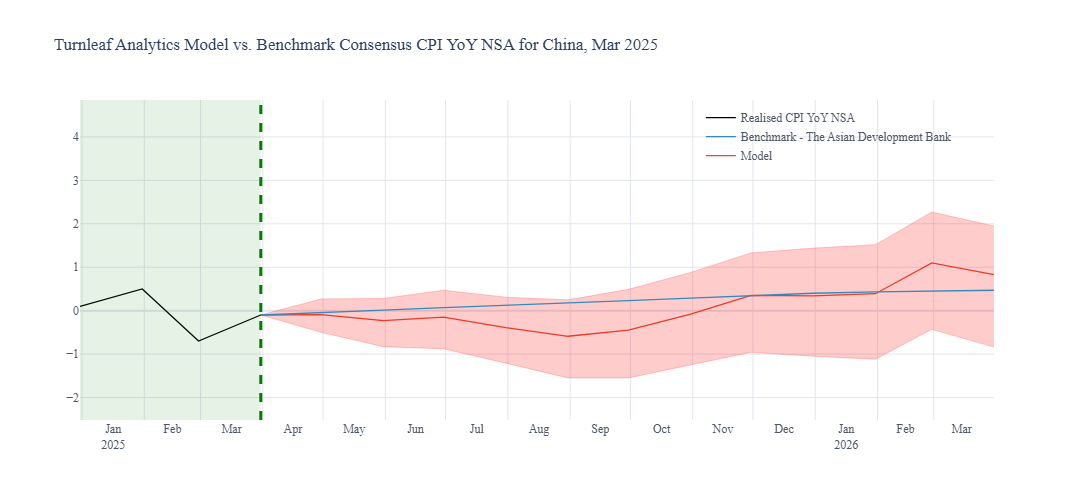

Based on recent weekly forecasts, Turnleaf is projecting deflation of -0.09%YoY in April 2025 as export growth is expected to contract and China begins to reorganize its economy to avoid the brunt of U.S. tariffs. Turnleaf’s China inflation 12-month inflation horizon continues to shift downwards as U.S. protectionism tips China inflation towards deflation.

China’s deflation risk is not new. Its fiscal and monetary stimulus efforts at the end of 2024 were aimed at supporting an ailing property market and revitalizing consumer demand for durable goods. At its core, the policies’ primary goal is to inject enough consumer confidence into the economy so that consumers are more willing to buy existing property inventory. In China, the property market constitutes at least 40% of steel demand, while much of the remaining steel demand is channeled towards manufacturing where it may be transformed into a durable good or as a raw material. Steel industries that formerly benefited from booming new property construction began to rely more heavily on external demand.

