At the start of 2025, tariffs posed a meaningful downside risk to Eurozone inflation. Yet Eurozone growth has proven more resilient than many expected. The potential loss of external demand from higher tariffs has been partly offset by dollar depreciation, stronger-than-expected and sustained demand, and lower global energy prices—together supporting growth.

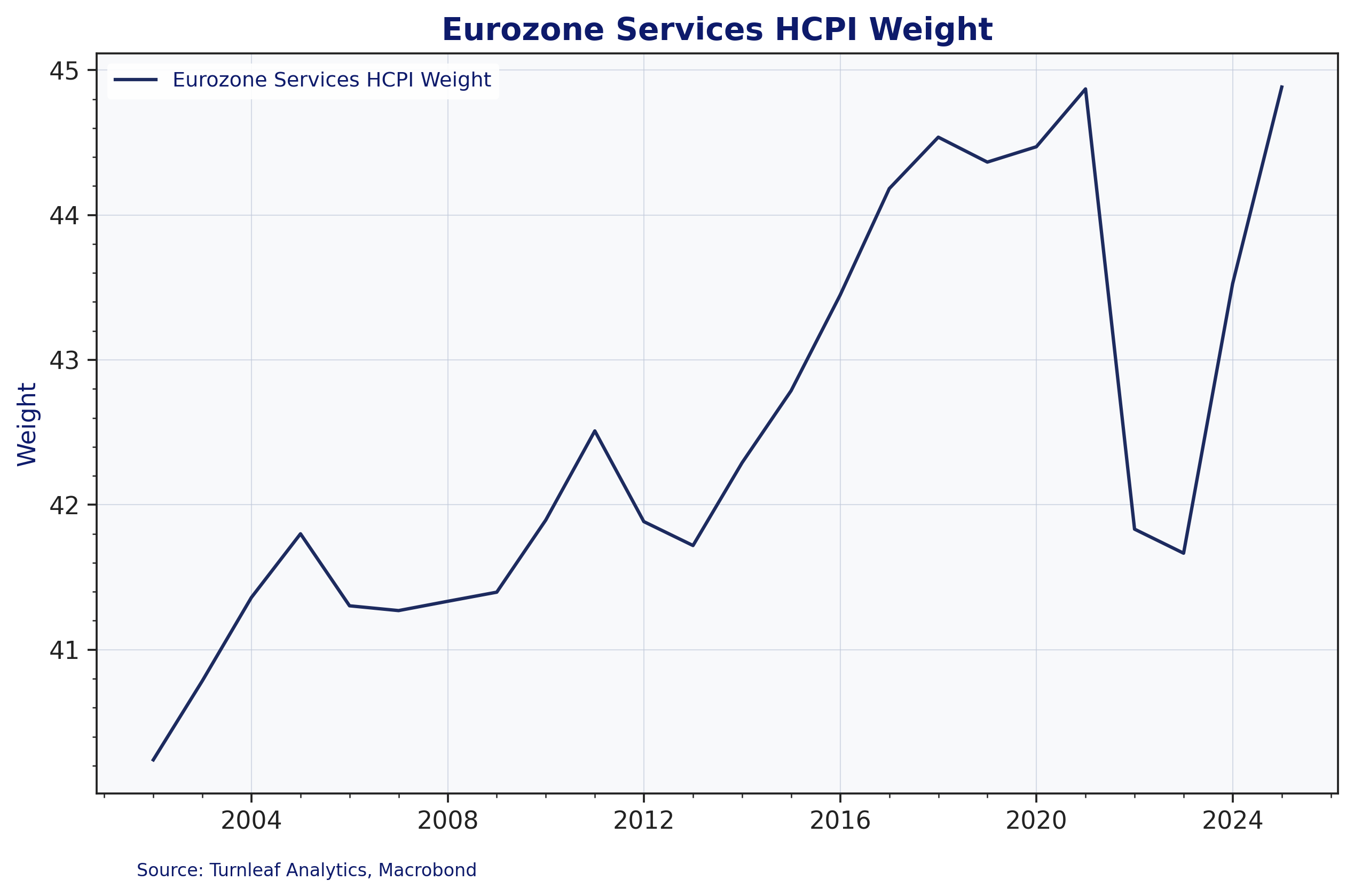

This year, services have been the key source of resilience. Services now account for over 45% of the consumer price basket, and their contribution has been rising, making it essential to capture price shifts in this subcomponent when interpreting moves along the curve (Figure 1). Sensitivity here depends on service demand, which in turn is shaped by wage growth and shows through in household savings behavior and overall consumer spending which have been accounted for by our model.

