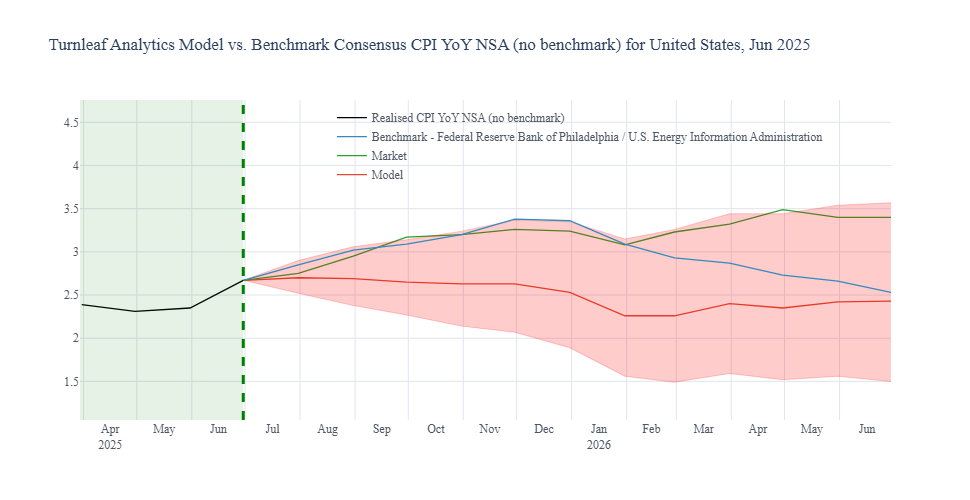

Since the inauguration of President Trump, uncertainty has significantly influenced inflation dynamics, primarily through unpredictable tariff policies. However, firms are now demonstrating increased adaptability, gradually adjusting their strategies to manage this uncertainty more effectively. Consequently, market volatility tied explicitly to tariff-driven inflationary pressures is diminishing (Figure 1).

Figure 1

Changes in COMEX inventories of precious metals such as gold, platinum, and copper have served as proxies of market sentiment regarding tariffs and the associated inflationary risks. Notably, even sectors seemingly distant from trade policy, such as livestock futures, experienced price volatility due to anticipated increases in feed costs—particularly soybeans and corn imports from tariff-targeted countries like Brazil. Furthermore, broader business sentiment provides insight into how firms internalize tariff risks, evidenced by restrained capital expenditure and hiring, contrasting sharply with inventory build-ups.

Our proprietary model leverages these market signals, employing alternative data sources to implicitly measure tariff-induced inflationary pass-through, a complexity typically challenging for traditional inflation models.

