Turnleaf is forecasting 2–2.5% headline inflation for the Eurozone in 2025, while core inflation is expected to decline through the end of the year towards 2% as momentum in wage growth slows and fiscal normalization settles. The uptick in inflation observed in January 2025 is largely driven by seasonality, as annual price adjustments for insurance premiums and excise taxes—both indexed to year-over-year inflation—feed into higher prices. Additionally, policy normalization is playing a role, particularly in Spain, which has reintroduced a 21% VAT on electricity and increased VAT on essential food items, further pushing inflation upward. Beyond domestic factors, the external trade environment remains a mixed picture. Eurozone exports increased in the short term, but this boost could be temporary, as companies rush to front-load inventories in the wake of Trump’s tariff threats. With geopolitical tensions rising and trading partners becoming more protectionist, the Eurozone’s export outlook is becoming increasingly fragile.

In this article, we examine four charts that illustrate localized emerging trends shaping the Eurozone’s inflation trajectory in 2025.

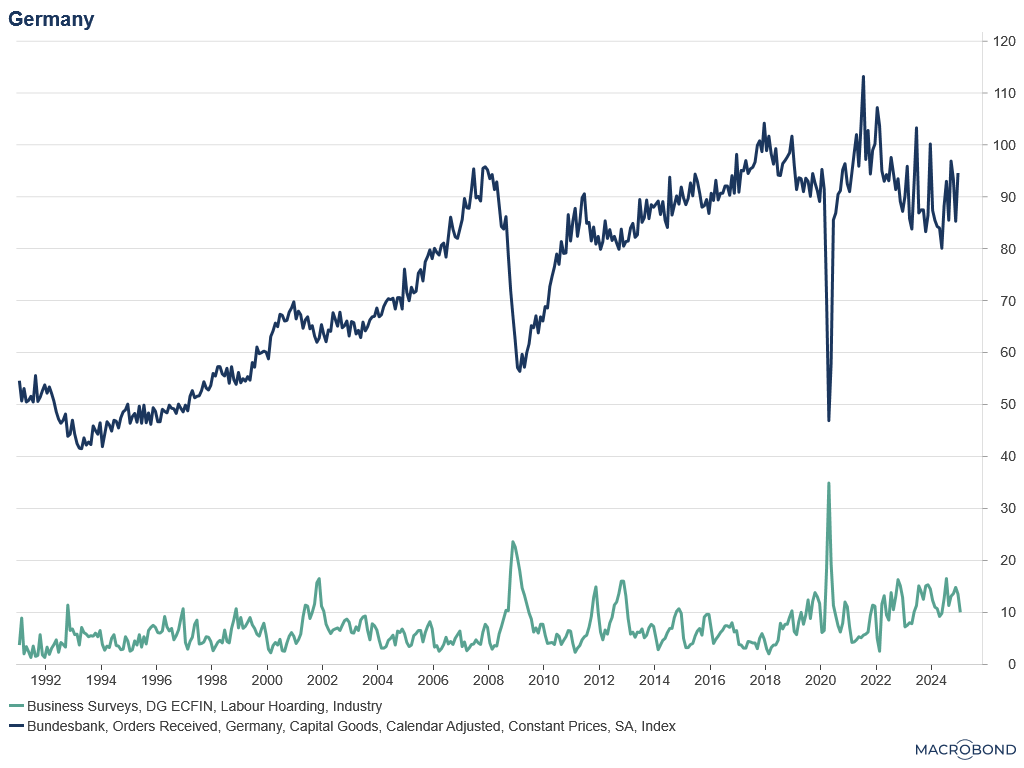

- Germany: Stronger Exports but Persistent Labor Hoarding

Germany headline inflation is set to fluctuate between 2%-2.8% in 2025. Germany has seen an uptick in exports, driven by demand for machinery and industrial goods. However, employment growth is slowing down, as many manufacturers are hoarding labor instead of laying off workers (Figure 1). This suggests uncertainty about future demand, as firms hesitate to cut jobs in case they need to rehire and retrain workers if conditions improve. Evidently, if we see observe orders received of capital goods, we notice a recent uptick that deviates from recent months declines. While this practice stabilizes the labor market in the short run, it also sustains wage pressures, making disinflation more difficult. Turnleaf projects core inflation to remain elevated at around 3% and decline throughout the end of the year to 2.5%. Given that exports to U.S. account for 10% of all German exports, tariffs would certainly weaken Germany’s manufacturing demand and exacerbate the growing affordability crisis faced by consumers.

