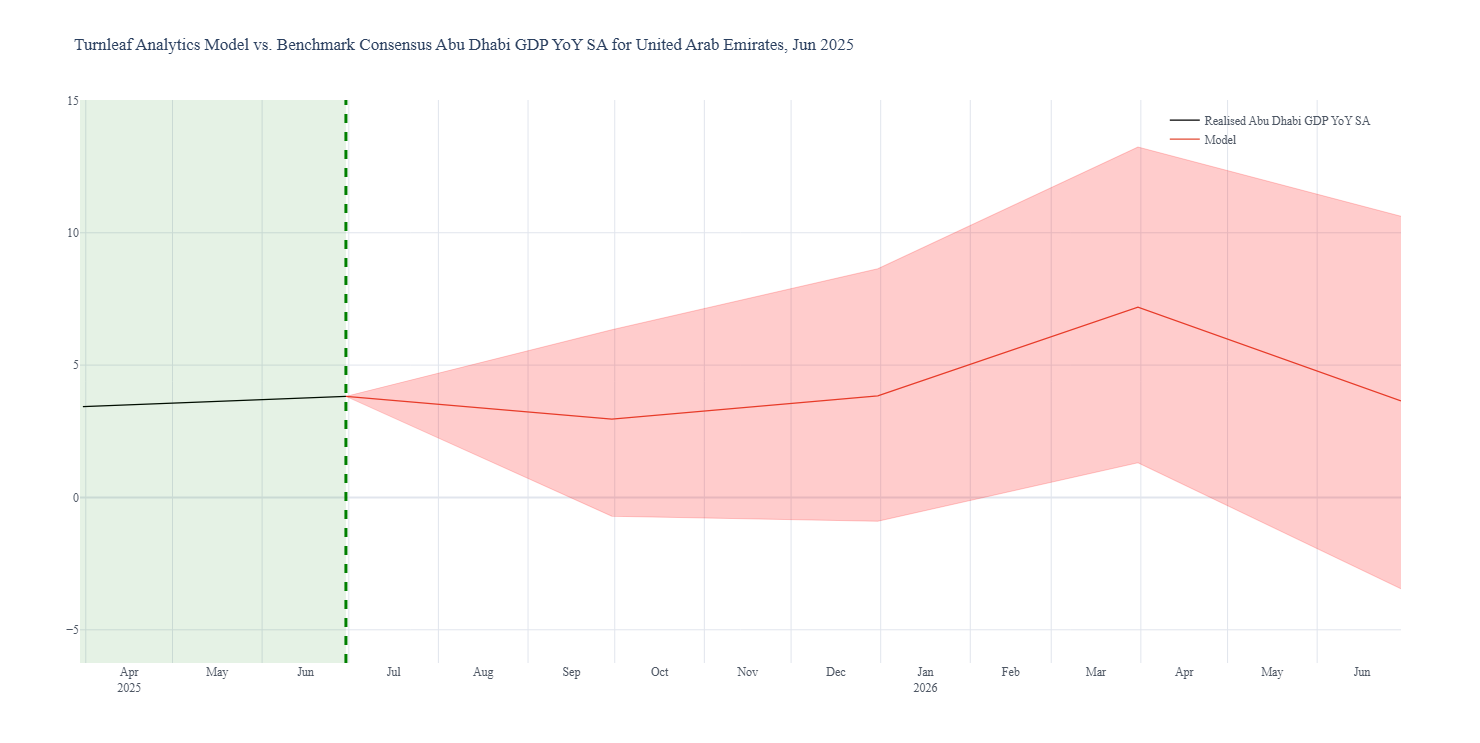

Turnleaf expects Abu Dhabi GDP growth to slow to 2-3%YoY in the next two quarters before hitting 7%YoY in 2026Q1 and then falling back to a bit over 3%YoY by June 2026 (Figure 1). Downward pressures are moderate and mainly concentrated in services and business confidence, primarily impacting the first quarters of Turnleaf’s forecast. Upward drivers are led by the non-oil sector, which is expected to support GDP growth through the first three quarters of the forecast period.