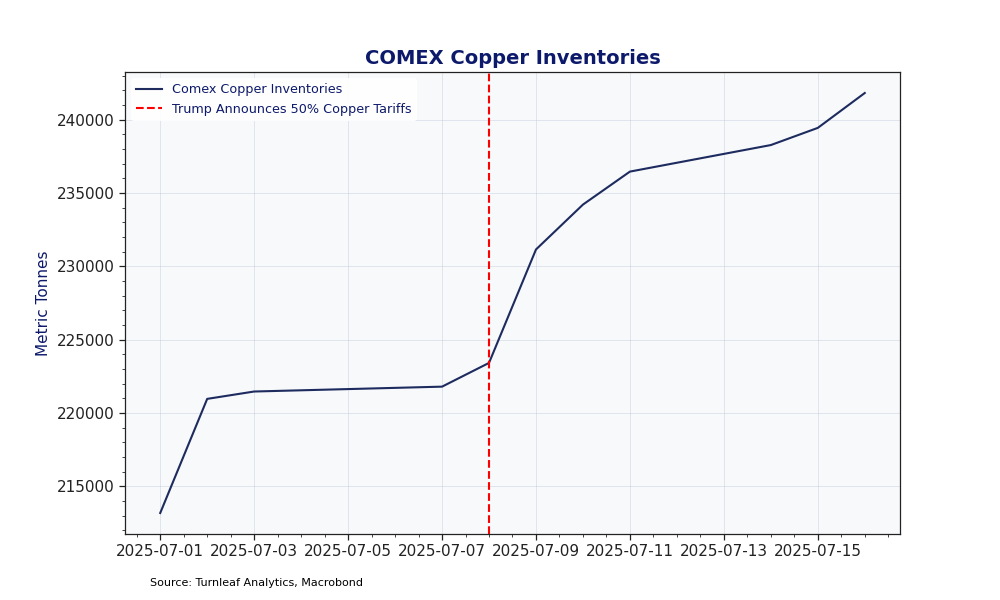

A compelling illustration of our model’s capability is evident in the copper market’s recent developments. In early July 2025, President Trump signaled the potential implementation of a 50% tariff on copper imports effective from August 1, 2025 (Ea-Nasir’s “Fine Quality Copper” could be hit). Although the detailed list of affected copper products remains unclear, copper futures rose sharply as markets front-ran the anticipated tariff. Firms and traders accelerated copper purchases to secure lower pre-tariff prices, creating a premium on futures and tightening global supply. Simultaneously, investors hedged inflation risks by shifting into copper futures, anticipating higher production costs post-tariff. Domestic producers, such as U.S.-based miners, stand to benefit from reduced foreign competition, further supporting bullish market sentiment. More concretely, firms have proactively expanded copper inventories, aiming to defer the tariff-induced cost surge, which partly explains the lower-than-expected inflation pass-through observed within manufacturing sectors.

Figure 2

At Turnleaf, copper-related indicators have been consistently highlighted across several monitored industrialized nations. For countries dependent on copper imports for manufacturing, strategic inventory accumulation is expected to provide temporary relief against inflationary pressures, typically lasting about 3–6 months. Conversely, for copper-exporting economies such as Chile, declining copper prices during a sustained global economic slowdown may reduce export revenues, leading to currency depreciation. This depreciation raises the cost of imported goods and thus intensifies domestic inflationary pressures. This interaction is especially critical during prolonged periods of global economic weakness, as declining global industrial demand can simultaneously suppress commodity prices in industrialized nations while exacerbating inflation in commodity-exporting countries. Going forward, Turnleaf will closely monitor the interplay between copper price fluctuations and global economic growth, refining our indicators to promptly capture emerging risks and opportunities tied to tariff developments and broader macroeconomic trends.

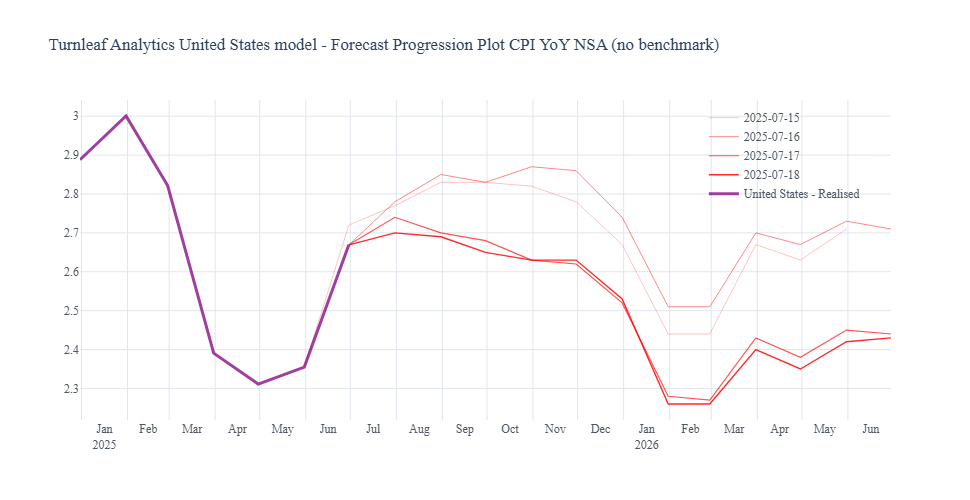

Our Latest U.S. 12-Month CPI YoY, NSA Daily Nowcast for July 18, 2025: