Yesterday, President Trump announced a minimum 10% tariff on all imports into the United States, with higher rates targeted at countries running large trade surpluses with the U.S. Notably, Canada and Mexico are exempt from these new measures.

For many analysts, the policy signals higher inflationary pressure across both consumer and producer prices. Consumer baskets are expected to become more expensive as import costs rise, while production inputs sourced from abroad will also face higher prices due to the tariff impact on supply chains.

That said, assessing the inflationary impact of these tariffs remains challenging. The Trump administration’s policy stance is sporadic, and it remains unclear whether these tariffs are subject to future negotiation or revision.

At Turnleaf, we have consistently advocated for a data-first approach to evaluating policy impacts, setting aside political noise in favor of empirical signals. Our U.S. inflation forecast for March 2025 (Figure 1), published on March 28, already projected an inflation trajectory above market consensus. In the immediate aftermath of yesterday’s announcement, market expectations surged in line with our forecast—reflecting the value of a model-driven approach that captures both direct pricing shocks and behavioral responses from consumers and firms anticipating tariff effects.

Figure 1

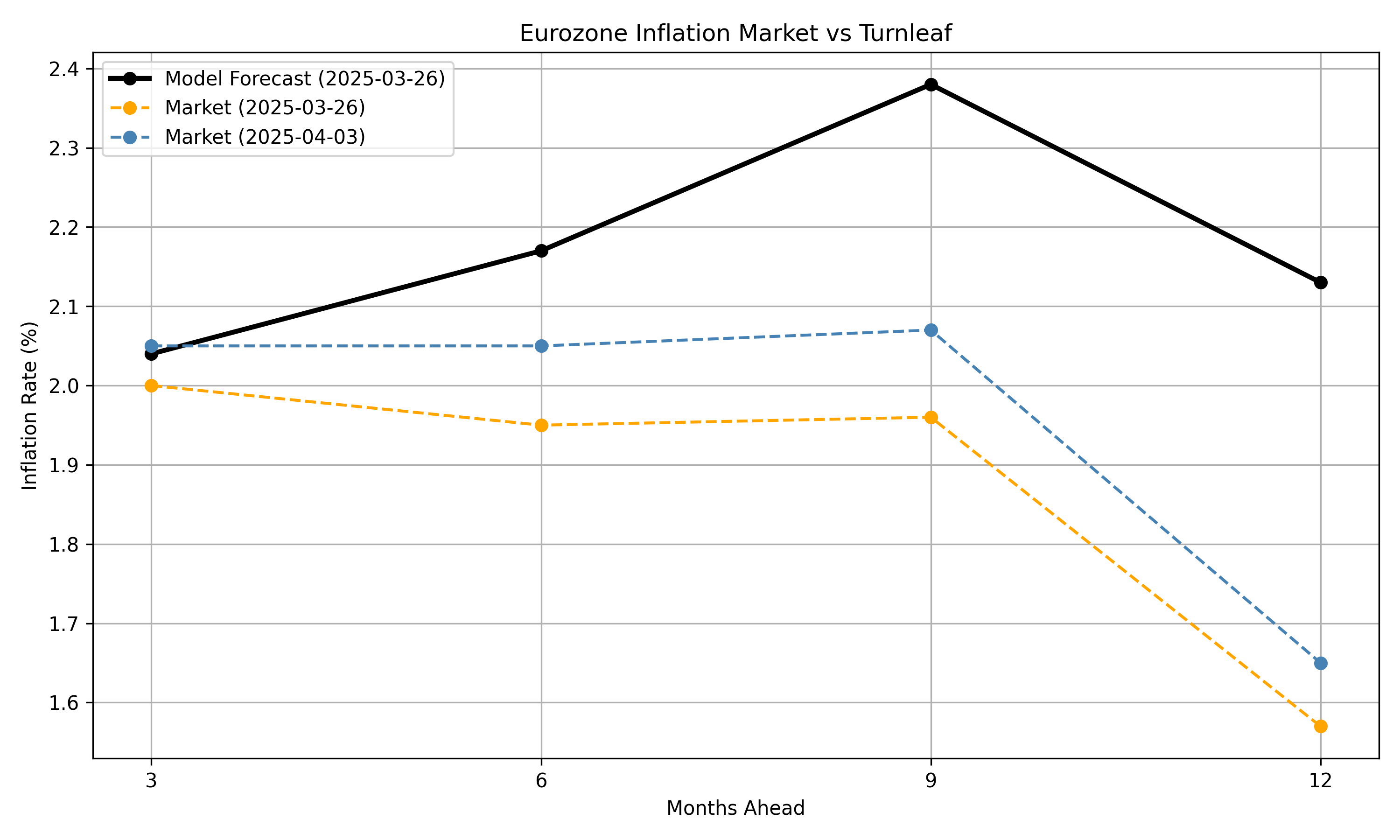

The Eurozone—facing tariffs as high as 39%—saw its inflation market curve (Figure 2) shift upward following President Trump’s announcement. However, the back end of the curve remains largely flat and below Turnleaf’s projections, indicating that markets view the tariff impact as a short-term price shock likely to fade within a 12-month horizon.

Figure 2

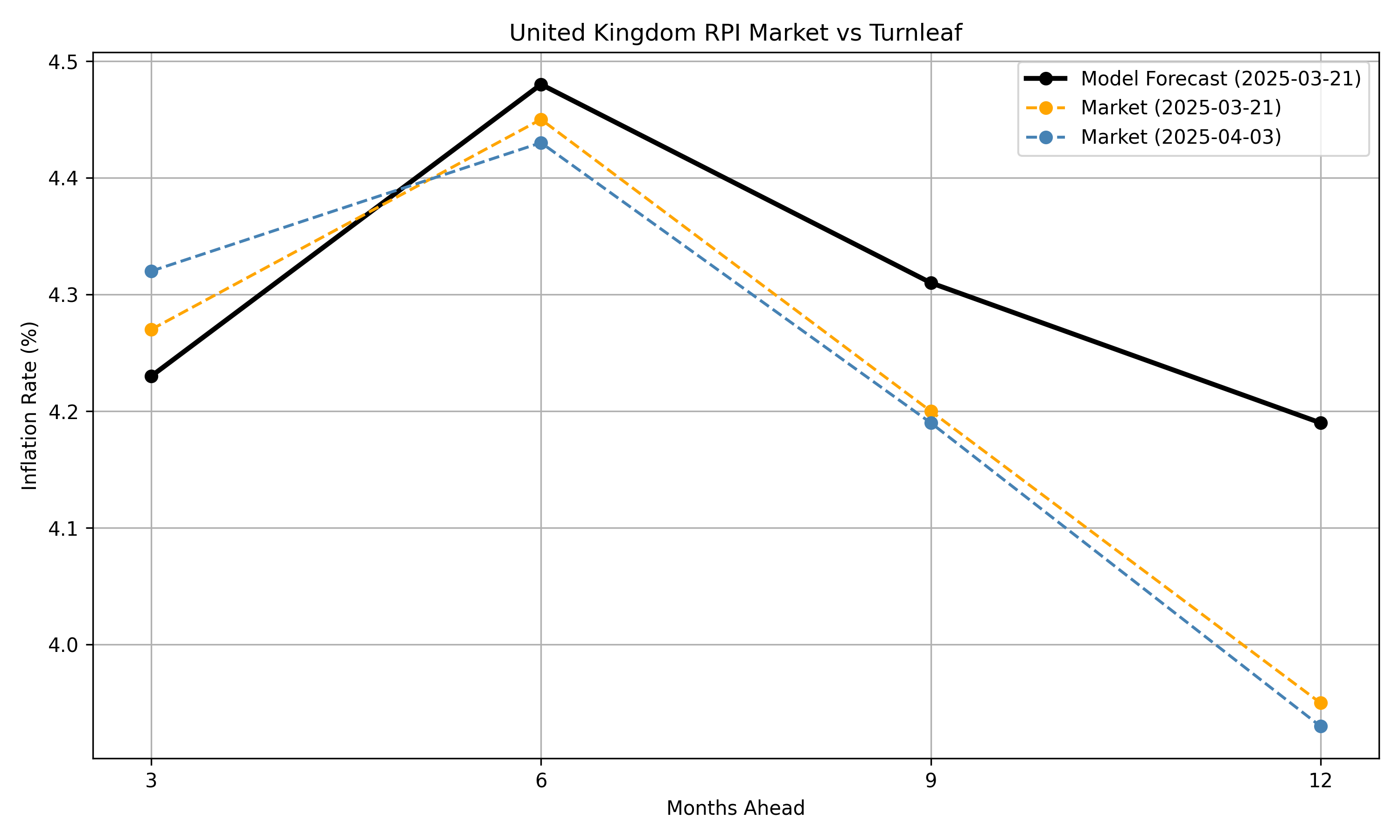

The U.K., by contrast, was subjected to the baseline 10% global tariff, yet the RPI market (Figure 3) showed only a muted response—especially when compared to the more pronounced shifts observed in U.S. and Eurozone inflation markets since the release of the Turnleaf forecast. Nevertheless, our model indicates that RPI inflation is likely to remain elevated relative to current market pricing.

Figure 3

We will continue to closely monitor developments in U.S. trade policy, and we remain committed to incorporating high-frequency, representative data to improve the accuracy of our macroeconomic models. Particular attention will be paid to global markets most exposed to U.S. demand and most penalized by the new tariffs—countries such as Brazil, South Korea, South Africa, China, and members of the Eurozone. Please watch for our weekly forecast updates covering the United States, United Kingdom, and Eurozone.