Japan’s battle with inflation has become a key issue, reshaping public sentiment and influencing recent election results. With the Liberal Democratic Party (LDP)–Komeito coalition losing its majority in the recent elections, Turnleaf is watching how economic conditions evolve under their guidance, especially as inflation affects every aspect of daily life.

Japan’s traditional Autumnal Equinox celebrations in late September—where families gather to enjoy seasonal treats like botamochi (sweet rice balls)—were hit hard by rising food prices. Our model detected a notable impact of these festivities, as food prices surged: rice alone increased 14.42% MoM in September, followed by another 15.28% MoM hike in October. Japan’s vegetable food basket, which makes up 2.72% of the overall CPI, experienced close to 1% MoM increase. A 3.05% increase in the global food basket has placed inflationary pressure on Japan sensitive to increases in staples like poultry and dairy which climbed by 1.29% and 3.79% in October.

Further exacerbating inflation is the Japanese yen’s depreciation against the U.S. dollar, declining 4.48% MoM, which places additional pressure on imports. Japan is the world’s largest importer of U.S. beef, which saw import costs rise by 8.51% YoY, adding to the growing strain on household budgets. With food imports being a major component of consumer expenses, currency depreciation has only deepened the inflationary impact.

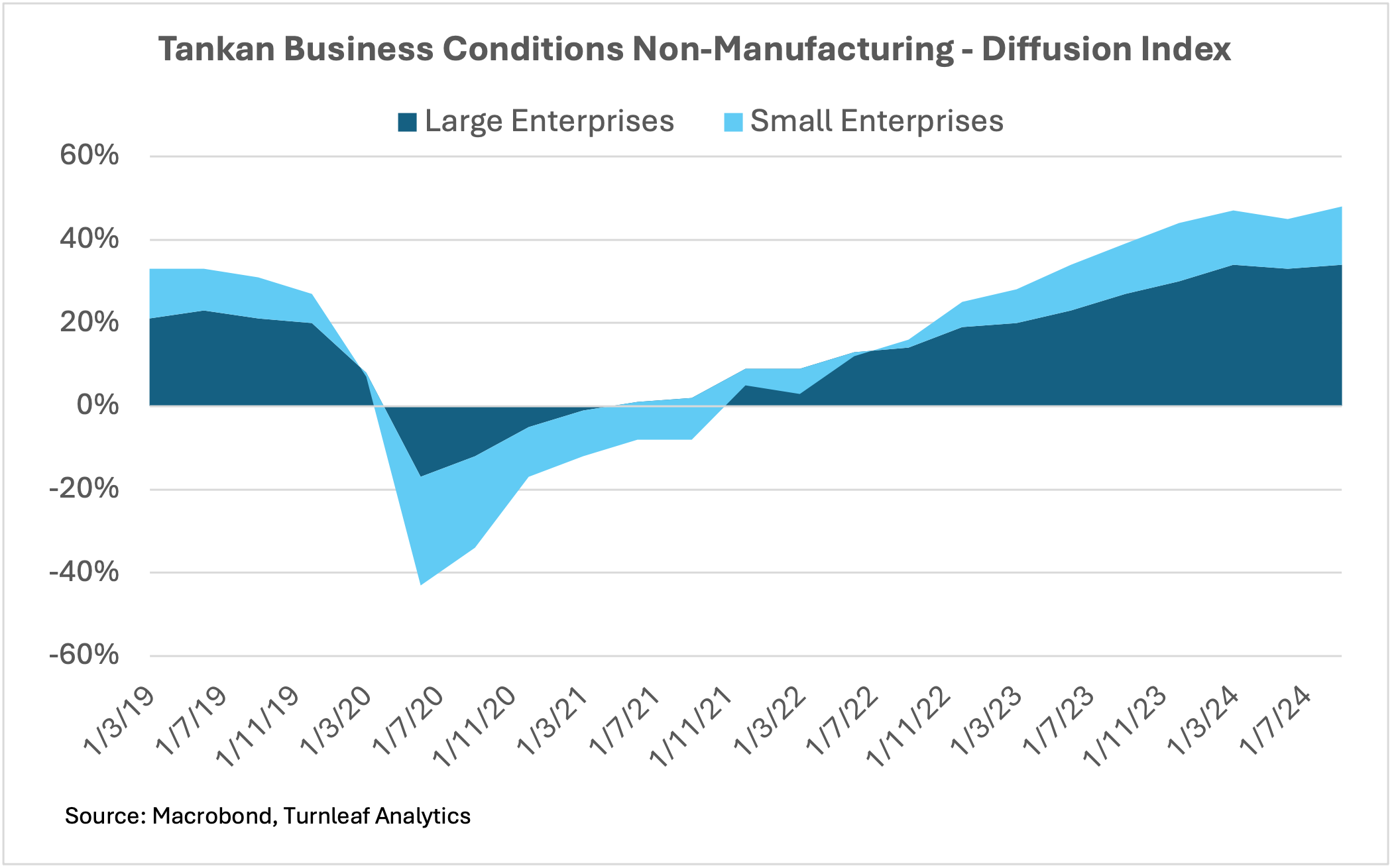

According to the Tankan Judgement Survey, both large and small non-manufacturing enterprises have reported moderate rises in business conditions from the previous quarter by 1% and 2%, respectively, with 34% more large enterprises and 14% small enterprises viewing business conditions as favorable than unfavorable. Although business sentiment is moderately optimistic, it is important to note that respondents may have chosen “Not so favorable.” Employment appears robust. Japan saw a decline in the number of unemployed -1.14% MoM. Consumers’ 2-3 month price perceptions increased 0.23%, reflecting deep-rooted concerns over further price hikes in daily essentials. The housing price index for the Tokyo Metro Area, also shows a 6.74% increase YoY which can also be reflected by Turnleaf’s Media Volume Monitor for housing, alternative data that captures how often people speak about housing in Japan.

