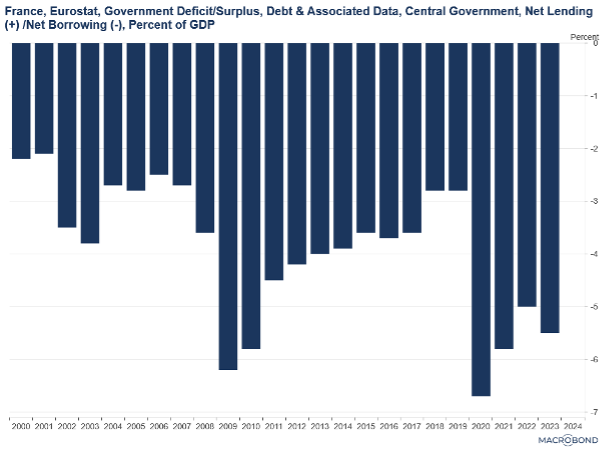

France’s inflation remains near the European Central Bank’s (ECB) 2% target despite significant fiscal spending during the pandemic and in response to the war in Ukraine. However, this spending has sustained a fiscal deficit of 5.5% of GDP since 2023—well above the European Commission’s 3% limit. In July 2024, France was formally placed under the European Commission’s excessive debt procedure, intensifying pressure to rein in spending. France’s inflation outlook hinges on its ability to navigate fiscal and economic challenges within a politically divided government.

Efforts to address the deficit through an austerity package—proposing €60 billion in spending cuts and tax hikes—have plunged the government into crisis. The package sought to reverse pandemic-era tax cuts, such as raising the corporate tax rate from 25% to its pre-pandemic level of 33.5%, and included cuts to welfare, healthcare, pensions, and local government funding. Opposition parties criticized the proposed electricity tax increase, arguing it unfairly burdens households already struggling with rising living costs. Disagreements over the bill’s revisions escalated, leading both far-left and far-right factions to support a no-confidence vote that removed Prime Minister Barnier, effectively bringing the government to a halt.

Political uncertainty adds to the economic strain. Given that Macron held a snap election last summer and is permitted to call another only once per year, the likely outcome of Barnier’s removal is that he will assume a caretaker role until a replacement is found. Macron, for his part, has stated he has no intention of resigning as President, even amid mounting political tension. While this stalemate deepens France’s fiscal challenges, it is unclear whether it will significantly erode investor confidence, as the government remains operational in its essential duties. Looming union strikes over proposed public service cuts threaten further disruption.