Figure 1

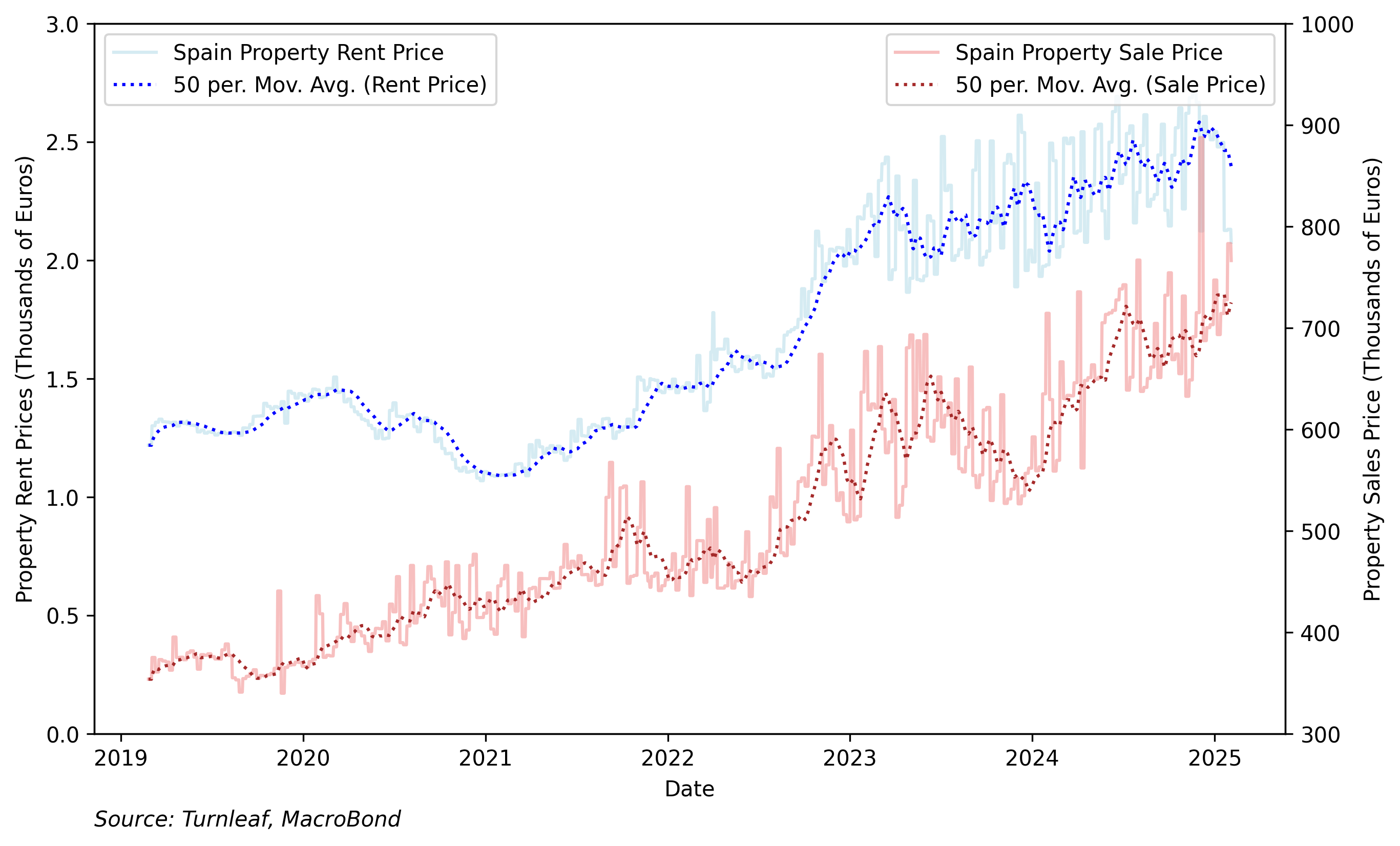

- Spain: Housing Market Pressures and Rising Capital Spending

In Spain, strong growth has pushed inflation to hover around 3% in 2025 with core inflation increasing throughout the year from 2 to 3%. Although mortgage payments are classified as financial expenses and not included in the consumer price index (CPI) basket, they have historically led rental prices, which carry a significant weight in core inflation calculations. These dynamics are expected to persist, especially in Spain, where capital spending is rising, leading to greater demand for real estate and construction. This acceleration in housing market activity is likely to contribute to higher rental prices, adding upward pressure on headline and core inflation (Figure 2).