Figure 1

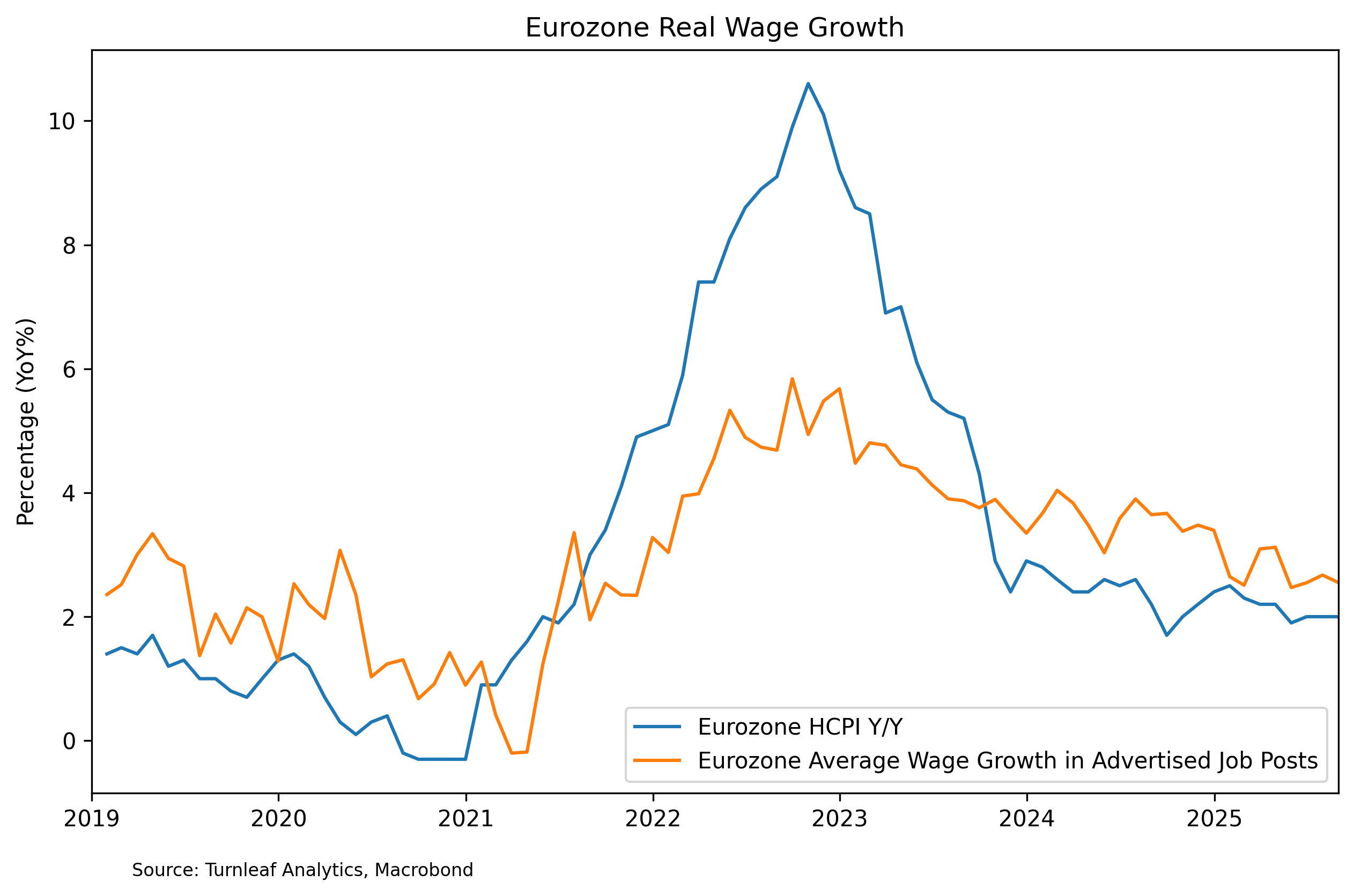

Our Eurozone services CPI forecasts have been trending higher over the past few months (Figure 3). While wage growth is easing across major economies they remain above average nominal YoY wage growth in advertised job listings (Figure 2), supporting household savings that are robust enough to sustain service demand. That has allowed weather indicators, like our proprietary ‘temperature price index’ and air-quality measures which have been flagged by our models, to play a larger role in explaining services inflation and, by extension, the headline figure. An additional upside risk is a reversal in global energy trends and changes in electricity prices, which are frequently passed through to service prices.

Figure 2

To read the rest of the article, please visit our latest Substack post.