Turnleaf expects Chilean inflation to ease below the central bank’s 3% target in early 2025, driven by peso appreciation compressing import prices and subdued energy costs (Figure 1 – PAID). Despite elevated copper prices sustaining terms of trade, export volume constraints have kept revenue growth muted.Energy Disinflation Driven by Currency Strength

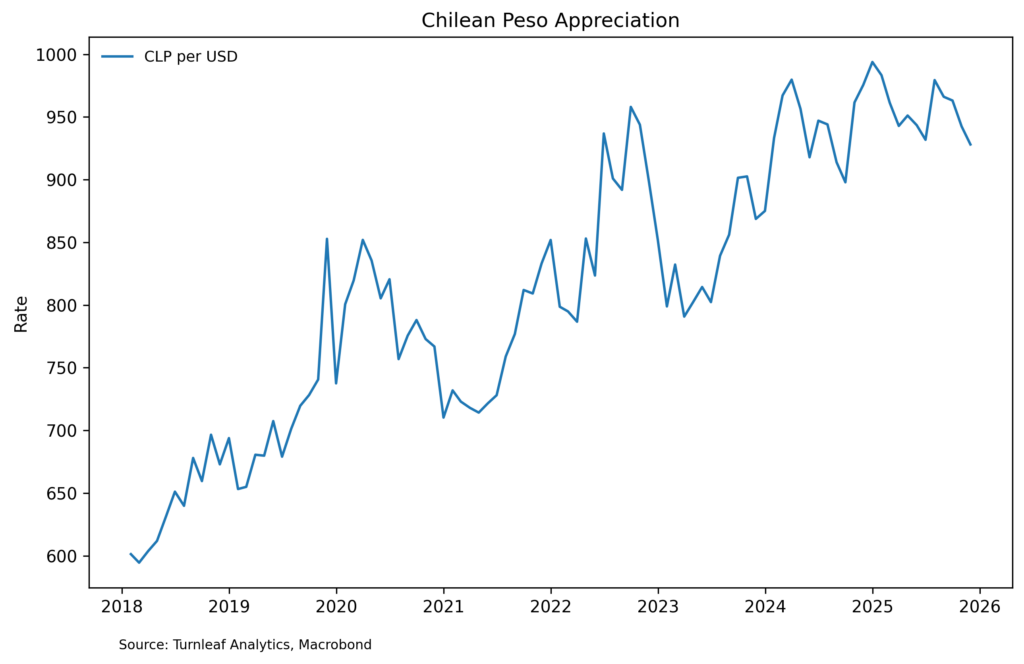

Chilean energy prices have decelerated notably in recent months, driven primarily by peso appreciation, which has reduced the local-currency cost of dollar-priced energy inputs, and lower global oil prices. As the CLP strengthened by roughly 8% against the USD since mid-2024, dollar-denominated electricity contracts translated into lower peso costs, offsetting underlying operational pressures (Figure 2)

Figure 2

However, retail fuel prices exhibit persistent stickiness relative to international crude benchmarks. Turnleaf’s proprietary Fuel Price Index for Chile indicates recent plateauing in benzine price growth (Figure 3), consistent with elevated retail margins stemming from oligopolistic downstream market structure and distribution constraints. This partial offset limits the full disinflationary impulse from lower Brent crude, though the net effect remains disinflationary.

Figure 3

Upward Cost Pressures Persist in Mining Sector

Upward Cost Pressures Persist in Mining Sector

Chile’s mining sector faces persistent cost escalation despite supportive copper price dynamics (Figure 4). Producer price inflation for mining has accelerated in recent months, driven by elevated energy and labor inputs alongside structural headwinds from declining ore grades at mature operations.

To read the rest, visit Turnleaf’s latest Substack post, here.