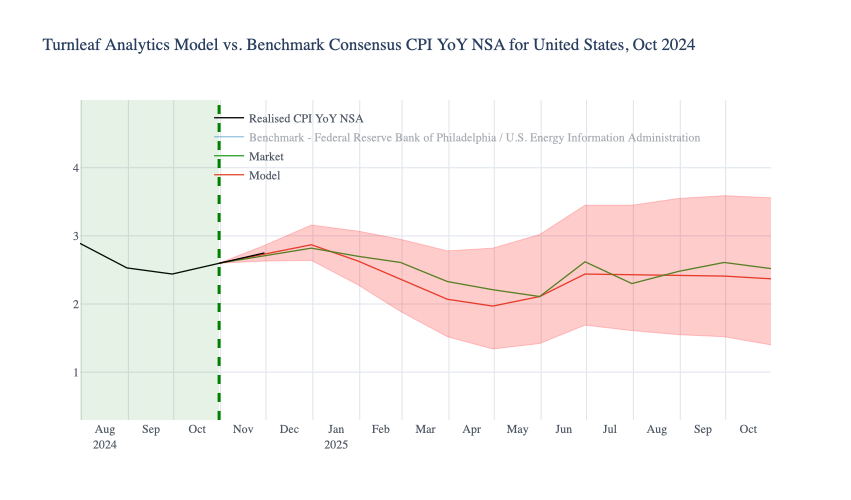

At Turnleaf Analytics, leveraging our machine learning models, we project U.S. inflation to stabilize between 2–3% through 2025, shaped by the interplay of import inflation, expectations, and economic slack, especially with the possibility of new tariffs. Rising import costs can drive up prices and influence inflation expectations, while economic slack affects how much those costs impact overall inflation. These ingredients, together, form the foundation of our inflation outlook.

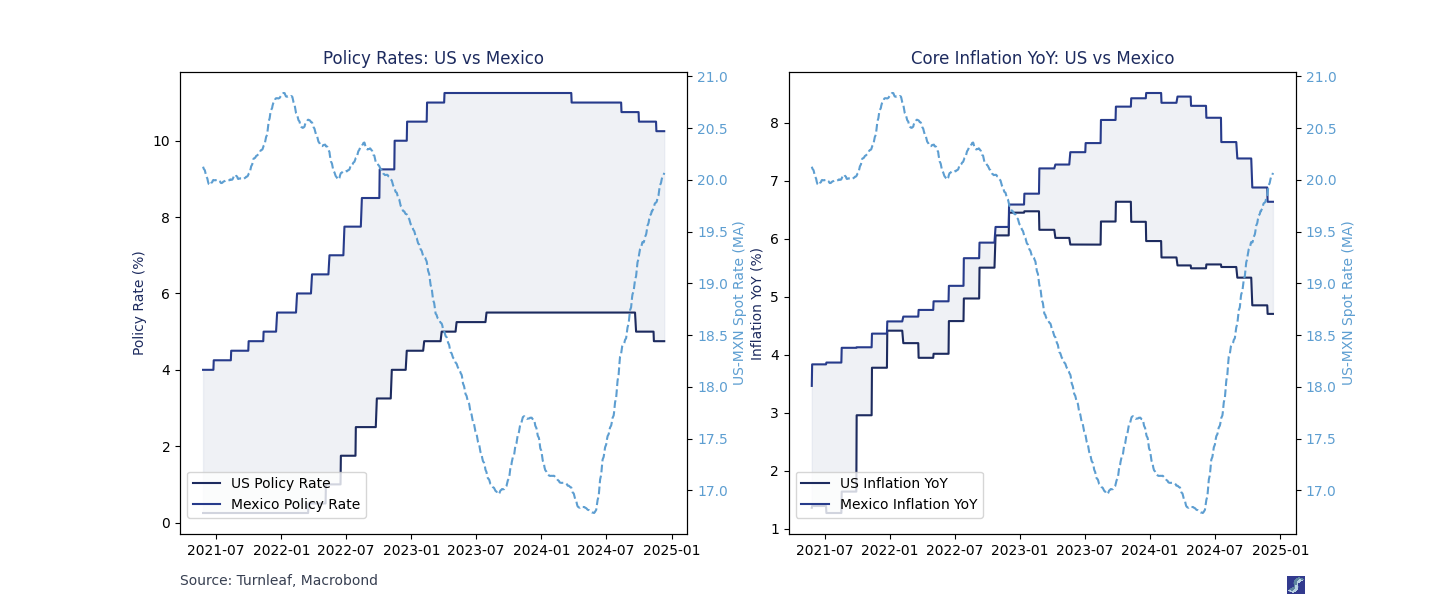

Below, we illustrate how central bank policy rates influence inflation through trade channels. Higher policy rates in the U.S. or Mexico attract foreign investors, strengthening their respective currencies. A stronger currency lowers import costs, reducing inflationary pressures by making goods and materials cheaper. Conversely, lower policy rates weaken currencies, driving up import costs and amplifying inflation.