Figure 2

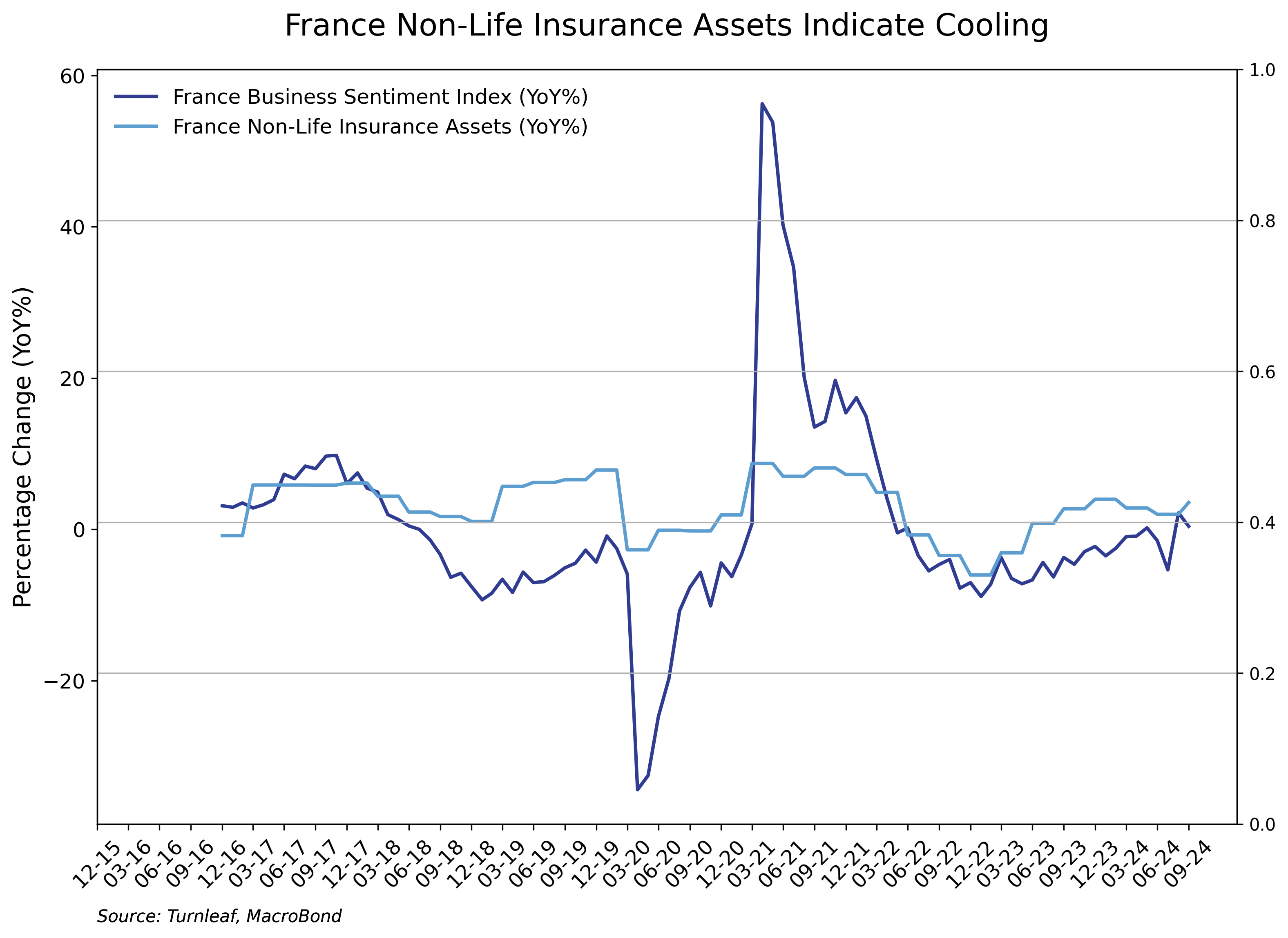

- France: Cautious Spending Cooling Inflationary Pressures

In contrast to Germany, France is experiencing subdued demand, with lower final consumption expenditure and a downturn in business sentiment. Weak consumer demand has translated to 1-2% inflation forecast for 2025 with core inflation slightly increasing to 1.5% from 1% by the end of the year as wage growth passes onto consumer prices. Employment growth is also slowing, contributing to weaker inflationary pressures. Turnleaf has flagged non-life insurance assets’ cooling contribution to inflation (Figure 3). Recent data is consistent with the narrative that French consumers are becoming cautious with their spending with households ultimately restrict their discretionary spending on services like insurance first, resulting in declining assets for affiliated institutions. Asset fluctuations appear to be loosely correlated with France’s business sentiment index, indicating that lower consumer spending is not only impacting consumers but could be exacerbated by worsening business sentiment which ultimately dictate wage growth expectations.

