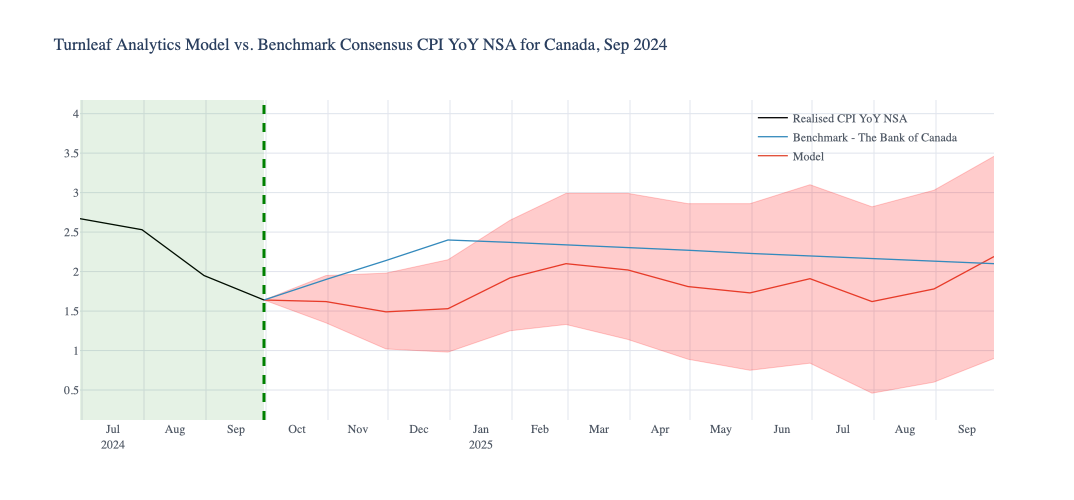

Canada’s inflation outlook is shaped by a complex mix of declining energy costs, rising food prices, and evolving trade dynamics. At Turnleaf Analytics, we’re closely tracking these factors to provide our clients with a clear view of CPI trends and their potential implications.

Last month, Canada’s CPI dipped below the Bank of Canada’s official inflation target of 2%. This milestone marks a period of disinflation, primarily driven by falling energy prices. Specifically, petrol exerted a strong downward influence, decreasing by -3.6% YoY, with our model capturing further -8.6% and -17.55 YoY declines in key energy indicators like NYMEX Gasoline Blendstock Futures (Front-Month Close, USD) and Crude Oil OPEC Basket Price. These global pressures are helping to moderate fuel costs, which could offer short-term relief to Canadian households.

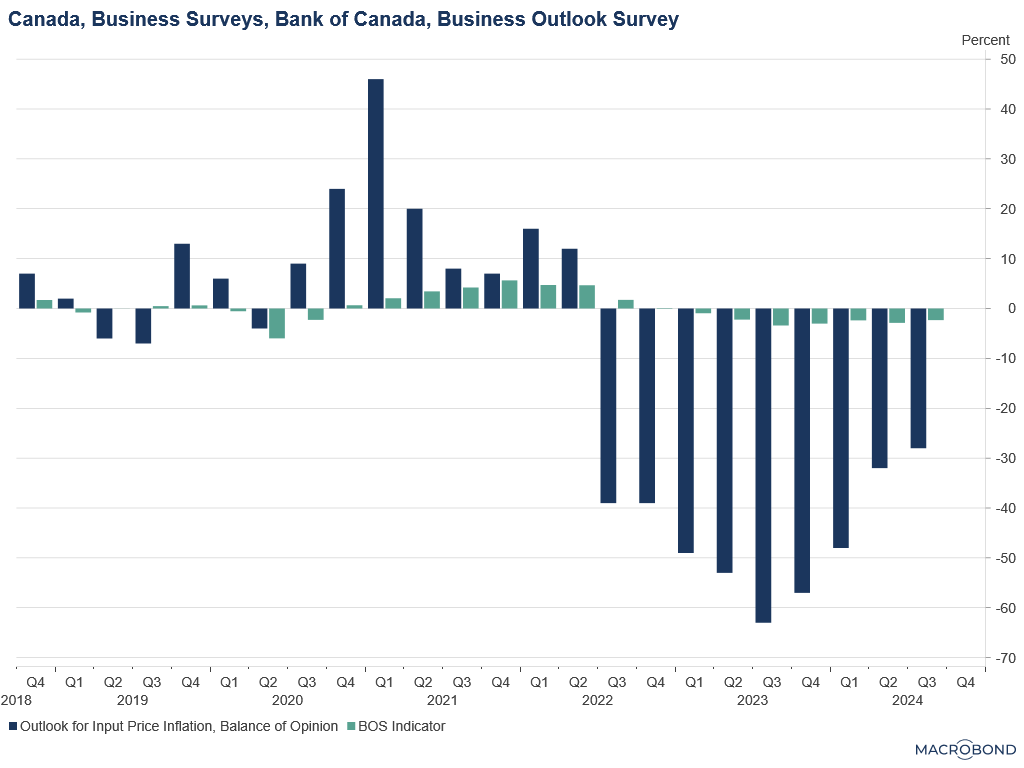

In the business sector, sentiment has responded positively to easing input prices. The Business Outlook Survey indicator showed a 0.57% improvement in sentiment this past quarter, signaling cautious optimism. Additionally, 28% of businesses now expect input costs to decline over the next 12 months, reflecting a hopeful outlook for stabilizing costs. The expected decline in input costs is also supported by a significant 12.69% decrease in 3-month yield rates, which implies an environment of lower borrowing costs and potential rate cuts. Together, these factors indicate a favorable climate for investment, as businesses brace for a period of moderate cost pressures.