Below, we illustrate how central bank policy rates influence inflation through trade channels. Higher policy rates in the U.S. or Mexico attract foreign investors, strengthening their respective currencies. A stronger currency lowers import costs, reducing inflationary pressures by making goods and materials cheaper. Conversely, lower policy rates weaken currencies, driving up import costs and amplifying inflation.

This trade-driven mechanism demonstrates how exchange rates serve as a key channel through which monetary policy shapes inflation, particularly in economies reliant on imported goods. Understanding these dynamics is essential for predicting how central bank decisions ripple through global trade networks to influence domestic price levels.

The second graph adds another layer to this story by highlighting the difference in inflation-adjusted policy rates, or real rates. When US real rates are higher than Mexico’s, investors favor the Dollar, leading to a weaker Peso. This weakens Mexico’s ability to contain inflation, as imports become more expensive. Conversely, when Mexico’s real rates are higher, the Peso strengthens, which helps Mexico control inflation but can increase inflationary pressures in the US by making imports more expensive.

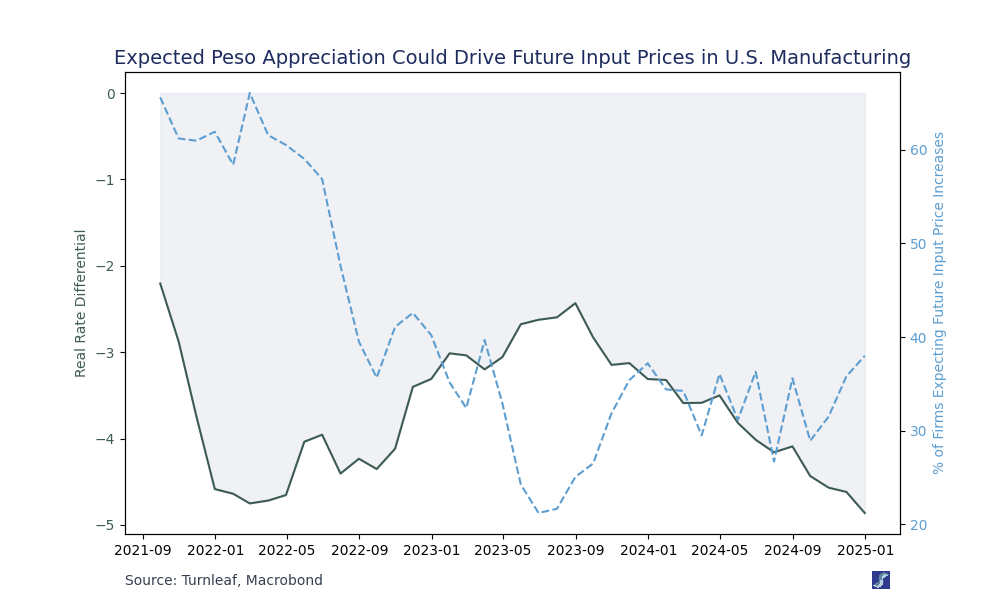

Expectations: Exchange rates, therefore, provide a forward-looking measure of inflation risk. By observing these dynamics, we can better understand the trajectory of future inflation in both countries. A stronger Peso often signals tighter Mexican policies or looser US policies, and vice versa. The Texas Manufacturing Outlook Survey highlights how negative real rates amplify expected raw material costs, reinforcing the link between market expectations, inflation, and exchange rates.

