Brazilian inflation has proved particularly sticky, driven by persistent wage growth, global trade dynamics, and elevated food inflation from weather-related supply constraints. Turnleaf projects inflation to remain close to 5% YoY through the end of the year, until strong base effects from February 2025’s electricity shock (which added 0.56% to headline inflation that month) shift inflation back down towards 4% YoY throughout 2026 (Figure 1). These base effects will also have direct implications for Food and Beverage CPI and Core CPI. Education fee changes that same month, which raised headline 0.28% in 2025, will similarly provide a favorable base effect provided typical fee hikes do not exceed those of 2025.

Food and Beverage Inflation

Turnleaf expects Food and Beverages CPI to remain elevated over the next 12 months. Food costs are projected to decline towards 4% primarily due to base effects from electricity prices before returning to 6% YoY in the long run. Food inflation currently sits at approximately 6.61% YoY as of September 2025, reflecting persistent upward pressure that has led Turnleaf to revise its 12-month inflation curve higher over the last few forecasts (Figure 2).

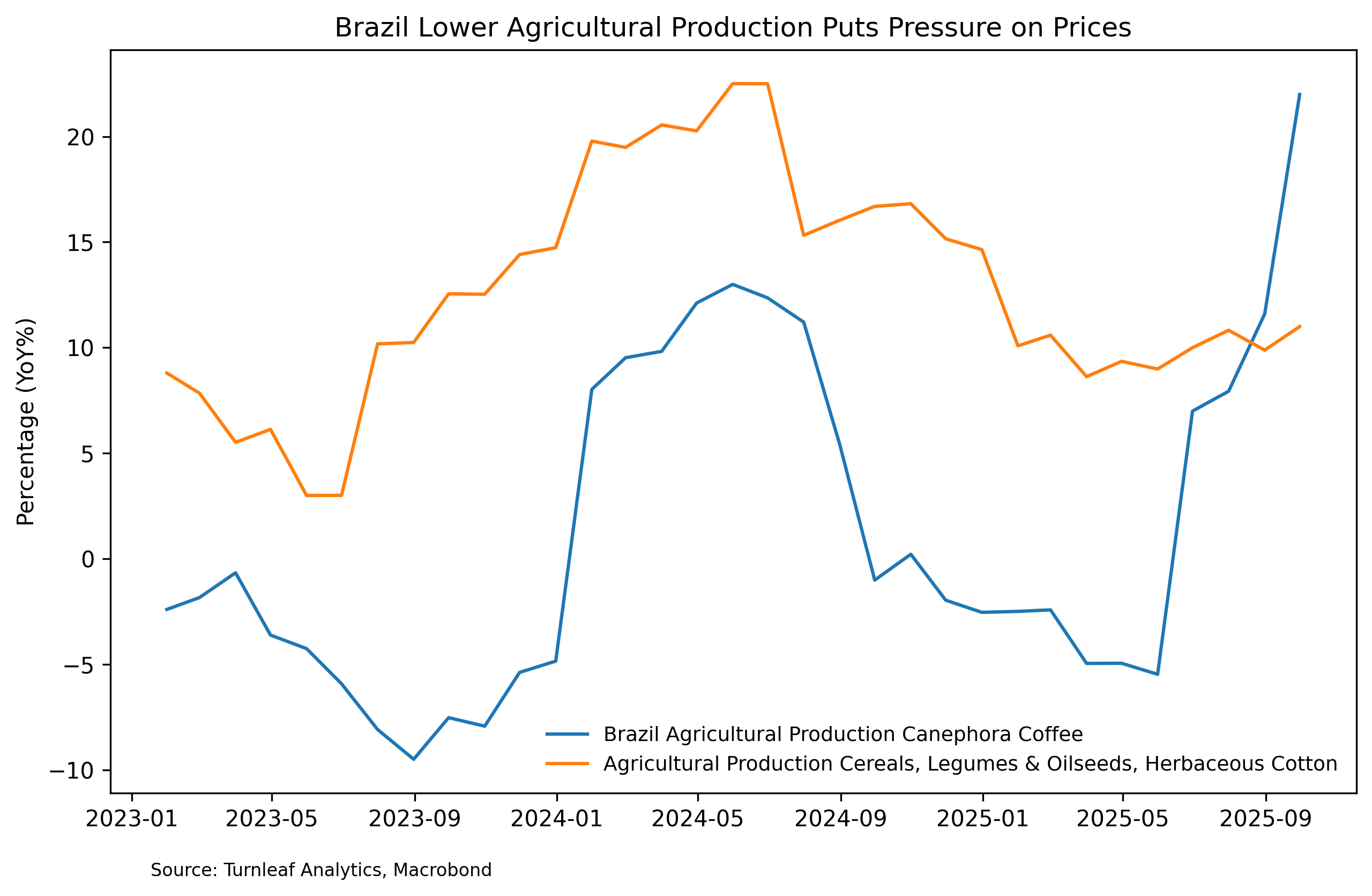

The primary source of inflation has been cost-push pressures that keep agricultural inputs high. Agricultural production data reveals a concerning pattern since mid-2024. Canephora coffee production reached approximately 10% YoY as of late 2024 before plummeting into