Figure 3

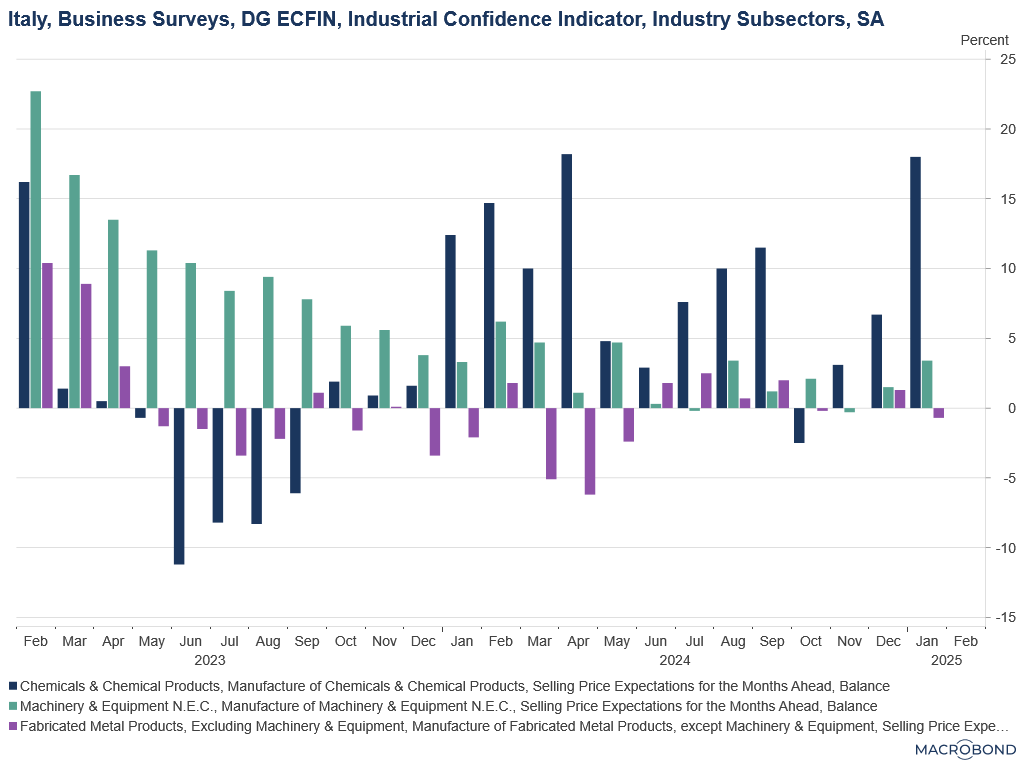

- Italy: Inflationary Pressures from Construction and Machinery Investments

Italy headline inflation is set to trend up towards 2% through the year, but keeping core inflation in check at 1.5%. Italy’s inflation trajectory is being shaped by rising selling price expectations for machinery and equipment and chemicals and chemical products (Figure 4). The rise in selling price expectations could be related the combination of ECB rate cuts and EC Recovery Funds is fueling a revitalization of the industrial sector. Additionally, as the U.S. is Italy’s largest non-EU export market, higher expected prices could reflect expectationed price pressures related to tariffs hikes. While this has positive implications for economic growth, it could also sustain inflationary pressures in key sectors.

Figure 4

A Mixed Inflation Outlook for the Eurozone

The Eurozone’s inflation outlook remains highly fragmented, with different economies facing unique challenges. While Spain and Italy are experiencing higher inflation due to capital spending and construction booms, France and Germany are seeing weaker consumer demand and industrial uncertainty, which could weigh on inflationary pressures. The ECB will need to navigate these diverging trends carefully to ensure a balanced monetary policy response that supports growth without allowing inflation to reaccelerate.

With uncertainty in global trade, rising geopolitical tensions, and varying domestic policy responses, inflation in the Eurozone remains at a critical inflection point. As we move further into 2025, monetary policy decisions and external shocks will be key determinants of inflation’s path.