The Eurozone Grew More Than Expected – Germany & Italy

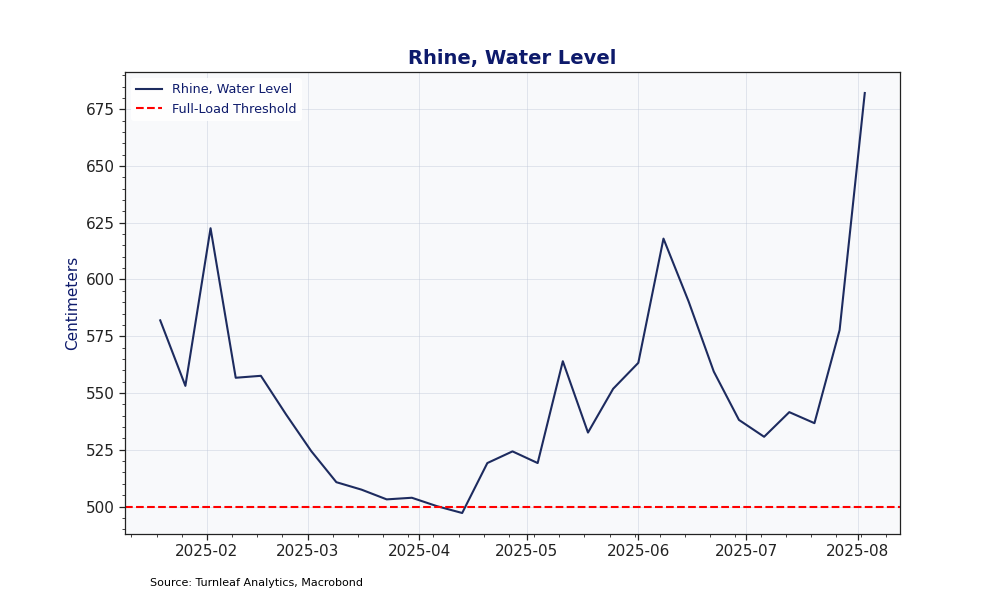

Overall, the Eurozone has enjoyed 0.6%QoQ growth in 2025Q1 despite disinflationary forces like weaker consumer and business sentiment subduing CPI. Recent priorities by the Eurozone to shift supply chains has helped sustain higher than expected growth, keeping prices firmer throughout the Eurozone.

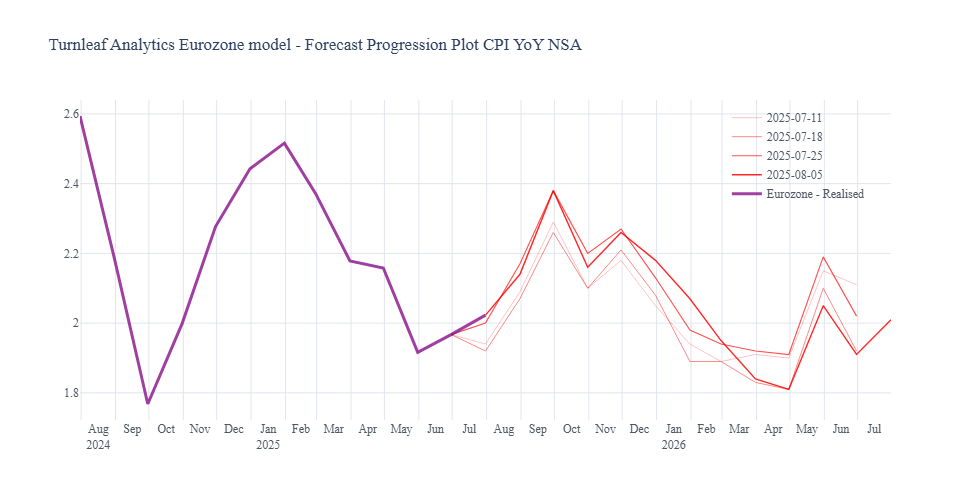

Germany: A key support was the continued flow of exports, despite a spell of logistical friction pushing up costs. In Germany, current shipping conditions have raised freight costs of German exports along the Rhine. The Rhine is a major shipping route for grains, minerals and ores, chemicals, oil products including heating oil, as well as coal, chemicals, and ores, some of which eventually reach the United States. Water levels on the Rhine began to recede in late June 2025 as a heatwave swept across the Eurozone. When river depth approaches or slips below five meters, loading limits force barges to sail partially empty and freight costs rise. By late July the river had climbed above five meters, allowing vessels to run at full capacity and temporarily easing the logistics bottleneck, but driving an even sharper spike in export traffic as cargo owners rush to compensate losses (Figure 1). We expect this pressure to abate during August now that U.S. tariffs are in force, potentially limiting export demand, and water levels remain higher.

