Mark Carney at Davos, January 20, 2026

“For decades, countries like Canada prospered under what we called the rules-based international order. We joined its institutions, we praised its principles, we benefited from its predictability… this bargain no longer works.”

The latest tariff threats from the U.S., backed by escalating rhetoric around Greenland, are shaking up 2026 just as Liberation Day disrupted 2025. Just last week, President Trump announced 10% tariffs on eight European NATO allies, escalating to 25% by June 1 unless an agreement is reached for the purchase of Greenland. A few days later, the U.S. president rolled back the tariffs after leaving the Davos conference with a framework for a U.S. presence in Denmark that – mostly – already existed.

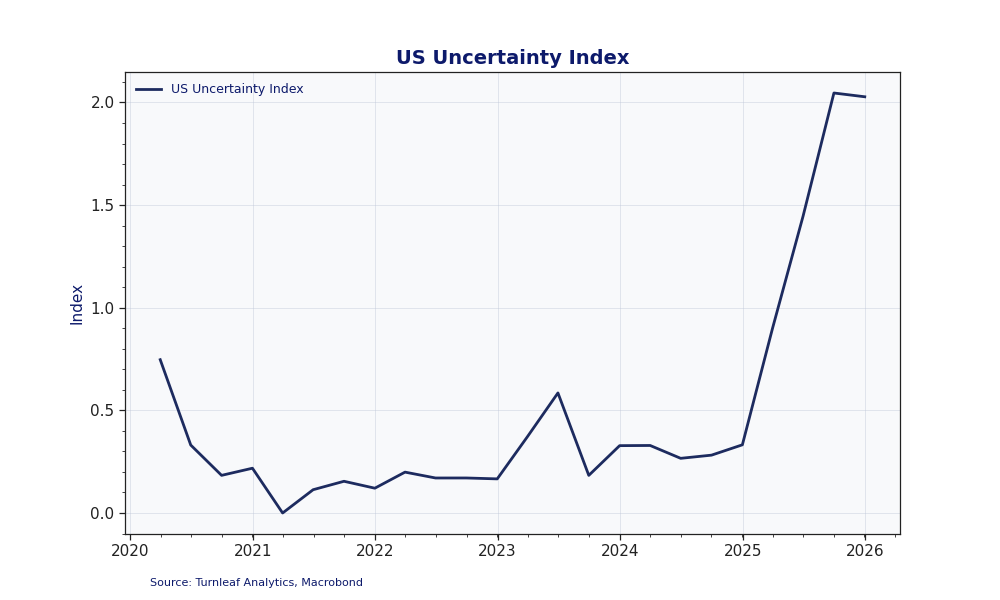

Yet Trump’s unpredictability isn’t the only wild card shaping global inflation. Over the past year, gold has surged to record highs (Figure 1) as rising sovereign debt and fiscal uncertainty have pushed reserve managers to diversify away from traditional reserve currencies.

Figure 1

Tracking Volatility Through Alternative Data

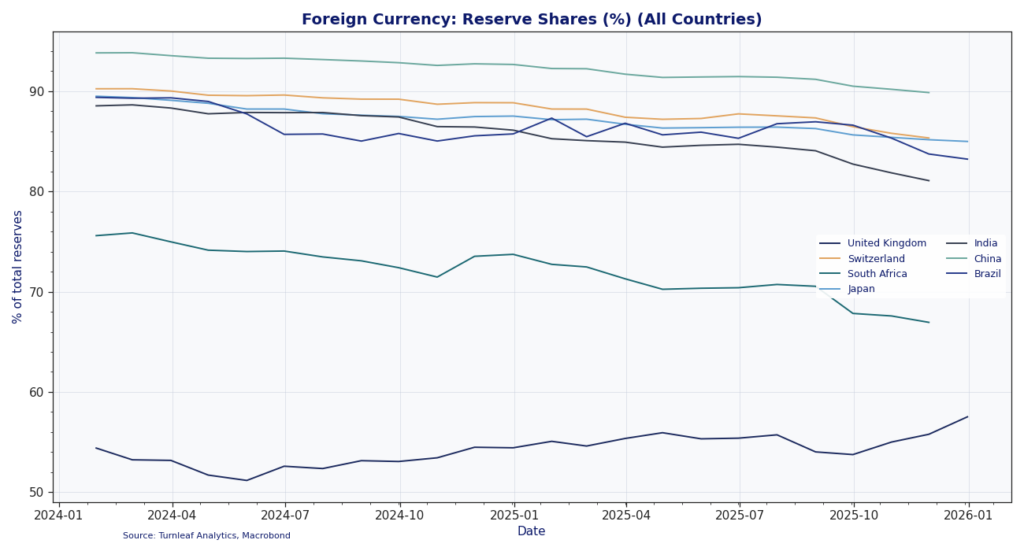

Over the past year, Turnleaf has accounted for volatility in tariffs and geopolitical risk by tracking alternative data that includes measures of global macroeconomic volatility, commodity indices, and expectations data. The patterns we’ve observed reveal several key transmission mechanisms that will define 2026.

1) Uncertainty indices have spiked in tandem with policy announcements, creating measurable effects on import prices, inventory decisions, and forward-looking inflation expectations (Figure 2).