Figure 1

As Abu Dhabi continues its economic diversification strategy with oil currently contributing approximately 44% and non-oil activities 56% of the emirate’s GDP in Q1 2025 monitoring both oil and non-oil GDP growth will be essential to assess progress toward strategic economic goals.

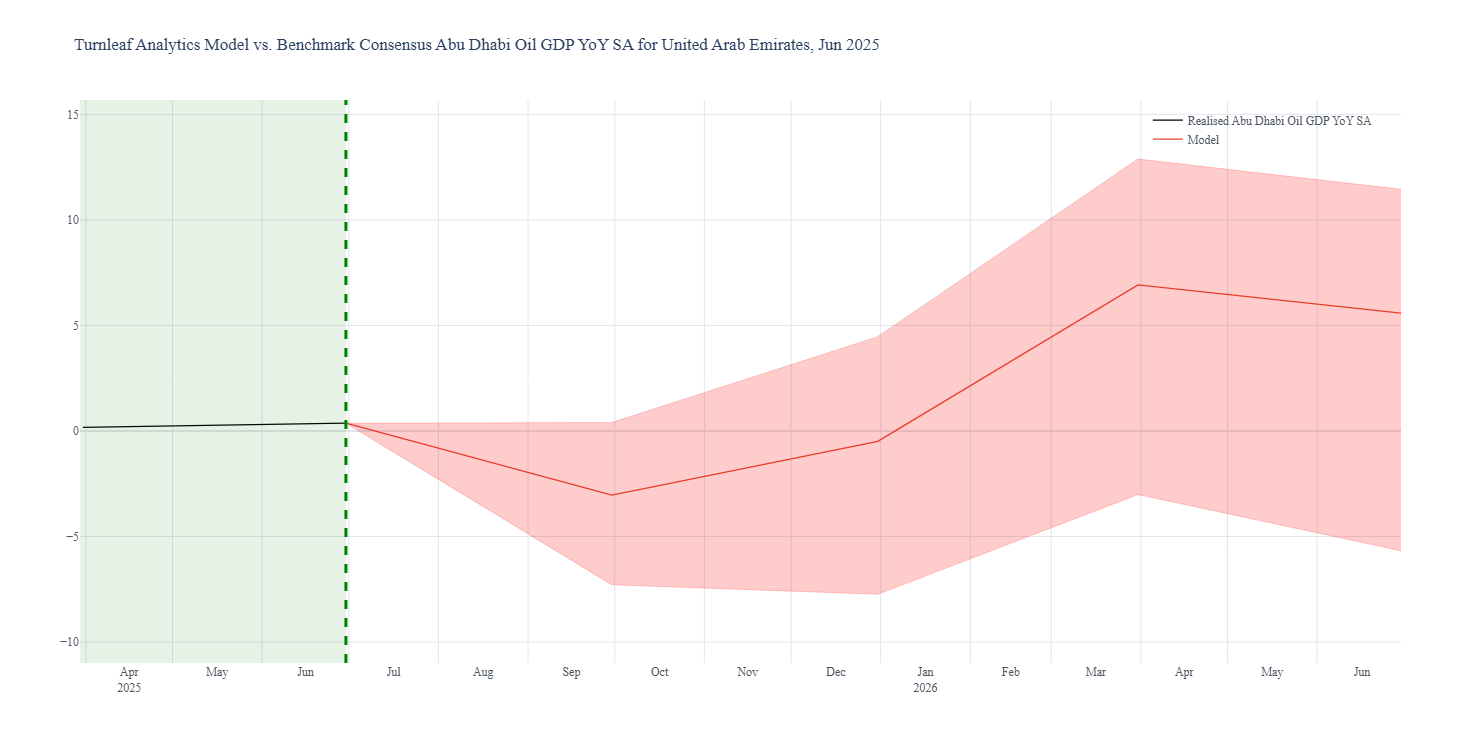

Abu Dhabi Oil GDP

Turnleaf’s Abu Dhabi Oil GDP model forecasts a temporary decline into negative territory in the next quarter, then steadily rebound to around 5%YoY by Q2 2026 (Figure 2).