Figure 1

Italy: In Italy, recent government initiatives targeting critical raw materials has helped fuel demand for mining and quarrying with associated PPI reflected in our model. We have seen some modest upside surprises in recent activity indicators, suggesting slightly firmer momentum than expected – not a growth story per se, but enough to support sequential price pressures. The recent heatwave and elevated solar irradiance in parts of Southern Europe have translated into higher electricity usage and AC-driven demand, which came through utility components. In the background, last year’s softer summer prints are now dropping out, which naturally lifts the YoY profile. All of this cumulatively shifted the curve higher.

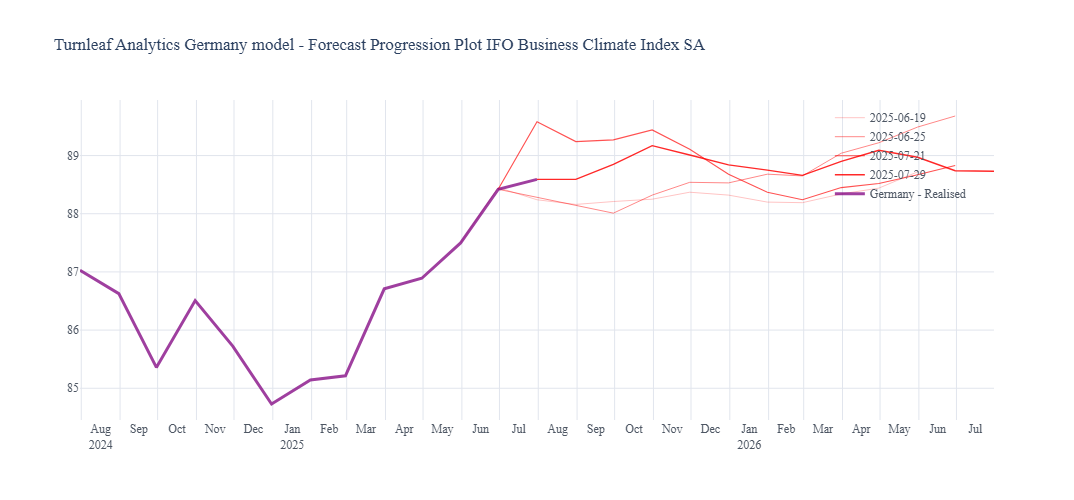

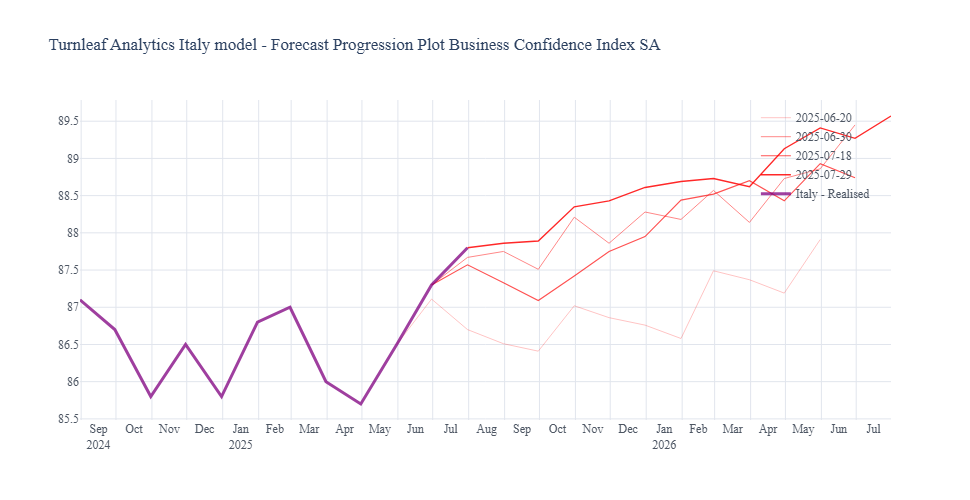

We see that during this time, Turnleaf’s business confidence indices for Italy and Germany, though still muted, have improved in the last few months. In particular, Business Climate Index SA for Germany and Business Confidence Index SA for Italy has gradually increased from the start of the year, with expected improvements through 2026 (Figure 2). At this stage, it appears that though the disinflation risk for the Eurozone remains high, it’s not as high as the market anticipated, which corresponds to more robust growth.

