Reaching 3.8% YoY in October 2025, headline CPI is currently above both the RBA’s 2–3% target band and the market consensus forecast of 3.6% (ABS CPI October 2025). Turnleaf’s model projected 3.7% YoY, capturing the direction and approximate size of the upside surprise (Figure 1). Over the next 12 months, our central forecast is that headline inflation declines gradually towards around 3%, as key price components remain sticky and adjust slowly.

Inflation Drivers: Three Key Dynamics

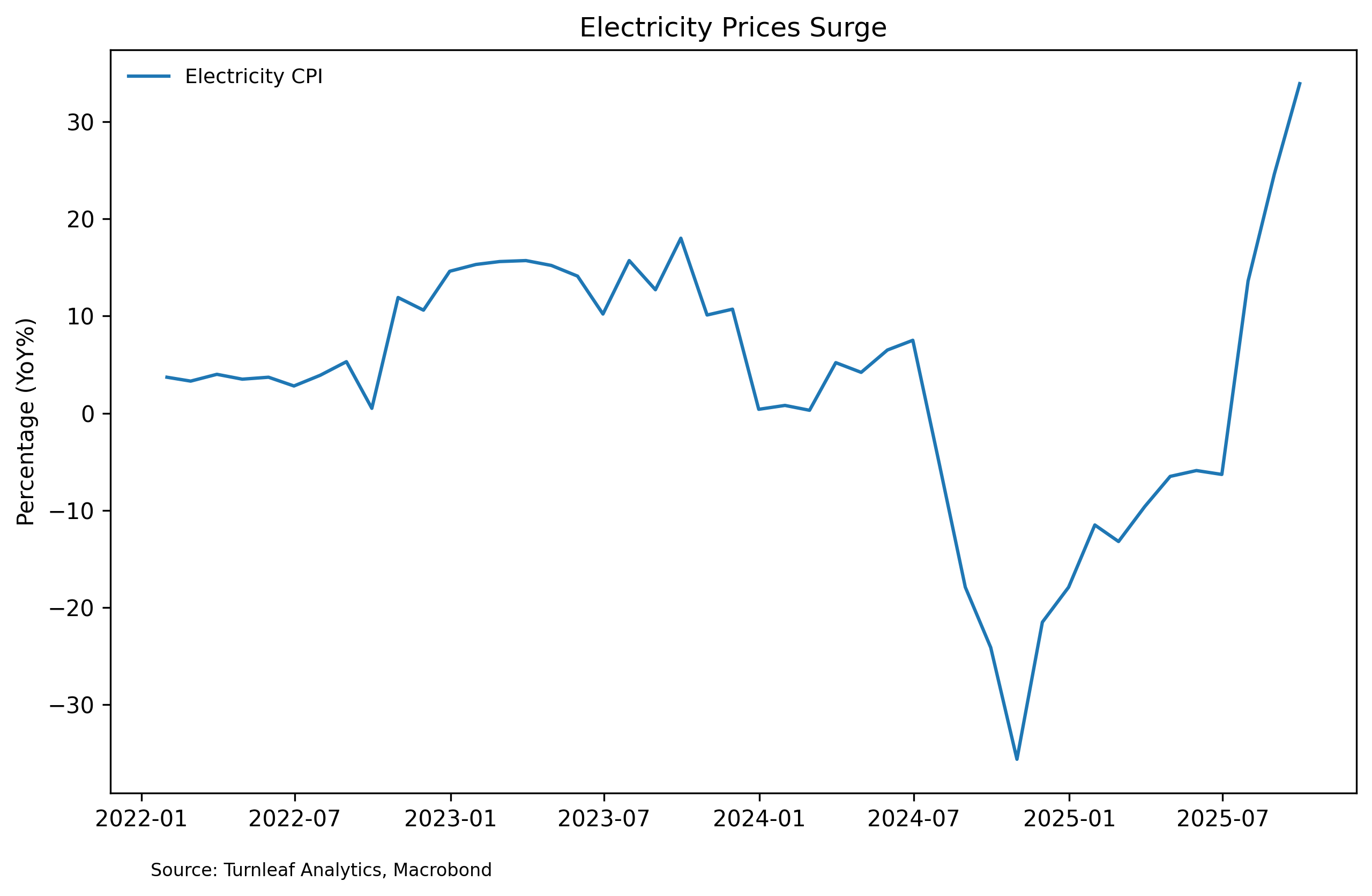

Our decomposition isolates three main drivers. First, base and seasonal effects are turning more favourable. Items that had large increases in the previous year including electricity (which rose 37.1% YoY in October after government rebates expired), fuel, rents, travel, and indexed government charges, now have a smaller weight in the year-ahead comparison, mechanically reducing their contribution to the annual CPI rate.

Second, scheduled policy measures will provide some modest disinflationary pressure in 2026. The PBS co-payment is frozen at $31.60 through 2025 for general patients, with a reduction to $25 scheduled for January 2026. The expanded Child Care Subsidy (“3 Day Guarantee”) begins in January 2026, providing minimum 72 hours of subsidised care per fortnight regardless of activity level. Additionally, the Solar Sharer program is scheduled to launch in July 2026, offering at least three hours of free daytime electricity to households in NSW, South-East Queensland, and South Australia. Combined, these measures are expected to subtract several tenths of a percentage point from headline and core inflation through mid-2026.

Third, household financial conditions show signs of stabilisation that may support consumption. The financial-account deposits series has moved from strongly negative YoY growth earlier in 2025 to values close to zero in recent observations, meaning households are still drawing down deposits but at a much slower pace. In our historical estimation window, changes of this magnitude are usually associated with slightly firmer consumption growth over the following year and a small positive contribution to core inflation.

Electricity Leads Upside Risks to Inflation

Electricity represents our single largest upside risk to the inflation forecast and requires careful monitoring. Retail electricity prices surged 37.1% YoY in October 2025 as households exhausted government rebates from the previous fiscal year (Figure 2). While wholesale electricity prices have fallen 6%YoY to around $68/MWh in H1 2025, retail prices remain substantially elevated due to rising network costs (poles and wires) offsetting wholesale declines.

Figure 2

The current Energy Bill Relief Fund provides $150 to households through December 31, 2025 (in two $75 quarterly instalments in July and October), temporarily suppressing measured electricity inflation. However, there is no announced extension beyond December 2025. As electricity bills issued in January 2026 will no longer benefit from these rebates, we expect the January 2026 CPI (to be released on 28 January 2026) to show an initial upward shock. Given the staggered nature of household billing cycles, the full impact will likely materialise across Q1 2026. Historical precedent from July 2025, when electricity rose 13.5% month-on-month as previous rebates rolled off, suggests the January 2026 impact could be substantial. Under our baseline, electricity moderates through 2026 only if wholesale prices continue to decline and no further supply disruptions occur.

To read the rest, visit Turnleaf’s latest Substack post here.