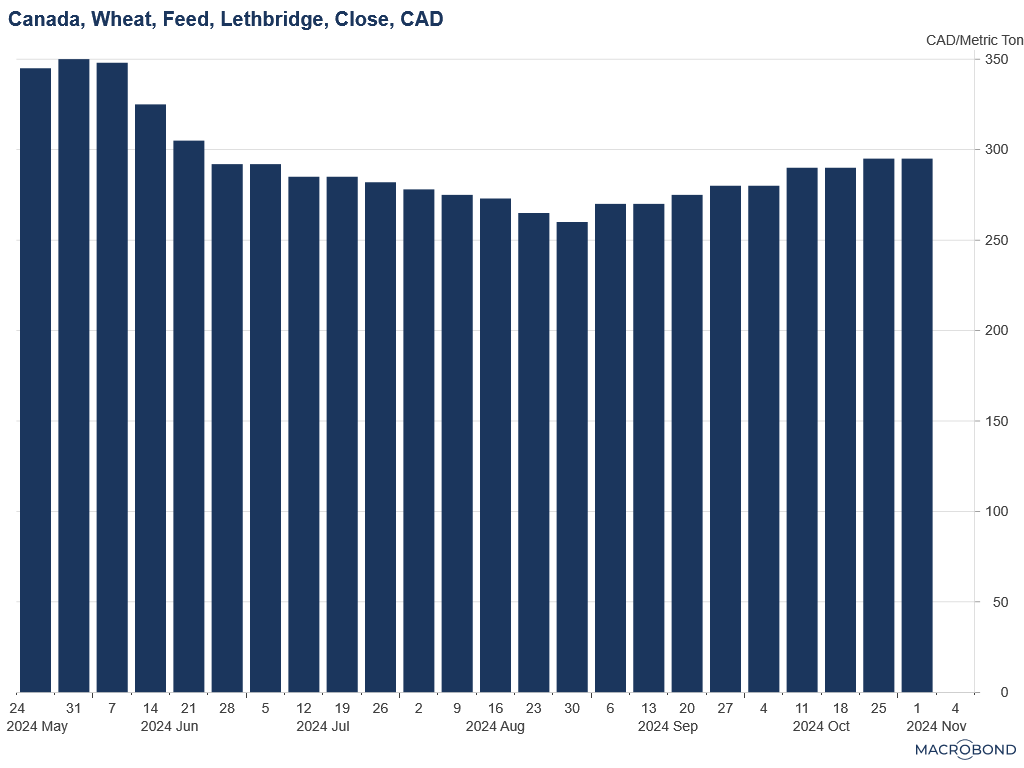

Consumer sentiment remains subdued, driven by elevated food prices, which make up 10.72% of the CPI basket. Food inflation rose by 2.8% YoY in September 2024. The Canada Commodity Price Agriculture Index increased by 0.34% over the past month, intensifying costs for essential goods. Particularly, HWWI Food Index for Canada rose by 2.9% MoM, likely to drive up wholesale import costs, while wheat prices for feed have seen a gradual increase in the last two months.

Factors that further contribute to this strain: between September and October 2024, the OECD Cereal Price Index and FAO Dairy Price Index increased 1.72% and 3.79%, respectively. Additionally, China’s Producer Price Index declined by 2.77% YoY, indicating reduced demand and production—a trend that could disrupt global supply chains and introduce price volatility in Canada.

Potential Trade Risks from U.S. Election Outcomes

Looking ahead, trade policy changes tied to the U.S. presidential election could introduce new challenges for Canada’s CPI. A Trump administration would likely reimpose strict tariffs, including a proposed 60% tariff on Chinese imports and a 10-20% levy on all other imports. These tariffs would pose a substantial risk to Canadian CPI, as Canada is highly sensitive to U.S. trade policies, given that 75% of Canadian imports come from the U.S., including essential consumer goods like soup, beef, and yogurt. Canada’s response to similar tariffs in 2018 included a 10% tariff on selected U.S. goods, resulting in higher import prices for Canadian consumers. Any renewed tariff measures could again lead to inflationary pressures on imports, particularly for staples in the consumer basket.

At Turnleaf, our CPI models are built to account for external shocks—ranging from tariffs to subsidies—by integrating high-frequency and alternative datasets to provide precise CPI forecasts. As trade conditions shift, our model equips clients with insights to anticipate inflationary impacts and navigate an uncertain economic landscape. We’ll closely monitor the U.S. election results and adjust our forecast accordingly, keeping our clients informed of any potential changes.