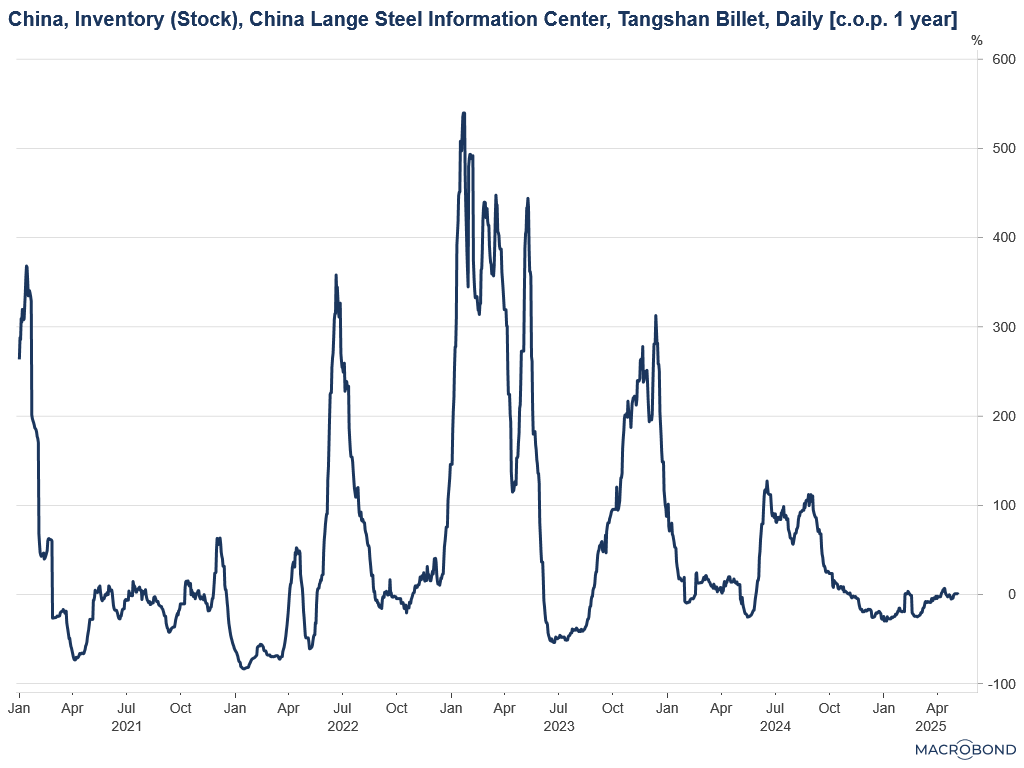

Today, the uncertainty pandemic has forced many industrial countries to pull back production inducing a broad decline in global industrial raw material prices (-5.96%YoY April 2025). Demand for basic metals, including iron ore and steel, required for manufacturing and construction remain subdued as businesses try to map out the impact of tariffs that may or may not be imposed. Downward price pressures reflecting this uncertainty and reduced domestic demand are captured by Turnleaf’s models through reductions in Extraction, Mining, and Quarrying PPI, as well as flat steel inventory growth (Figure 1), further prompting Beijing to cut steel production to alleviate overcapacity.

Figure 1

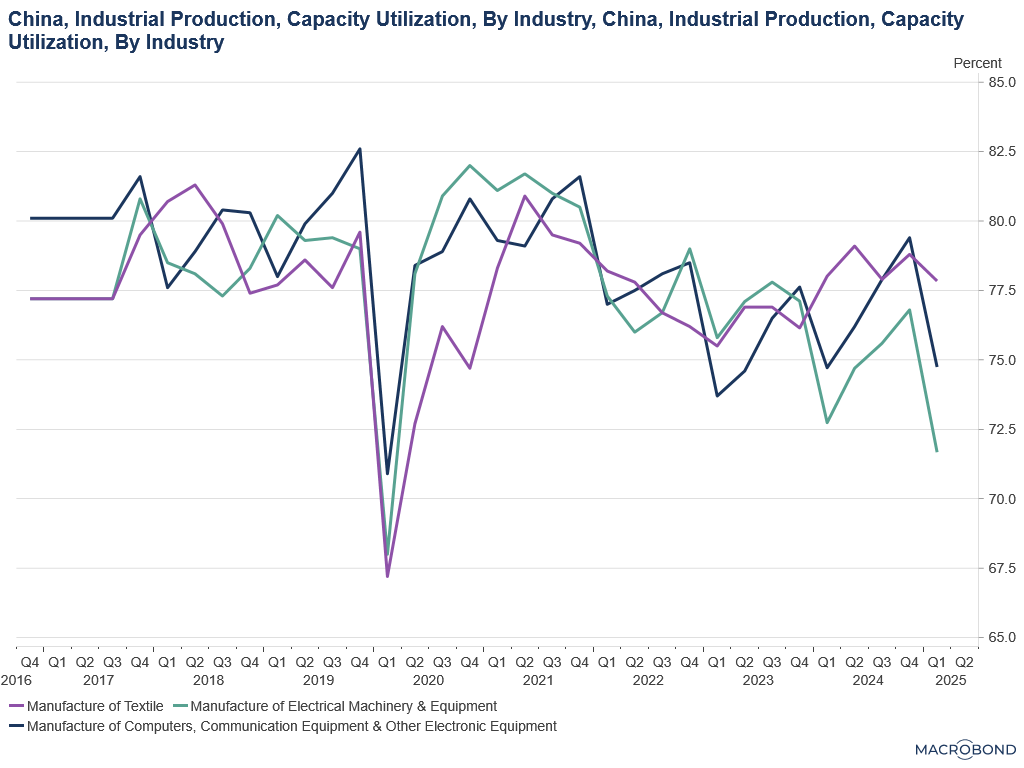

China won’t rely on its exports to compensate for the discouraged consumer forever and its already beginning to restructure manufacturing—Capacity utilization for dominant Chinese industries like machinery and electronics are declining as tariffs make exports less competitive (Figure 2).