Broader Inflation Trends

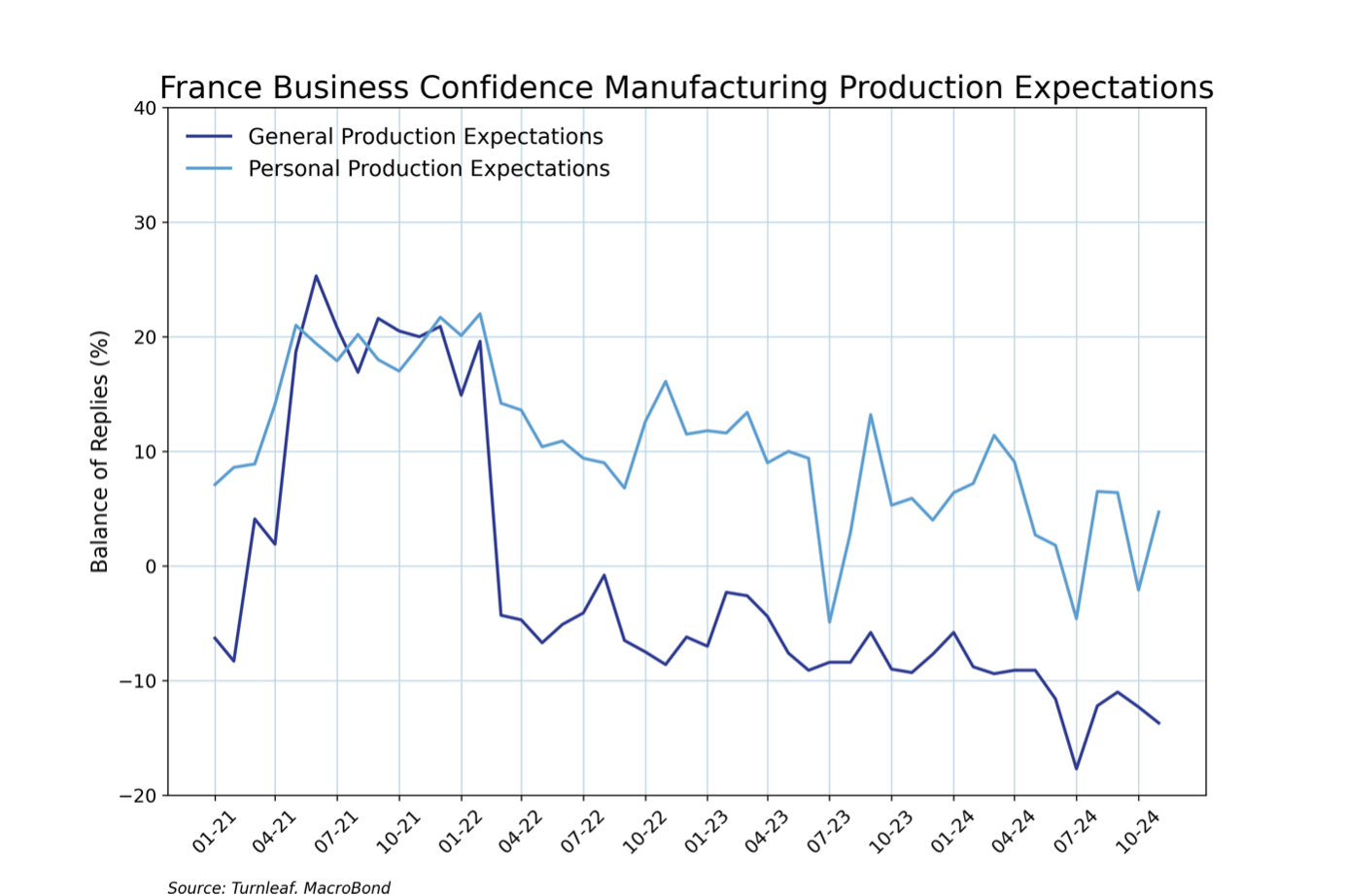

Business and consumer confidence remain weak as high borrowing costs, trade pressures, and sluggish growth weigh on the broader economy. Manufacturing output continues to decline, driven by weaker demand and increased competition in export markets. Rising input costs, such as a 10.37% year-over-year increase in industrial materials in November 2024, have worsened production expectations, with 13.7% more respondents reporting pessimism about general manufacturing production.

The divergence between general industry sentiment and slightly improved personal production outlooks reflects fragmented conditions. Liquidity constraints, with industrial firms’ cash positions falling to -3.4% in October 2024 from -1.5% the previous month, are further limiting investment capacity. Trade tensions add another layer of difficulty, as a depreciating Chinese yuan (down 2.5% Dec 2, 2024 YoY against the Euro) increases competition from low-cost Chinese imports in European markets, particularly as China seeks to mitigate U.S. tariffs.

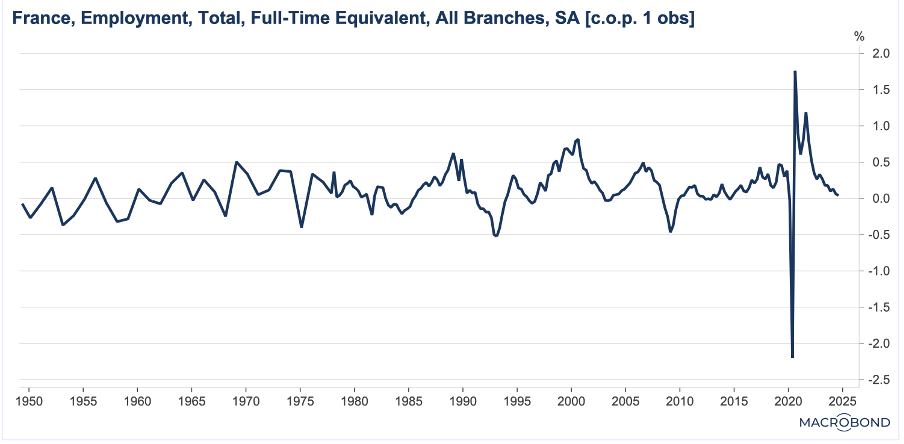

Though inflation has cooled, the cost-of-living crisis continues to erode household purchasing power. In November 2024, consumer surveys showed that 17% more respondents were pessimistic about the economy than optimistic, marking a continuation of a worsening trend. While wages have kept pace with inflation, this support is fading, and employment gains have slowed in recent quarters. Weak domestic demand risks further dampening inflationary pressures but could deepen economic stagnation.