Figure 2

Oil Sector Spillover Effects

Crude oil production remains the primary growth driver, reinforced by several domestic factors. Overall employee compensation growth in the UAE (10%YoY in 2025Q3), generates local economic spillovers as workers spend wages locally, increasing resident bank deposits (12%YoY in October 2025), that provide capital for lending, creating a reinforcing cycle that amplifies oil production’s impact on growth into the next few quarters.

Global Market Risks

Eurozone and United States market conditions warrant close monitoring, as economic contractions or slowdowns driven by inflationary pressures could significantly impact Abu Dhabi’s oil-dependent economy. Based on Turnleaf’s model, the inflationary trajectories of these economies are currently providing a positive contribution to Abu Dhabi GDP growth. The EU is the UAE’s second-largest global trade partner, with $67.6 billion in non-oil trade, while the US maintains deep energy sector partnerships with Abu Dhabi. A recession in either region would suppress global oil demand. The US accounts for approximately 15-20% of global oil consumption, while the EU represents roughly 10%. This would directly pressure prices and production volumes that support Abu Dhabi’s primary revenue source. Economic stress in these advanced economies would also reduce foreign direct investment flows and trade activity, intensifying downward pressure on Abu Dhabi’s growth.

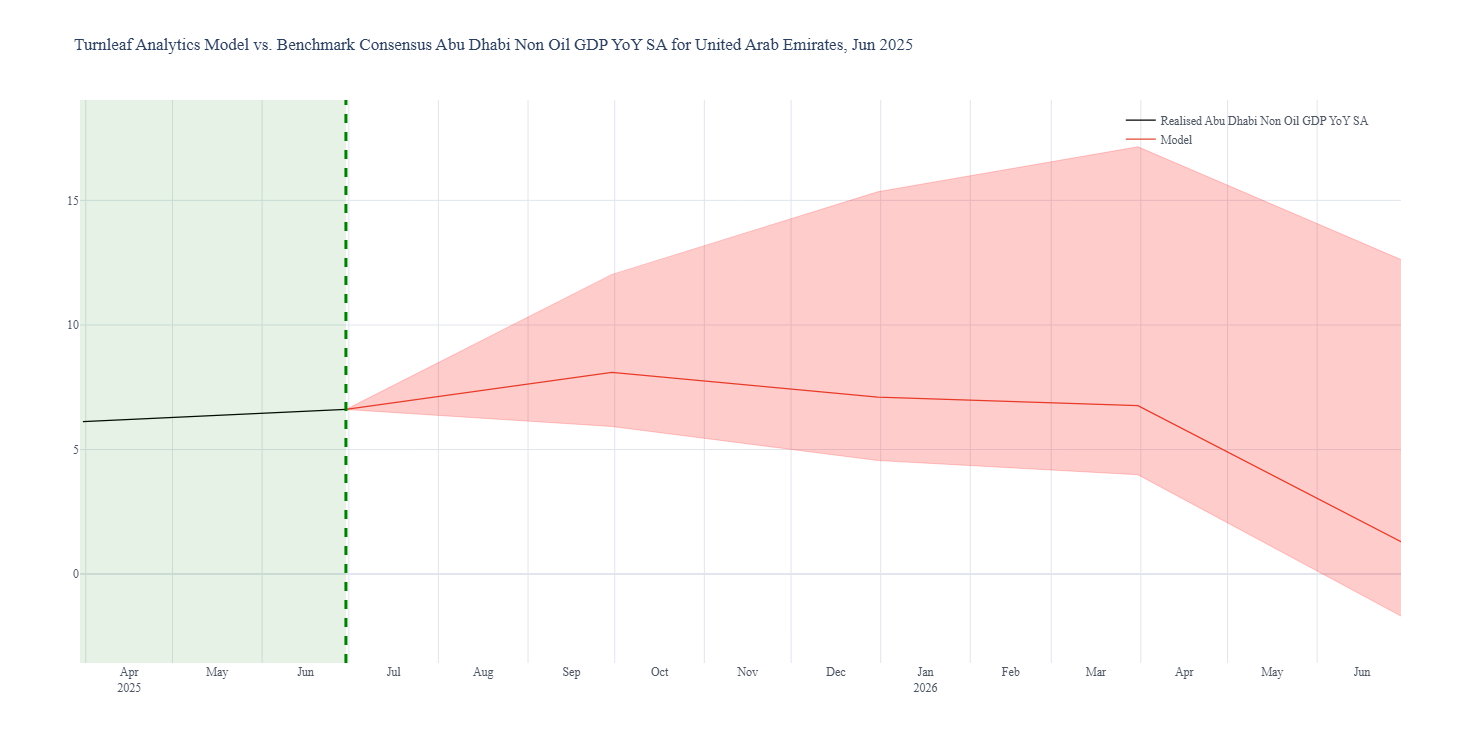

Abu Dhabi Non-Oil GDP

Abu Dhabi’s non-oil economy is set to maintain strong momentum, with growth rising to nearly 8%YoY by early 2026, as robust tourism inflows and improving business sentiment continue to underpin activity, before easing to around 1%YoY by midyear 2026 (Figure 3).

