keep capacity utilization low —at just 76.5% in January 2025—to mitigate excess supply (Figure 2). Preparing industrial facilities to meet the anticipated surge in domestic production demand will take at least a year, leaving manufacturers with limited capacity to quickly scale up production.

Figure 2

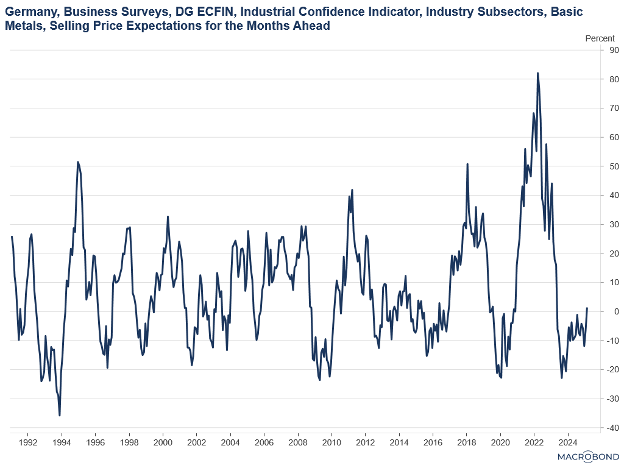

In the meantime, we can expect increased short-term pressure on imports of raw materials from the EU and key trading partners. Strong demand for inputs such as basic metals could drive up the selling prices of German metals, offering some relief to the industry from U.S. tariffs on imported steel and aluminum (Figure 3). Additionally, if other EU members increase defence spending, Germany’s exports of basic metals and steel to other member states could rise, further boosting prices for machinery and equipment that depend on these materials.

Figure 3

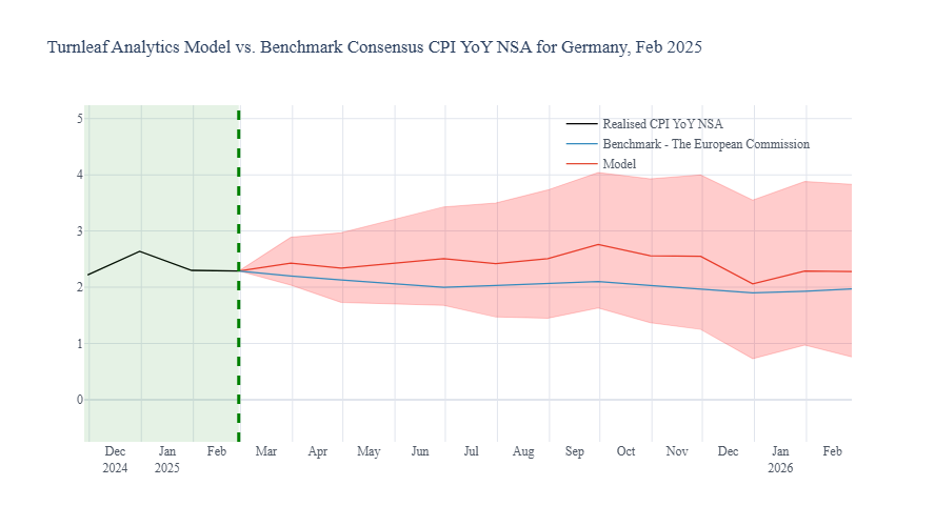

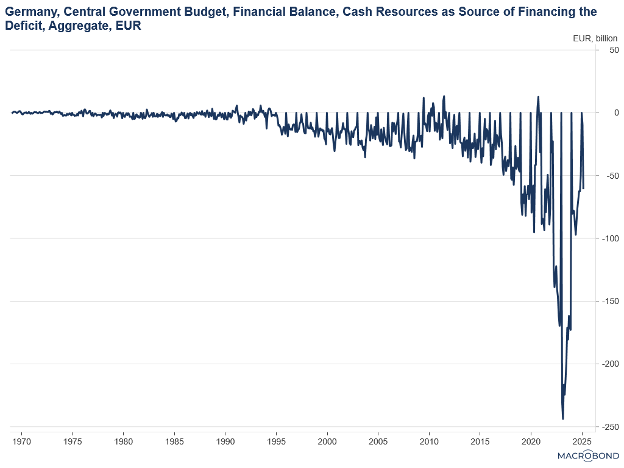

As we assess the potential inflationary impact of Germany’s fiscal policies, a key factor that stands out is government cash financing. Our models have flagged it as a strong driver of upward pressure on inflation. Figure 4 shows that while cash financing remains in a deficit, it is still lower than in previous years, constrained by the debt brake. However, with exemptions to the debt brake, we anticipate deeper borrowing, which will likely push inflation higher as government spending diverges from seasonal trends and stimulates the economy. This inflationary impact will likely be more pronounced in the medium term as the investments from the fiscal stimulus begin to materialize and take effect.

Figure 4

Turnleaf anticipates that rapid shifts in fiscal policy, particularly those impacting manufacturing, will significantly influence Germany’s long-term inflation trajectory. As factories gear up for increased orders, we expect inflation to push the tail of our forecast slightly higher, with demand placing an upward pressure on prices. By closely monitoring high-frequency indicators of manufacturing activity and trade performance, we are better positioned to assess the implications for our inflation outlook. We will continue to provide regular updates as the situation evolves.