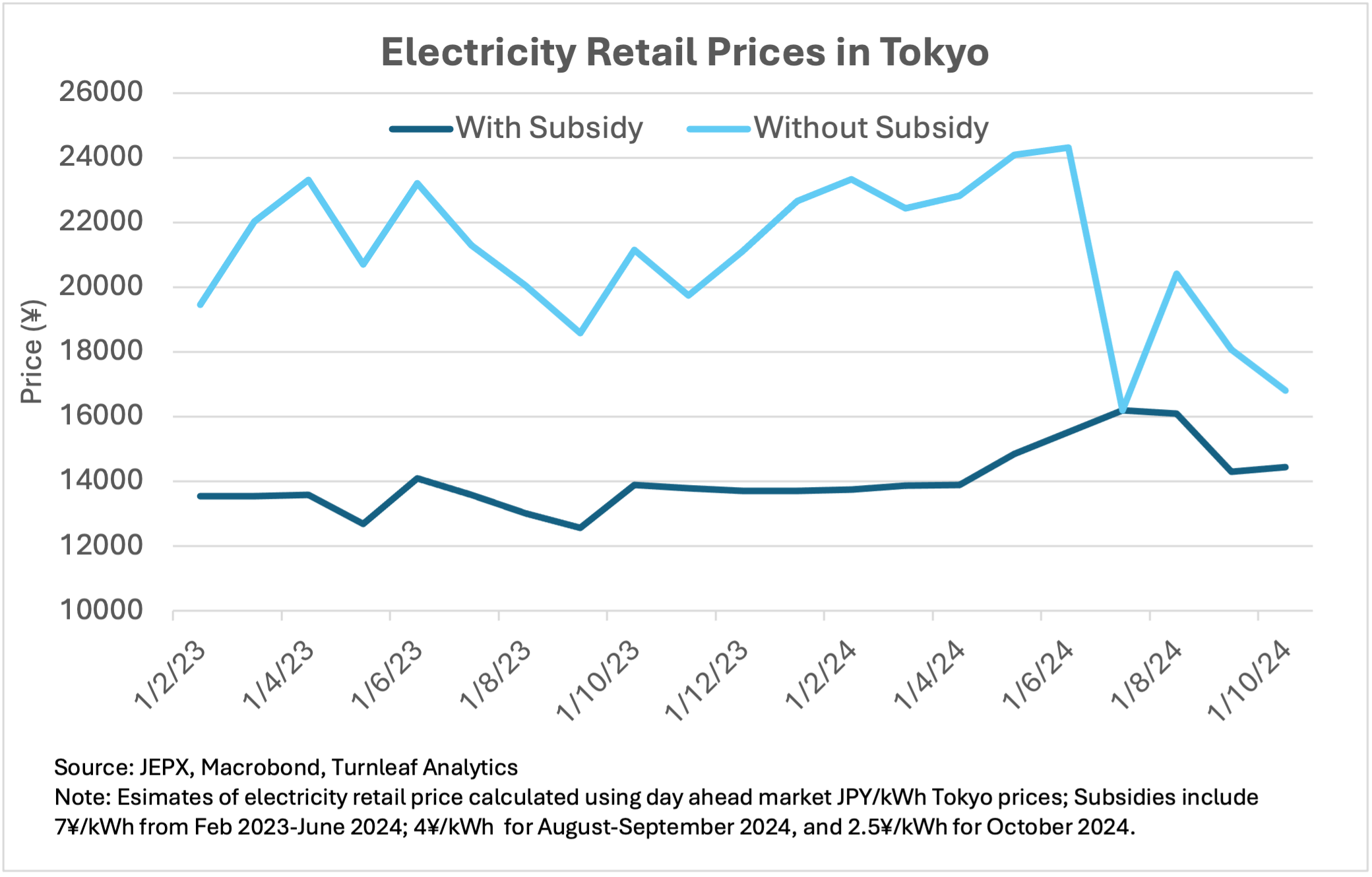

Japan’s temporary energy subsidies, which included reductions in electricity costs by 7 ¥ per kilowatt-hour from February 2023 to June 2024; 4 ¥ per kilowatt-hour from August-September 2024; and 2.5 ¥ per kilowatt-hour in October 2024, are set to expire soon. As these subsidies phase out, inflationary pressures on energy costs will likely rise. Electricity prices remain elevated, with October recording a 0.94% MoM increase. Continued tracking of energy prices—especially in Tokyo—will be essential to assess the broader economic impact and guide any potential government interventions.

As Japan enters this period of transition, Turnleaf will continue to track these critical variables. Inflation remains a defining issue, and with rising costs and new leadership, the nation faces a pivotal moment in addressing its economic future.

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, ‘Seasonality’ and ‘CPI Basket’ are large, indicating their significant weight in the model, while their color suggests whether they contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.