Figure 3

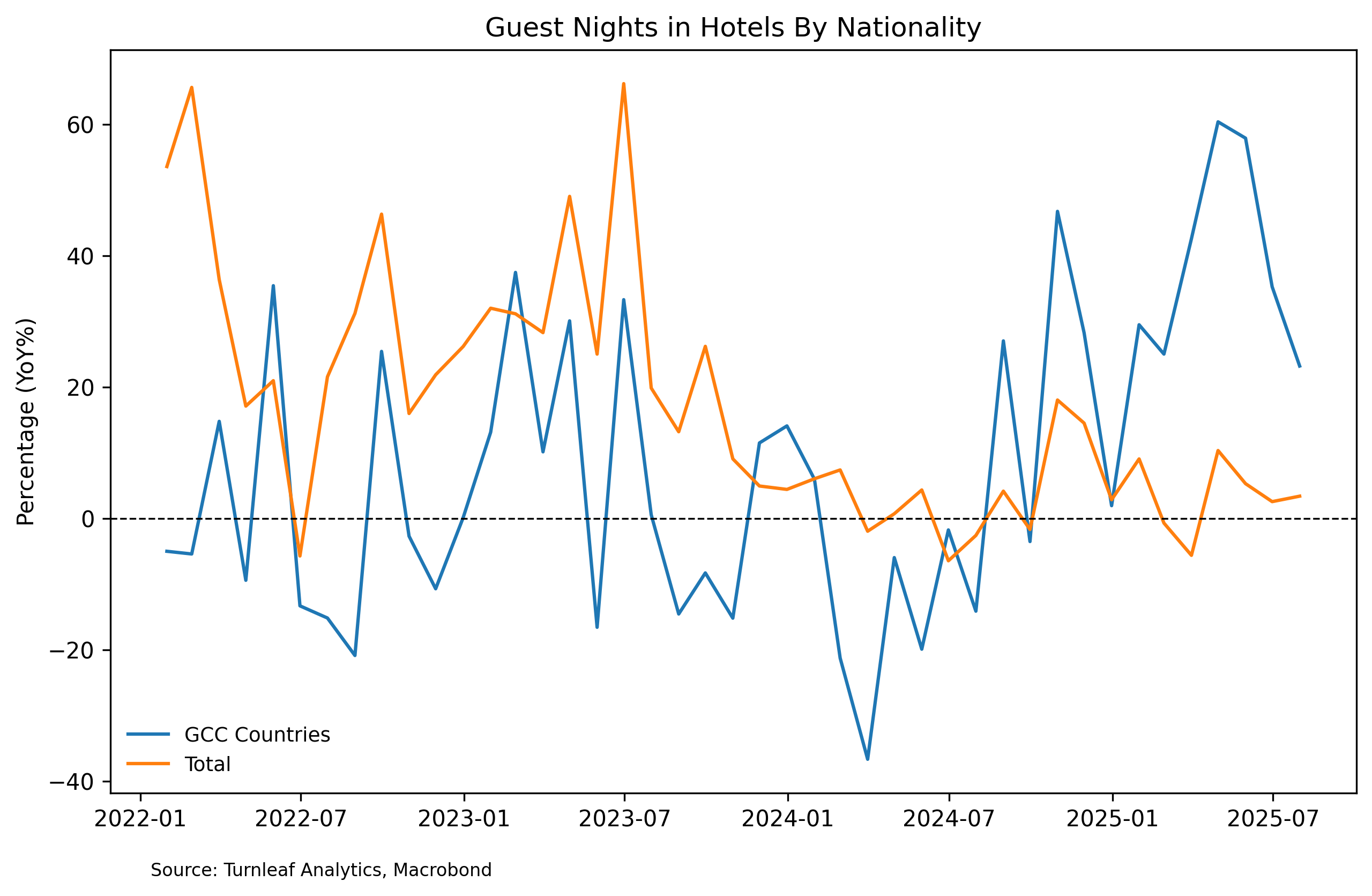

Tourism and Regional Demand

Strong oil markets generate regional spillover effects that sustain domestic demand across Abu Dhabi’s diverse economic sectors, including its cultural economy, which attracts foreign visitors and extends guest stays. These tourism dynamics lift non-oil GDP growth by expanding the services sector. Visitors from GCC countries are leading this contribution with 20%YoY growth in September 2025, though the growth rate is moderating (Figure 4). Overall, total guest nights across all visitor segments remain positive, ensuring tourism continues to support broader economic growth beyond the oil sector.

