South Korea’s brief declaration and subsequent revocation of martial law by President Yoon has damaged investor confidence, further weakening the won and placing pressure on the country’s inflation trajectory. This political instability comes at a critical time for South Korea’s export-driven economy, particularly as its chip manufacturing giants face mounting global competition.

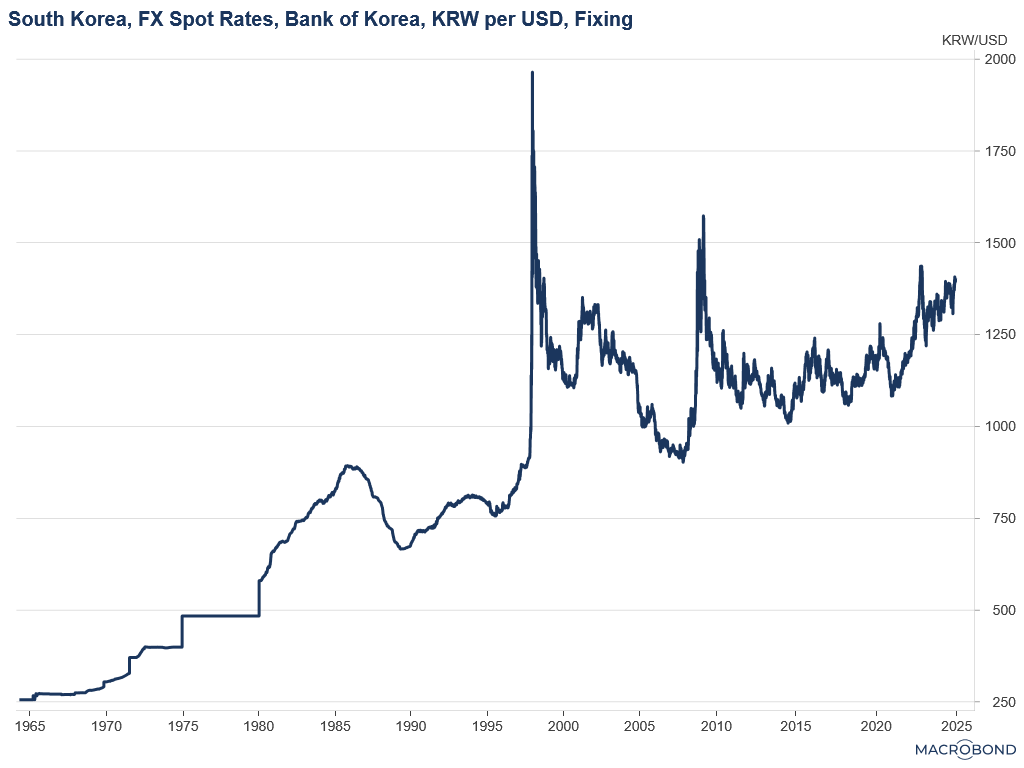

- Currency Depreciation and Imported Inflation: Following the coup, spot rates for the won depreciated about 1.1% against the dollar from the previous day on Dec 3, 2024 (+7.89 YoY December 4, 2024) as investors reversed flows and deals were withdrawn. For instance, the canceled KKR and HD Hyundai Marine Solution deal highlights the immediate fallout. A weakening won will likely put upward pressure on the cost of imports, especially energy and raw materials, exerting upward pressure on inflation in the short term. So far, the South Korean government will mitigate some energy cost pressures through the mid- 2025 by extending a consumption tax cut on LNG (reduced to Won 10.2/kg ($0.01/kg) from 12/kg previously) and coal (Won 36.5-41.6/kg dependeing on caloric values compared to 43-49/kg previously) used for electricity production by an additional six months through the end of June. It will also extend import tariffs cut for LNG (0%) from January to March 2025. Turnleaf will continue to watch how energy prices evolve one these subsidies expire after mid-2025.

- Investor Confidence and Export Pressures: South Korea’s economy relies heavily on exports, particularly semiconductors, which account for a significant share of GDP. The political uncertainty could damage investor sentiment, creating challenges for export-oriented industries like Samsung Electronics and SK Hynix. Weakening supply chain confidence and intensifying competition in global chip markets could hurt export revenues and limit growth.

However, the Bank of Korea’s proactive measures are providing some stability. Following its August 2024 commitment to mitigate systemic risks to growth, the central bank moved swiftly this morning to reassure markets. It announced unlimited liquidity support for stressed markets and convened an emergency Monetary Policy Board meeting. These decisive actions signaled resilience in South Korea’s financial system, even as the short-lived political turmoil was resolved by institutional vote. Despite the turbulence, the swift response underscores the strength of South Korea’s financial safeguards and its capacity to weather economic disruptions.

- Delayed Fiscal Spending: Political instability surrounding the upcoming impeachment could delay the passage of the 2025 government’s budget, limiting fiscal impulse in the beginning of 2025. It could also lead to further debate on tax cuts for the ultra-wealthy and pullback on public spending on state agencies. However, possible impeachment should not affect the government’s ability to carry out its daily duties and deter existing programs.

- Broader Uncertainty: The chaotic handling of martial law, coupled with impeachment proceedings, undermines confidence in the government’s ability to enact coherent fiscal policies. This uncertainty will likely weigh on both consumer and business sentiment, reducing investment and spending.

The immediate effect of these events is some upward pressure on inflation, driven by the depreciating won and weakened business confidence. The swift response from both the central bank and the government has helped contain broader risks. The central bank’s decisive liquidity measures and the rapid veto of martial law by the very institution that declared it indicate a level of resilience in South Korea’s governance and financial systems. While this event has undoubtedly shaken confidence, it doesn’t point to systemic flaws in the country’s economy or political framework at this time. Therefore, the uncertainty surrounding the coup is likely to primarily South Korea’s inflation trajectory through investment sentiment and corresponding currency depreciations.

However, this could be partially counterbalanced by softer domestic and external demand due to uncertainty. The trajectory of inflation will depend heavily on how quickly political stability and investor confidence is restored and whether fiscal policy uncertainty is resolved. For now, the risks lean toward slower growth increasing inflation pressures, particularly if export competitiveness is compromised further. Turnleaf will continue monitoring developments and provide updates as the fiscal and monetary responses evolve. Watch for our updated forecast to be published later this week.