In Colombia, almost 17% of the consumer price basket are administratively set. This includes household public services, transport, fuel, and education fees. The legislation behind these prices is typically subjected to many draft iterations, which make policy decisions slow moving and subject to abrupt changes. Though we partially rely on seasonal dummies to anticipate regular changes to regulated prices, there are cases in which prices for these items change beyond expectations.

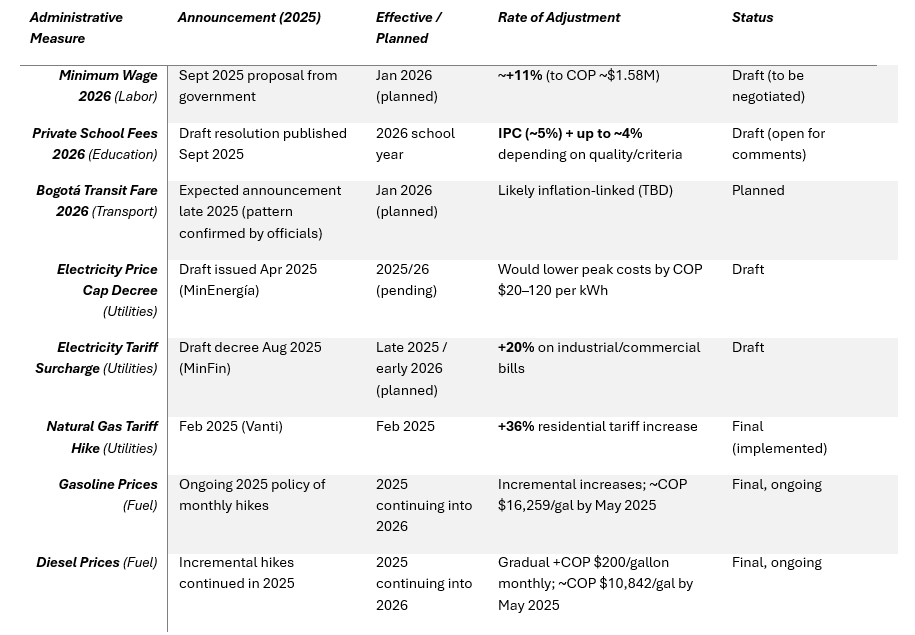

Manually tracking regulated price developments in Colombia would yield a long list of proposed changes awaiting confirmation into law through 2026, as shown in Table 1. Turnleaf could assess the likelihood of these measures being enacted, their timing, and their potential inflationary impact. However, without firm confirmation, incorporating them risks shifting our inflation curve in ways that introduce unintended bias.

Table 1

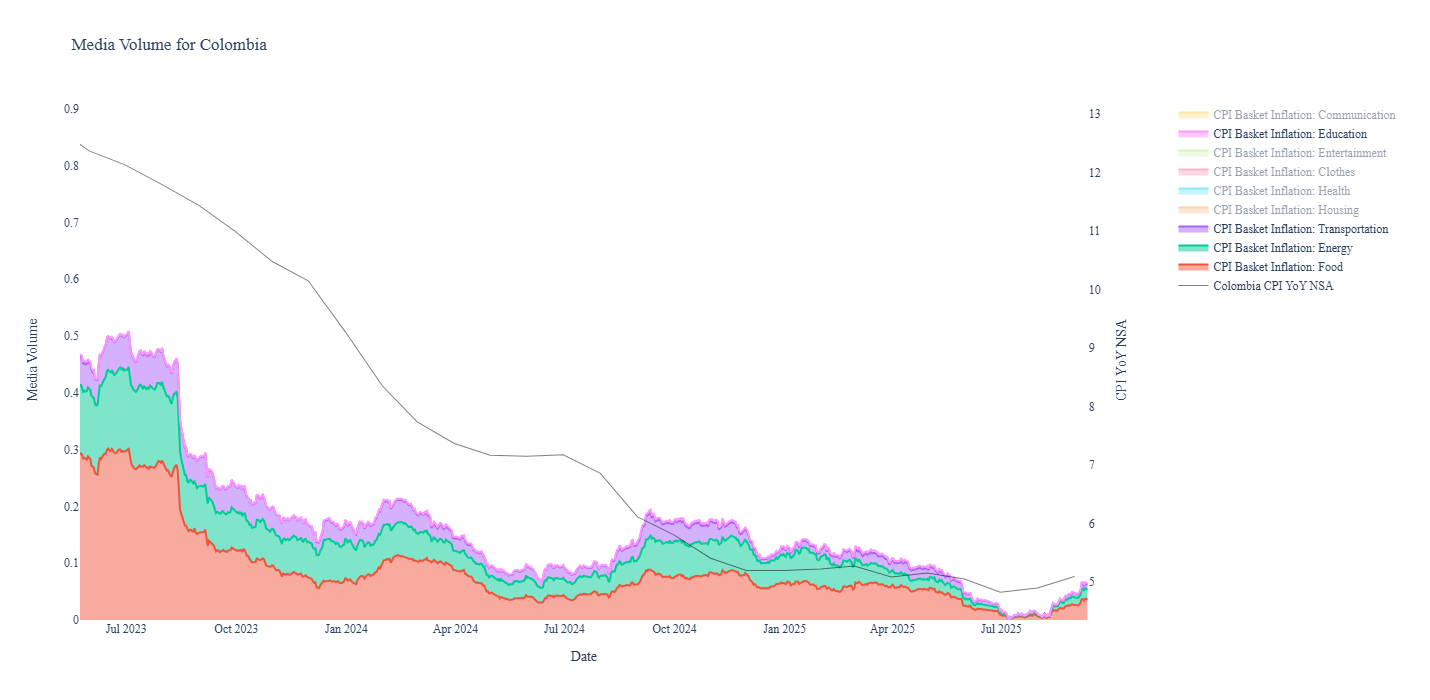

Given the complexity of regulated price indexation, it can be difficult to derive an appropriate estimate of the impact a fee increases may have on overall inflation. It can also be difficult to foresee so many legislative developments before an actual policy is officiated. To capture early signals, Turnleaf instead tracks media-volume indicators that aggregate coverage of anticipated price changes by scanning global professional news for relevant token combinations such as ‘Colombia’ + ‘inflation’ (Figure 1). A key implication here is that if policies are expected to have an outsized impact on prices, media volume will increase, and therefore, the indicator will more likely be flagged by our models.