Figure 2

Spanish Sun is Still Shining

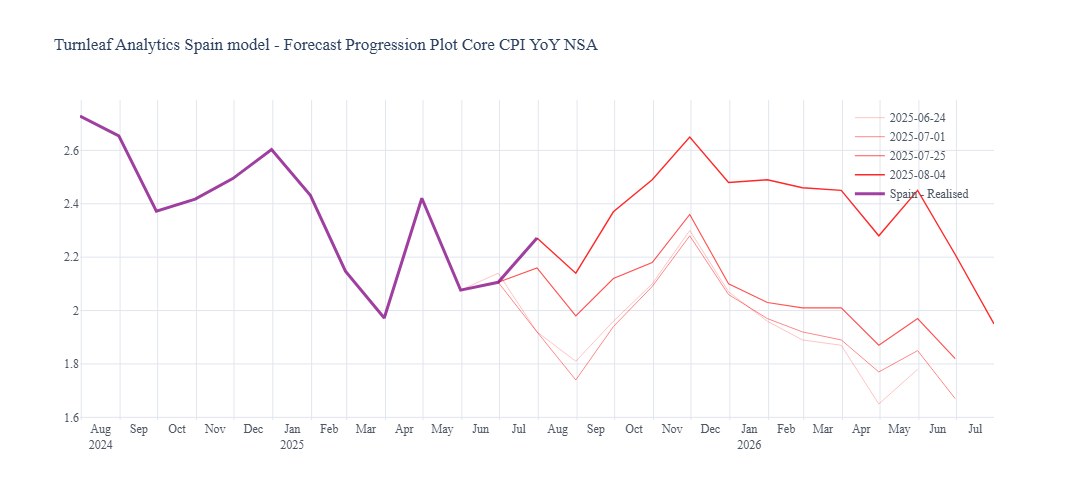

Spain, a strong driver of Eurozone inflation, has experienced sustained growth in its services sector over recent months. Core inflation therefore remains elevated, and a salient driver has been the VAT-induced base effect on electricity that took effect in early 2025 affecting service costs (Figure 3).