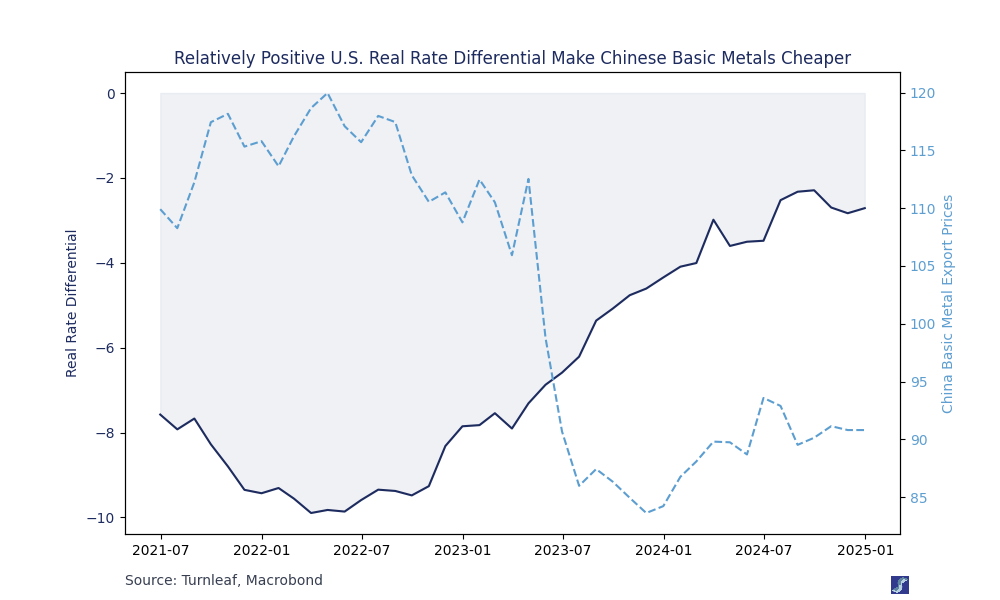

Imported Inflation: Positive interest rate differentials between the U.S. and its trading partners not only help anchor domestic inflation expectations but also support currency appreciation, which can reduce import costs. A notable case is the U.S. dollar’s appreciation against the Chinese yuan following the Fed’s aggressive rate hikes amid a subdued Chinese economy, which eased inflationary pressures on imported goods. For example, as U.S. real rates rise, the dollar appreciates with respect to the Yuan, making metal exports cheaper. When considering imported inflation, adding tariffs could be analogous to increasing China’s real rates, leading to Yuan appreciation and costlier raw material imports for the U.S.. The future of inflation in a tariff world will largely depend on the interplay between real rates between the U.S. and China.

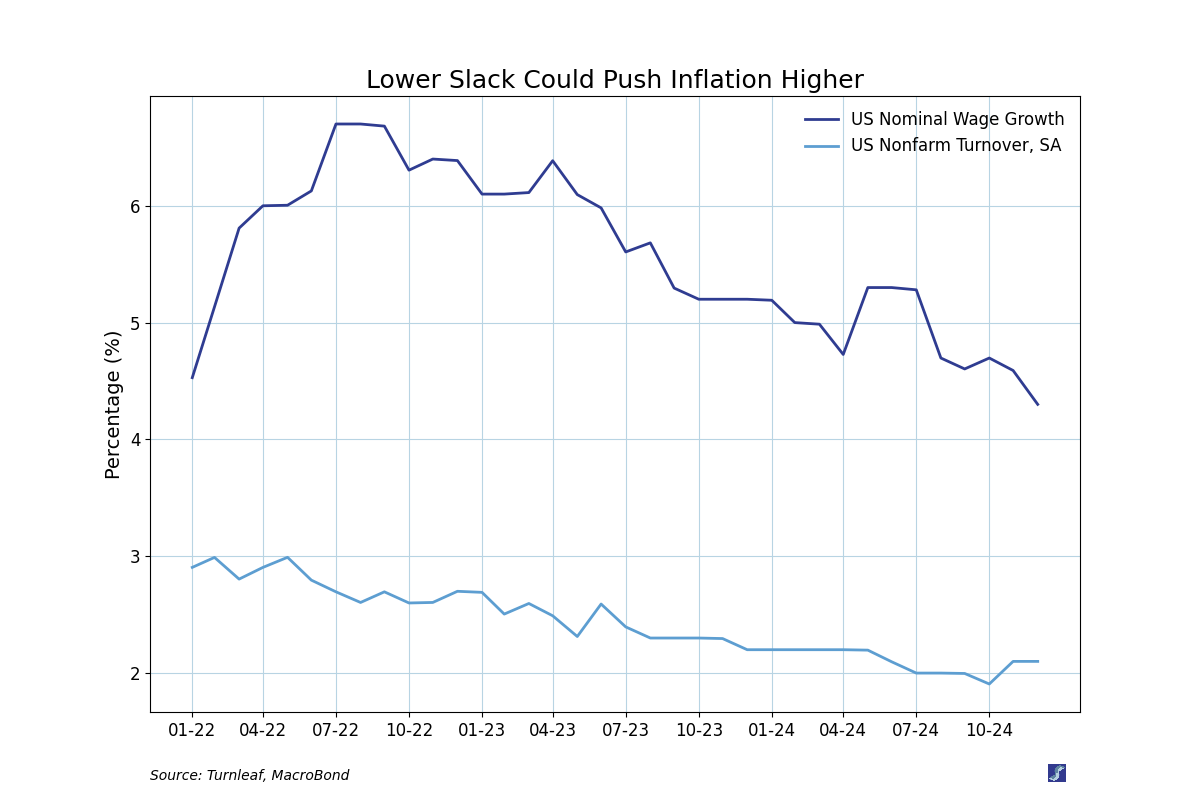

Slack: Lower turnover could indicate that fewer workers are switching jobs due to reduced hiring or preference for greater job stability. At the same time, slowing wage growth suggests a moderation in labor-driven inflation pressures. However, factors such as deportations leading to labor shortages could further reduce slack, tightening the labor supply and potentially driving wage growth higher. This dynamic complicates the relationship between slack and inflation, requiring close monitoring of how these forces evolve in the coming months.

By analyzing hundreds of interconnected factors within these major groups and by leveraging the power of machine intelligence, we can better interpret the forces shaping inflation and identify the conditions likely to drive future price changes through 2025.

By analyzing hundreds of interconnected factors within these major groups and by leveraging the power of machine intelligence, we can better interpret the forces shaping inflation and identify the conditions likely to drive future price changes through 2025.