The Role of Fiscal Policy in Shaping Inflation

The Role of Fiscal Policy in Shaping Inflation

France’s fiscal decisions will play a central role in determining its inflation trajectory. Reinstating higher energy taxes would increase household costs and put upward pressure on inflation, while raising corporate taxes could lead businesses to pass on higher costs to consumers. Conversely, sharp fiscal tightening could slow economic activity enough to ease inflation, keeping it near the ECB’s 2% target through 2025. However, if businesses and consumers absorb higher taxes without reducing spending, inflation could rise above expectations.

High debt levels and rising interest payments make fiscal consolidation essential, but poorly calibrated spending cuts risk undermining the economy. The balance between managing deficits and supporting growth will be critical in shaping consumer behavior, investment patterns, and broader inflation trends.

Turnleaf’s Inflation Insights

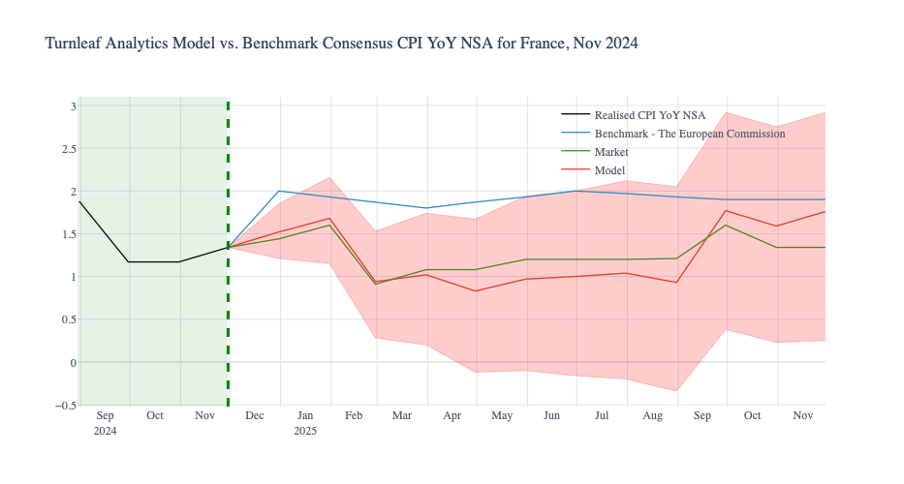

Turnleaf anticipates inflation will remain below the 2% target throughout 2025, with deviations depending on fiscal policy implementation and global economic conditions. France’s ability to address its fiscal challenges while maintaining economic stability will define its path forward in an increasingly uncertain environment. Turnleaf will continue monitoring these developments, especially as France grapples with a government shut down, and will update forecasts as economic conditions evolve.

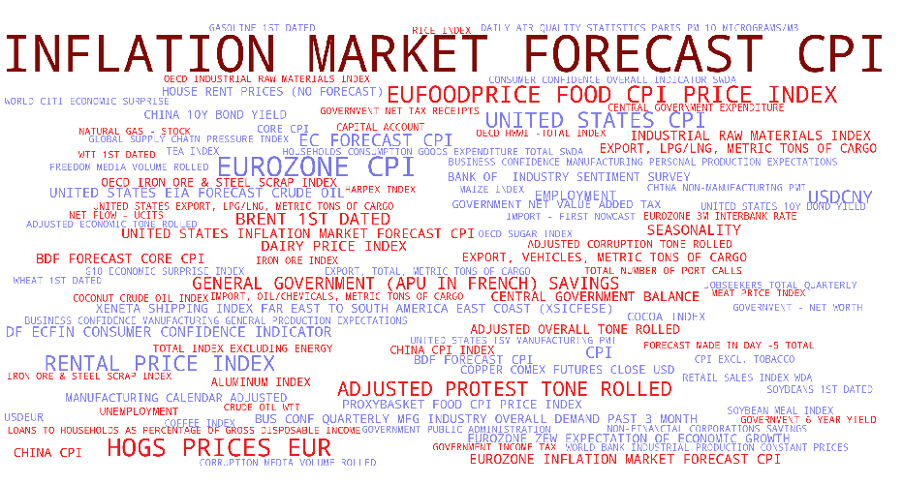

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, words or phrases that are large, indicating their significant weight in the model, while their color suggests whether they contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.