Figure 2

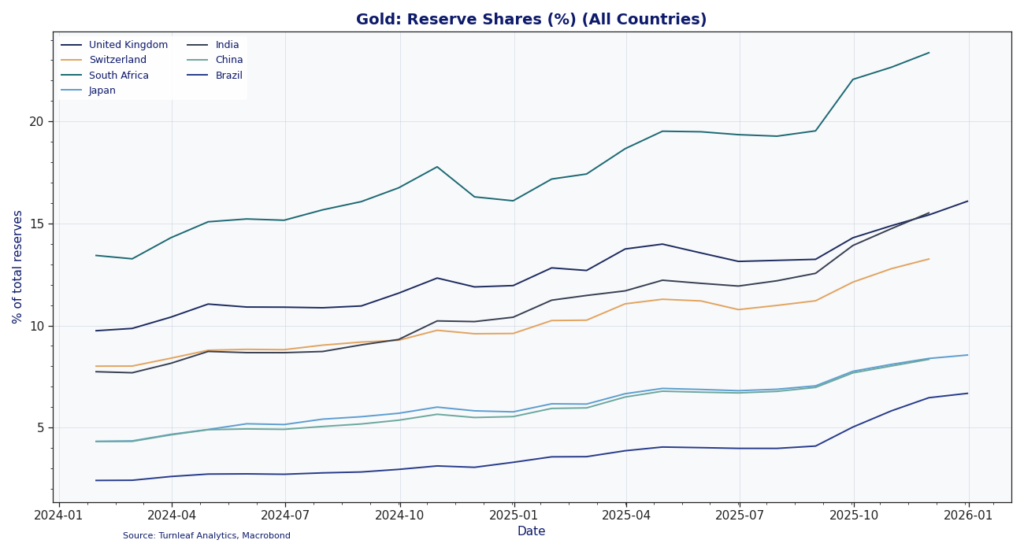

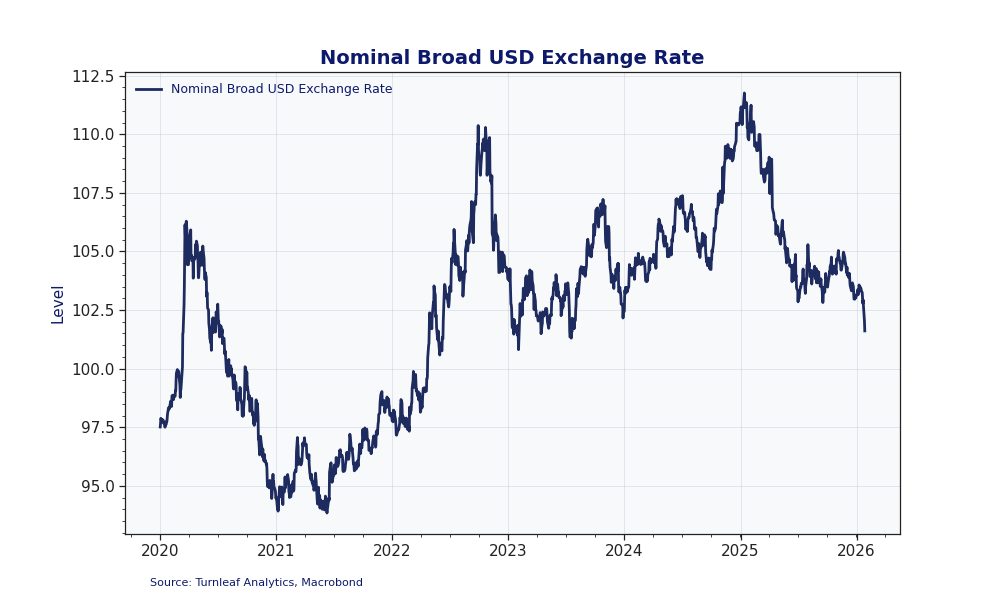

2) The relationship between reserve composition and currency volatility has tightened, particularly in economies where gold now represents a growing share of total reserves relative to foreign currency holdings.

Central banks across emerging markets and select advanced economies have accelerated gold accumulation, shifting the composition of international reserves in ways that signal declining confidence in dollar-denominated assets and heightened concern over financial stability (Figure 3a & 3b).

Figure 3a

Figure 3b

What This Means for Inflation Forecasts

Reserve composition shifts are changing how currencies respond to shocks. Countries with higher shares of gold in reserves relative to foreign currency will likely demonstrate lower sensitivity to dollar volatility but face greater exposure to gold price fluctuations in the event of reversal. Exchange rate pass-through is evolving as hedging behavior changes in response to reserve diversification, while the dollar continues to fall in value (Figure 4).

Figure 4

Continued elevated levels of uncertainty will lead to increased likelihood of upside inflation surprises for economies with high import content in consumption baskets (i.e. Japan, South Korea). We’re incorporating this into our baseline scenarios by adjusting pass-through assumptions and allowing for greater persistence in cost shocks.

Looking Ahead

Ultimately, 2026 will be dominated by the unexpected. Volatility will push costs upward as firms attempt to navigate uncertainty in imported input costs and softer demand. The abandonment of predictable trade policy frameworks means firms are building in risk premia to pricing decisions. They are effectively embedding a volatility tax into goods prices. This shows up in our alternative data as elevated import price volatility and longer supplier delivery times, both leading indicators of inflation persistence. At the same time, governments are beginning to rethink defense spending in the wake of what Canadian Prime Minister Mark Carney described at Davos as the end of a “rules-based international order.” European nations have announced significant increases in defense budgets, with Canada doubling its defense spending and Europe moving toward strategic autonomy. All of this will contribute to elevated baseline inflation as structural shifts in trade relationships, supply chains, and security arrangements create persistent cost pressures that monetary policy alone cannot address.