Figure 2

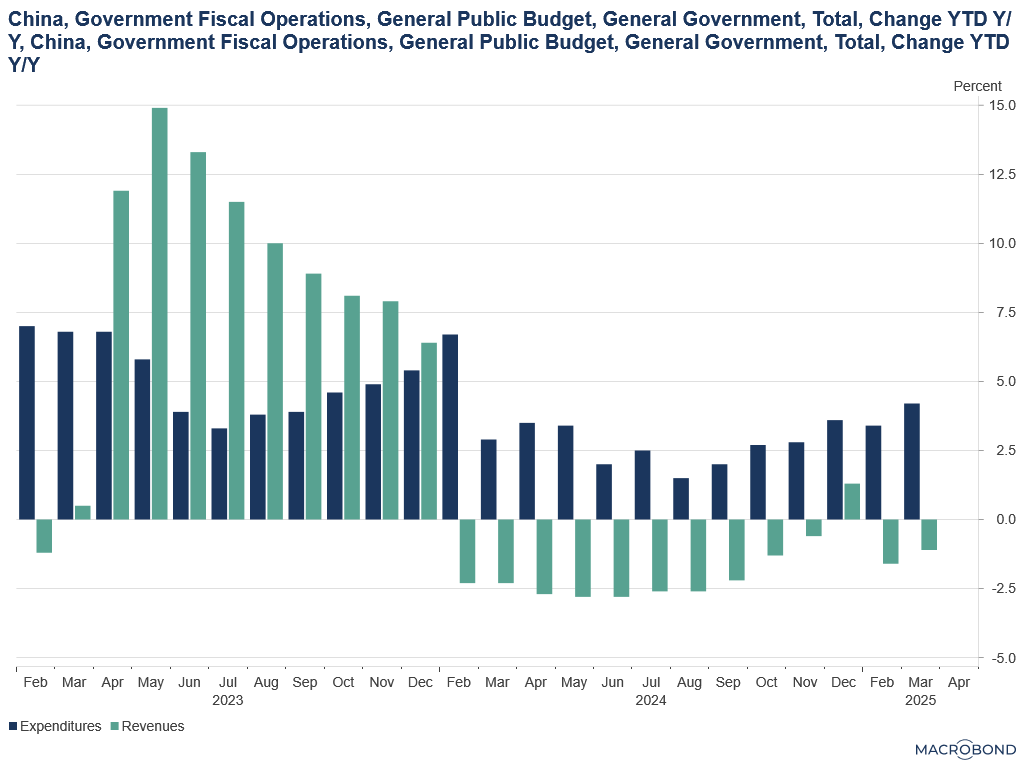

Continued government stimulus efforts to promote consumer spending will therefore, be crucial. Any upwards price pressure will originate from factors that directly impact consumers’ ability to spend their money on domestic industries. Beijing’s recent child subsidy measures do this by expanding parents’ disposable income and increasing the number of consumers by making it more affordable to have children. Higher food prices not linked to supply factors (e.g. disinflationary NASA Weather Rain CPI Price Index and inflationary Food Price CPI) will be among the first indicators of persistent price growth in China. Steady gains in China’s consumer confidence index since November 2024—mirroring the roll-out of expanded stimulus measures—have driven shifts in government revenue (Figure 3) that reflect growing demand for taxable goods and reduced taxes, making this trend an important gauge of overall price over the next 12 months.

Continued government stimulus efforts to promote consumer spending will therefore, be crucial. Any upwards price pressure will originate from factors that directly impact consumers’ ability to spend their money on domestic industries. Beijing’s recent child subsidy measures do this by expanding parents’ disposable income and increasing the number of consumers by making it more affordable to have children. Higher food prices not linked to supply factors (e.g. disinflationary NASA Weather Rain CPI Price Index and inflationary Food Price CPI) will be among the first indicators of persistent price growth in China. Steady gains in China’s consumer confidence index since November 2024—mirroring the roll-out of expanded stimulus measures—have driven shifts in government revenue (Figure 3) that reflect growing demand for taxable goods and reduced taxes, making this trend an important gauge of overall price over the next 12 months.

Figure 3

As more progress is made during trade negotiations between the U.S. and China and market participants diversify away from U.S. risk exposure, we expect the impact of uncertainty on inflation to diminish. Turnleaf will continue to update its forecasts on a weekly basis to keep up with a rapidly changing global economy.

Contribution Word Cloud for CPI YoY NSA for China, Mar 2025

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, ‘Inflation Market Forecast’ is large, indicating their significant weight in the model, while its color suggests whether it contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.