negative territory. Production of cereals, legumes, oilseeds, and herbaceous cotton decelerated sharply from over 20% YoY growth in early 2024 to around 10% YoY by late 2025. While both categories have shown recent recovery, production remains below the robust levels of early 2024 (Figure 3).

Figure 3

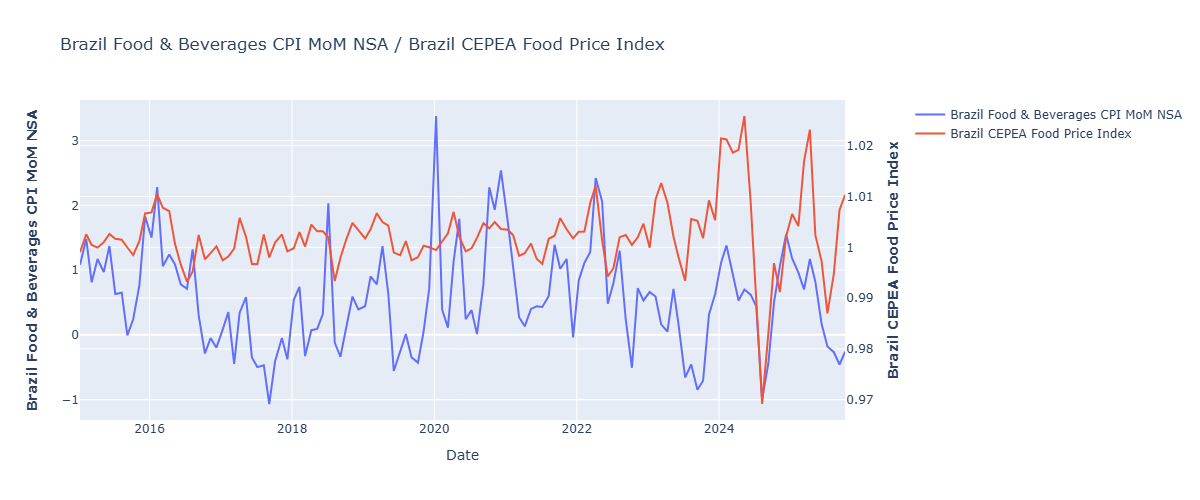

This extended production weakness, driven by unfavorable weather conditions and climate volatility, has translated into sustained upward pressure on food prices. The recent uptick in production has not yet been sufficient to rebuild depleted inventories or ease the accumulated supply constraints from the prior year’s shortfall. Food prices reflect cumulative supply pressures over time rather than responding immediately to short-term production changes. Additionally, Brazil’s export-oriented agricultural model means domestic food supply remains vulnerable even as production recovers, since producers continue prioritizing more profitable international markets. Overall, Turnleaf’s proprietary food index, CEPEA Food Price Index (Figure 4), which accurately tracks the direction of price changes across major food categories, signals continued elevated pressures, despite Brazil’s government eliminating import tariffs on essential food items in early March 2025, including coffee, olive oil, sugar, corn, sunflower oil, sardines, cookies, pasta, and meat with rates that had ranged from 7.2% to 32%.

Figure 4

To read the rest, visit Turnleaf’s latest Substack post here.