Figure 3

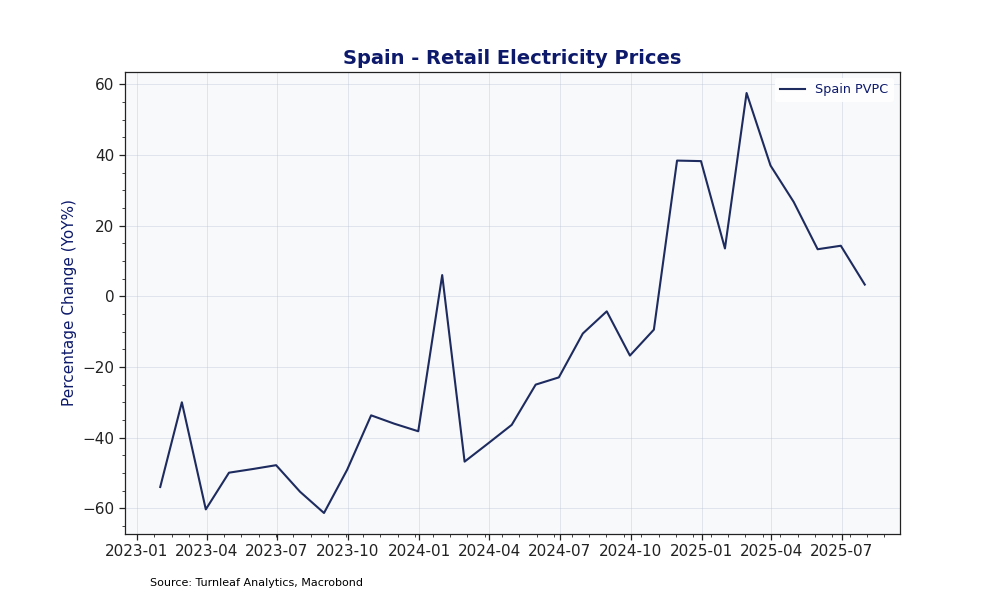

The January 2025 return to the standard VAT rate on electricity lifted Spanish power bills just as a heatwave boosted electricity demand (15% higher between June 24 and July 1, 2025) for air-conditioning. By embedding retail electricity prices directly, the model traces that cost spike through to higher service prices and the associated wage pressures, preventing Eurozone core inflation from easing. We notice that retail electricity prices, though higher compared to the previous year, are decelerating keeping headline in check in the next few months (Figure 4).

The January 2025 return to the standard VAT rate on electricity lifted Spanish power bills just as a heatwave boosted electricity demand (15% higher between June 24 and July 1, 2025) for air-conditioning. By embedding retail electricity prices directly, the model traces that cost spike through to higher service prices and the associated wage pressures, preventing Eurozone core inflation from easing. We notice that retail electricity prices, though higher compared to the previous year, are decelerating keeping headline in check in the next few months (Figure 4).

Figure 4

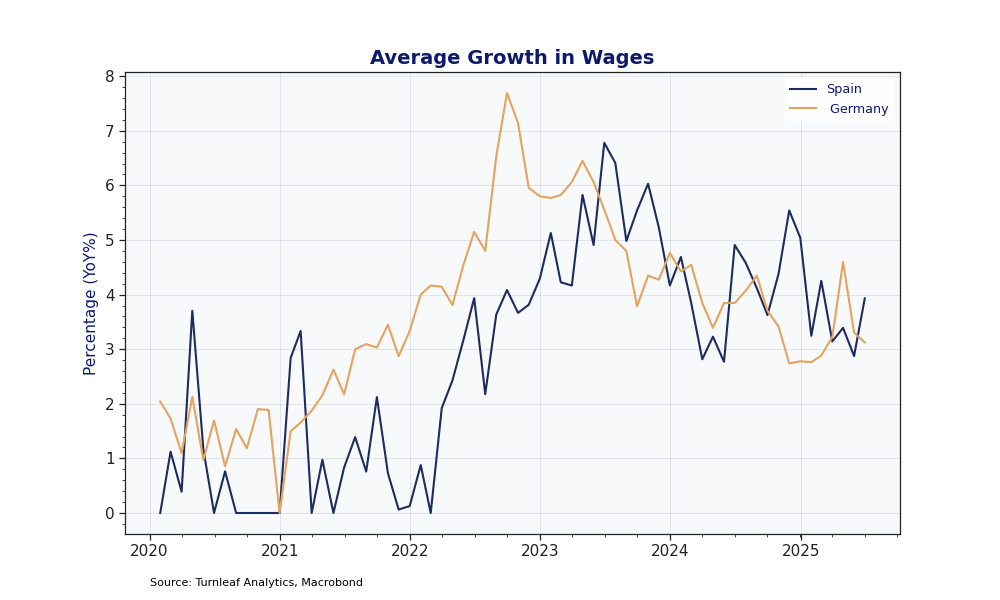

Because service-sector prices respond with a lag, we anticipate the resulting cost-pressure to feed into wages, intensifying Spain’s wage growth relative to the wider Eurozone. For instance, comparing wage growth trajectories between Germany and Spain, both countries exhibit wage growth deceleration; however, Spanish wage growth saw an upward shift relative to Germany in Q2 2025 (Figure 5).

Figure 5

In short, the upward CPI movement reflect (1) better than expected growth (2) sudden heavier Rhine traffic enabled by deeper water after a period of low water levels and (3) Spain’s electricity-VAT base effect on services. Both influences should fade once the shipping surge normalizes and the VAT jump rolls out of annual comparisons, leaving overall economic and wage growth as the main factor to watch. As those impulses dissipate, Spain’s wage-cost spillovers are likely to converge with the rest of the Eurozone, allowing headline inflation to fall back toward 2% target by late 2025 or early 2026 (Figure 6).

Figure 6