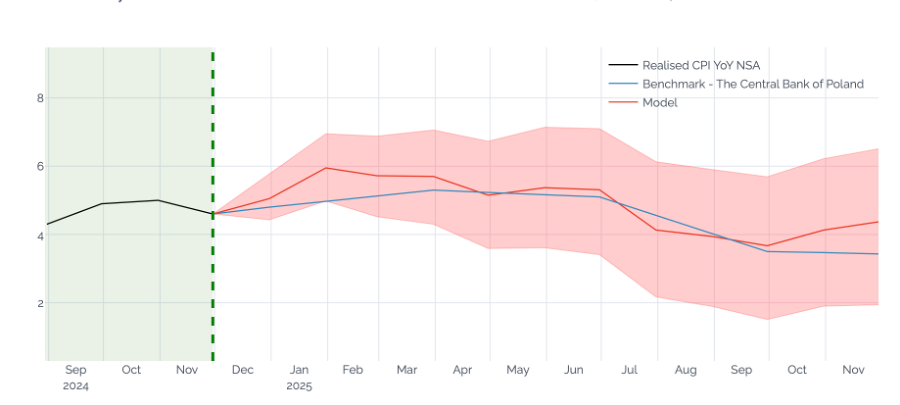

The Polish government’s decision to extend the cap on electricity prices at 500 PLN/MWh is a critical measure to limit inflationary pressures on households. To understand its implications, consider an average 3-person household with an annual electricity consumption of approximately 2.0 to 2.1 MWh. For this reason, Turnleaf has revised it’s inflation outlook for Poland downwards through September 2025, with a slight uptick from October 2025.

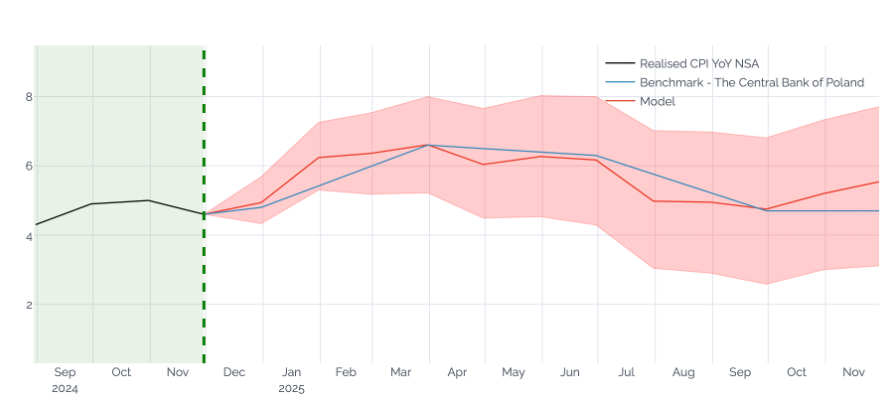

CPI YoY NSA for Poland Nov 2024, Before Adjustment:

CPI YoY NSA for Poland Nov 2024, After Adjustment:

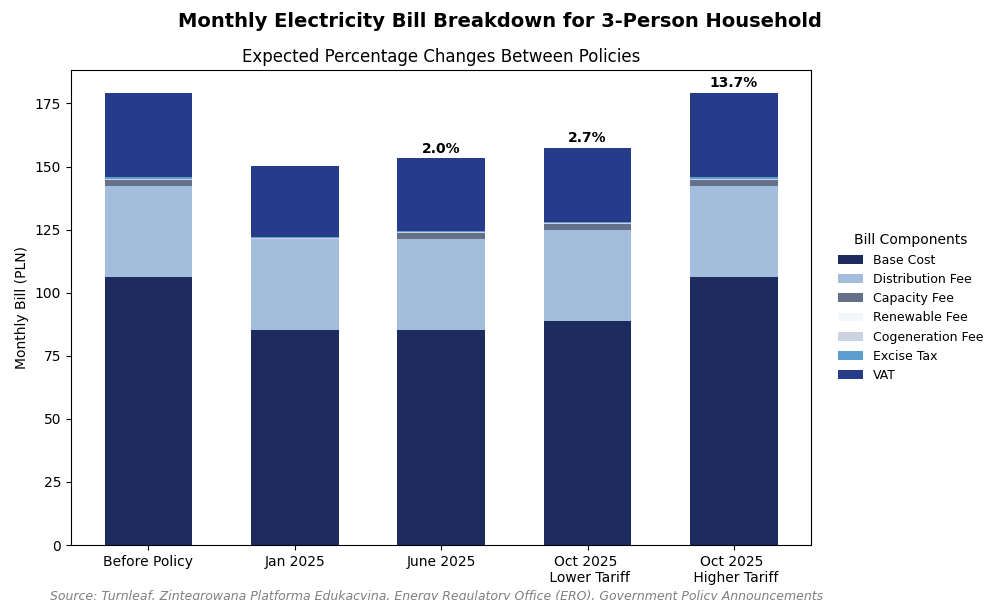

The graph below breaks down the monthly electricity bills across key policy stages: before the cap, during its implementation, and after it expires under two potential tariff outcomes.

Before the cap was introduced, households were paying bills based on the full market price of 623 PLN/MWh alongside a 30 PLN/month capacity fee, pushing their costs to higher levels. This stage represents the baseline scenario, where energy prices could contribute significantly to overall inflation due to their weight of 4.36% in Poland’s CPI.

By January 2025, with the 500 PLN/MWh cap in place, the total monthly electricity bill for a household consuming 2,100 kWh annually is calculated as follows:

- The first 2,000 kWhis billed at the capped rate of 500 PLN/MWh.

- The remaining 100 kWhis billed at the market rate of 623 PLN/MWh.

- No capacity fee is charged.

- To this, distribution fees, taxes, and other fixed charges(such as renewable and cogeneration fees) are added.

- Finally, VAT at 23%is applied to the sum of all components.

By June 2025, the capacity fee is reinstated at 30 PLN/month, resulting in a modest 2% increase in bills. This stage shows the sensitivity of household costs to even minor changes in energy policy. Although the cap remains, incremental additions like the capacity fee gradually erode the savings provided by the price control.

The most significant test comes in October 2025, when the cap is set to expire. At this point, electricity tariffs will depend on negotiations between energy providers and the Energy Regulatory Office (ERO) happening towards the end of April 2025. If tariffs remain close to 520 PLN/MWh (the lower tariff scenario), bills will rise by only 2.7%—a manageable increase. However, if tariffs revert to the full market rate of 623 PLN/MWh (the higher tariff scenario), bills will jump by 13.7%, placing considerable strain on households.

This example highlights how price caps directly impact inflation. In a scenario where tariffs return to market rates, the 13.7% increase in electricity bills could contribute 0.59% to headline inflation, given the 4.36% CPI weight of electricity.

The future trajectory of electricity prices—whether they remain low, rise to higher levels, or even fall below the capped rate—depends on several key factors:

- Q2-2025 Tariff Negotiations: Energy providers will justify future rates based on wholesale electricity prices, fuel costs, and carbon allowances.

- Capacity Fee Reintroduction: Even partial reinstatements will add incremental costs, as seen in the June 2025 stage.

- Wholesale Market Trends: Falling global coal and gas prices could ease upward price pressure, reducing the need for price caps.

Although the cap provides short-term relief, its expiration and the return of fees pose significant risks to inflation. This thought exercise underscores the importance of monitoring tariff negotiations and wholesale energy costs to anticipate future economic impacts. For policymakers and consumers alike, the outcome will determine whether energy prices remain affordable or contribute to renewed inflationary pressures.