Figure 1

Our media-volume indicators serve two critical functions: (1) they flag potential price developments even before we manually search for them, prompting timely investigation; and (2) they provide early insight into whether administrative price-setting decisions are likely to push expected inflation higher or lower. Together, these signals are essential for anticipating shifts in our projected inflation curve.

Our media-volume indicators serve two critical functions: (1) they flag potential price developments even before we manually search for them, prompting timely investigation; and (2) they provide early insight into whether administrative price-setting decisions are likely to push expected inflation higher or lower. Together, these signals are essential for anticipating shifts in our projected inflation curve.

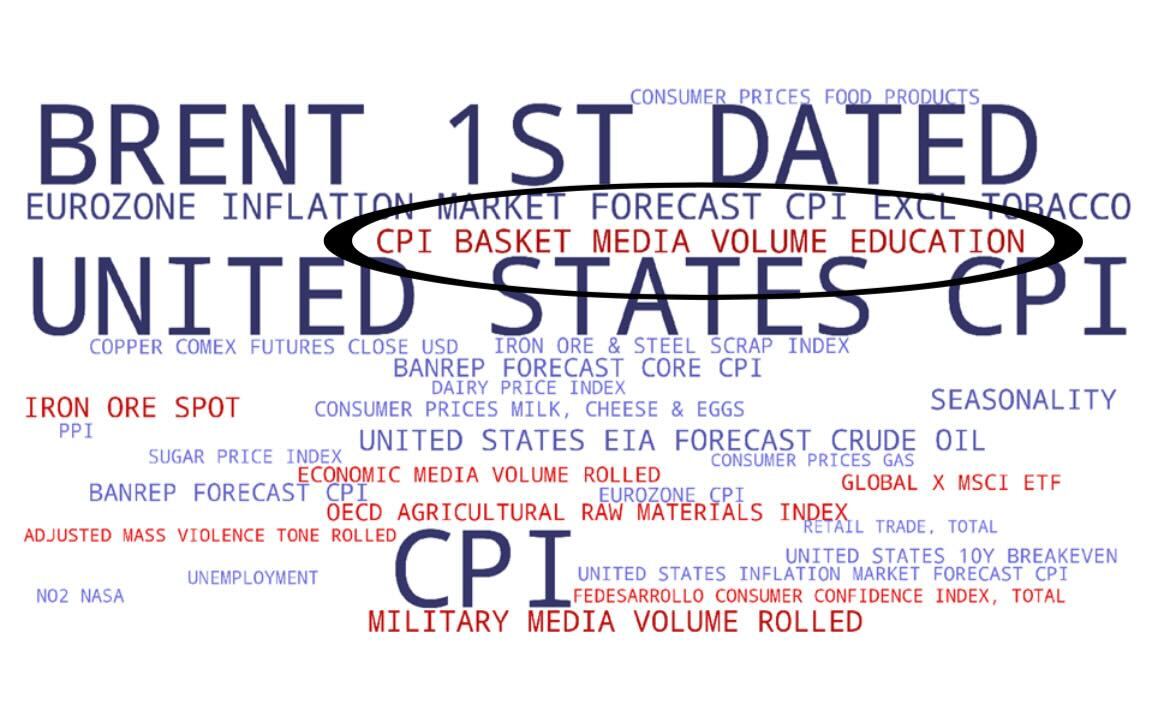

Our model has flagged discussion of the electricity tariff surcharge decreed in Aug 2025 through ‘Media Volume Energy’; changes to private school fees for Sep 2025 through ‘Media Volume Education’, and upcoming announcements for increases in transport fees in late 2025 through the ‘Media Volume Transport’. Interestingly, comparing our proprietary inflation contribution word clouds across at each time horizon, we see that the contribution of ‘Media Volume Education’ is much large for 5-8 months across when tuition fees are due than for 1-4 and 9-12 months across.

Contribution Word Cloud – Short Term

Contribution Word Cloud – Medium Term

Contribution Word Cloud – Long Term

At present, these indicators are exerting mild upward pressure on our forecasts. Because many fees are tied to inflation, ongoing price-setting discussions tend to mirror inflation expectations and have, in recent months, reinforced a trend that is pushing Turnleaf’s entire inflation curve higher. It also functions as a forward-looking signal for price dynamics in subcomponents such as energy. For instance, media tone around legislation on natural gas price caps is shaped by expectations of a supply deficit through 2026, widely discussed in the press and likely to push tariffs higher.

At present, these indicators are exerting mild upward pressure on our forecasts. Because many fees are tied to inflation, ongoing price-setting discussions tend to mirror inflation expectations and have, in recent months, reinforced a trend that is pushing Turnleaf’s entire inflation curve higher. It also functions as a forward-looking signal for price dynamics in subcomponents such as energy. For instance, media tone around legislation on natural gas price caps is shaped by expectations of a supply deficit through 2026, widely discussed in the press and likely to push tariffs higher.