Turnleaf expects Czech CPI to fall close to 2% YoY by the end of 2025 and then float back up towards 3% YoY through 2026.

In the short term, our model places greater weight on cooling energy prices, especially Brent crude, which should continue to push inflation lower through year-end before regulatory and structural drivers lift it again in 2026. Indeed, we find that diesel, LPG, and Petrol 95 all saw decreases in the first week of September 2025, corresponding to the downwards trend we see in our inflation path for the end of 2025. The appreciation of the koruna since the beginning of the year also reinforces these disinflationary pressures.

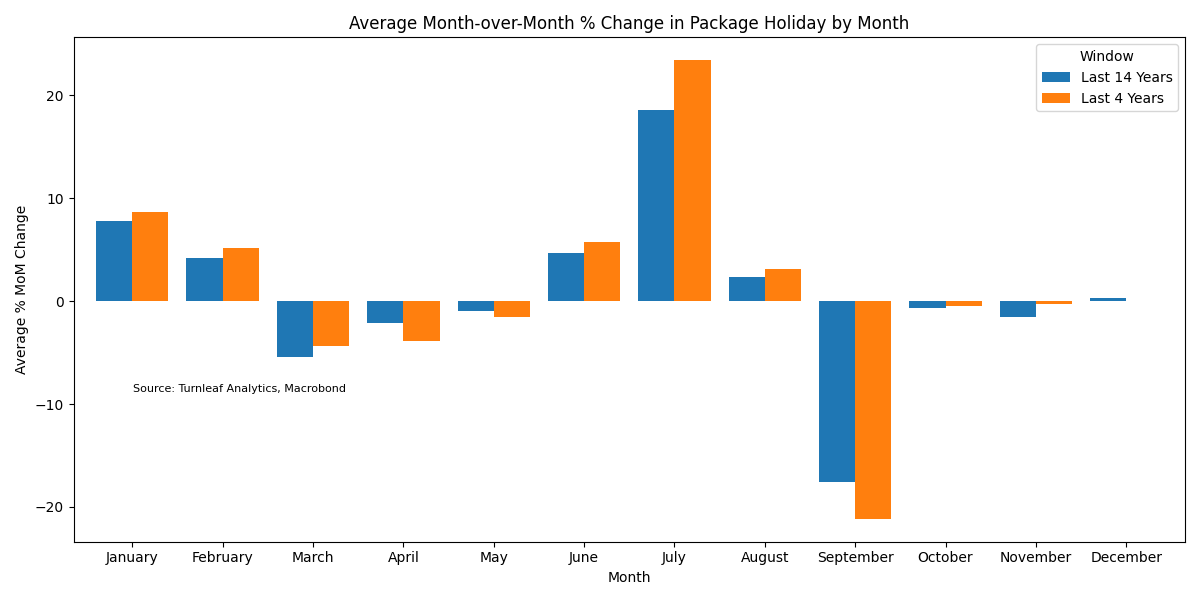

Incidentally, another factor that is pulling inflation downwards is ‘Package Holiday CPI’ which has seen persistent seasonal declines in the last 4 years for the month of September.

In the medium to long term, we expect sustained upward pressure on energy prices. Our model incorporates leading indicators that have historically preceded price increases, and this dynamic is central to the shape of our inflation curve. We also rely on a makeshift energy CPI model which, even under conservative assumptions, forecasts higher energy costs from 2026 onward. This perspective is reinforced by regulatory developments. From 2026, new measures will raise electricity and gas tariffs in line with inflation, with scope for an additional 1–2% depending on wholesale market conditions and consumption trends (ERÚ draft price decision, 2026).

Our baseline assumption is that the disinflation observed into late 2025 will not extend far into 2026. In the short term, we acknowledge that unregulated energy components may still see another round of price declines. Economists’ models that project lower headline CPI rely heavily on the idea that falling energy tariffs will persist, but we see no concrete evidence to support this. Historical CPI patterns show that once energy price restrictions are lifted, cost pass-through tends to be both rapid and sustained. With administrative measures contributing less to inflation in 2025 than in the past two years, the energy channel and housing costs are likely to dominate again in 2026.

Housing will also remain a key driver of inflation, particularly if energy inputs in construction, which have not kept up with demand, increase further, and supply continues to lag behind demand as wages grow.

For these reasons, we maintain a higher inflation forecast than the market from 2026 onwards. While we will adjust if Brent crude prices continue to fall or regulatory signals shift materially, our assumptions on energy dynamics and historical precedent suggest that consensus underestimates the upside risk to inflation.

Our MoM model, which tracks slightly lower than Czech National Bank estimates, supports this view. Turnleaf’s forecast aligns with central bank estimates through the end of 2025, but diverges upward in 2026 as our assumptions on energy and housing costs take effect.