Figure 4

Credit Market Dynamics

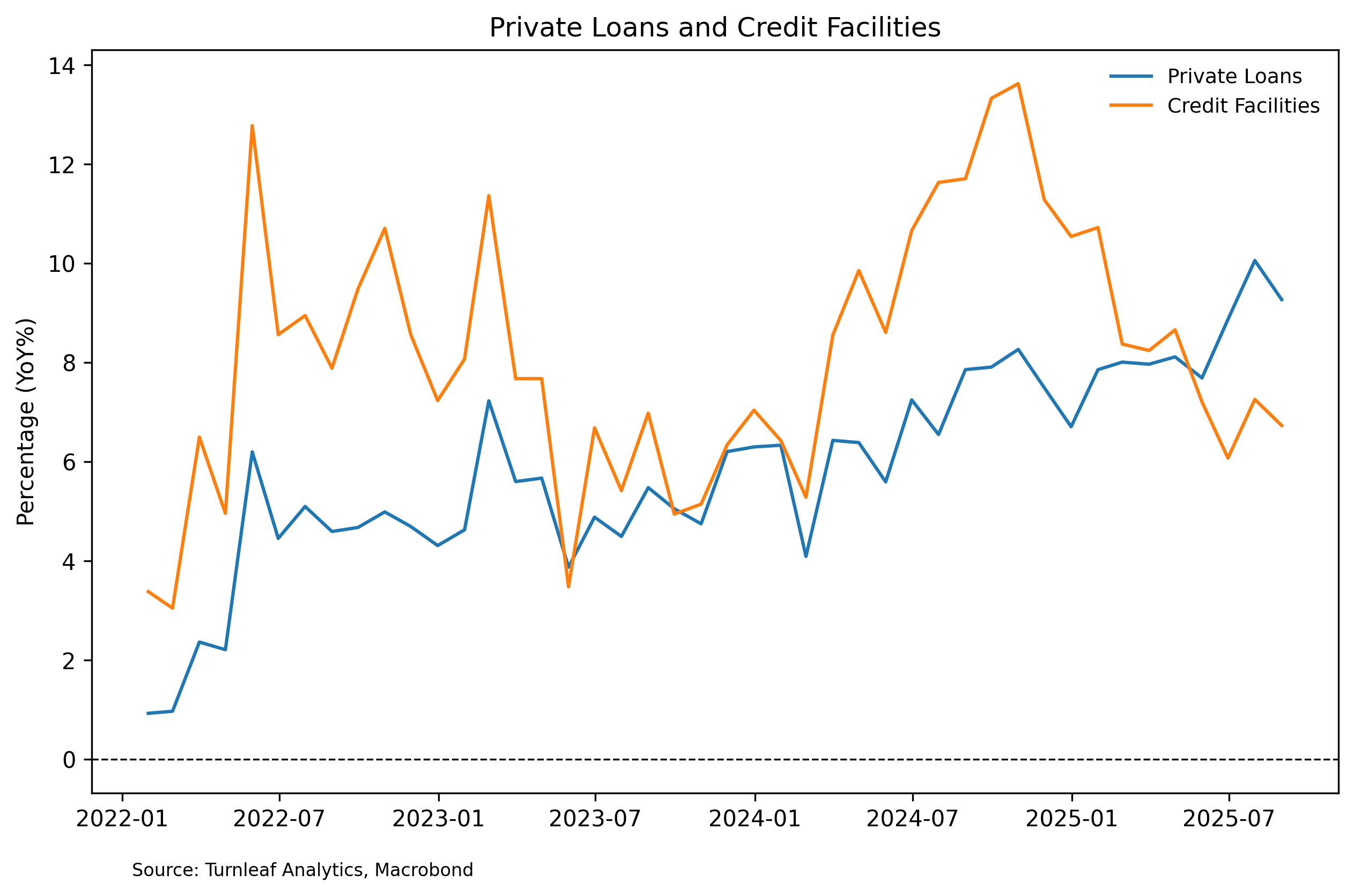

UAE credit market dynamics point to slower GDP growth in Abu Dhabi. Credit facilities across the UAE have decelerated from 14% to 7%YoY, indicating reduced appetite for large-scale project financing that typically drives infrastructure investment and corporate expansion in Abu Dhabi (Figure 5). While private sector loans are accelerating to 10%YoY, this growth likely reflects working capital needs rather than productive investment, particularly given the sharp volatility in Dubai’s business confidence, which collapsed from 142 to 110 before recovering to 147, though conditions remain optimistic.

Figure 5

The deceleration in institutional lending, despite recovering business sentiment, signals underlying caution among financial institutions about committing to long-term projects. This split between declining credit facilities and rising private borrowing suggests the UAE economy, including Abu Dhabi, is losing momentum in its primary investment-driven growth engines even as smaller-scale borrowing activity continues. These dynamics will likely steer the tail end of the non-oil GDP curve, unless there is a reversal in trends.

Turnleaf’s Abu Dhabi GDP Outlook

Abu Dhabi’s economic trajectory through mid-2026 reflects a period recalibration. The emirate faces near-term growth moderation driven by cautious credit markets and softening business confidence, even as fundamental drivers like tourism growth provide some underlying support. The divergence between declining large-scale project financing and accelerating consumer lending suggests businesses are postponing capital-intensive investments despite improving sentiment.

Abu Dhabi’s growth trajectory hinges on whether the oil sector rebounds as forecasted in Q12026 and whether recovering business confidence restores institutional lending for large-scale projects. Global oil demand must also hold steady despite risks of economic slowdowns in the US and EU, which together consume roughly 25 to 30% of global oil. If these conditions align, and regional tourism sustains its momentum, Abu Dhabi can reach its targeted 4% growth rate by mid-2026. The non-oil sector, now contributing over half of GDP, provides a buffer but cannot fully offset weakness in oil revenues or institutional credit markets.