In our January 2025 YoY CPI forecast, we projected inflation at 4.57%, slightly above the realized 4.3%, yet outperforming consensus (4.71%)—even with our estimate released a full week ahead of the official print.The primary driver of disinflation in January was the continued decline in vegetable prices, following a strong Kharif harvest and the seasonal softening of prices during the Rabi season. Kharif harvests (Sept–Oct) impact vegetable prices in Rabi (Nov–April) due to supply storage. Rabi crops (March–April) influence food inflation in mid-year months (May–June). Zaid crops (May–June) provide off-season vegetable supply, affecting price stability.

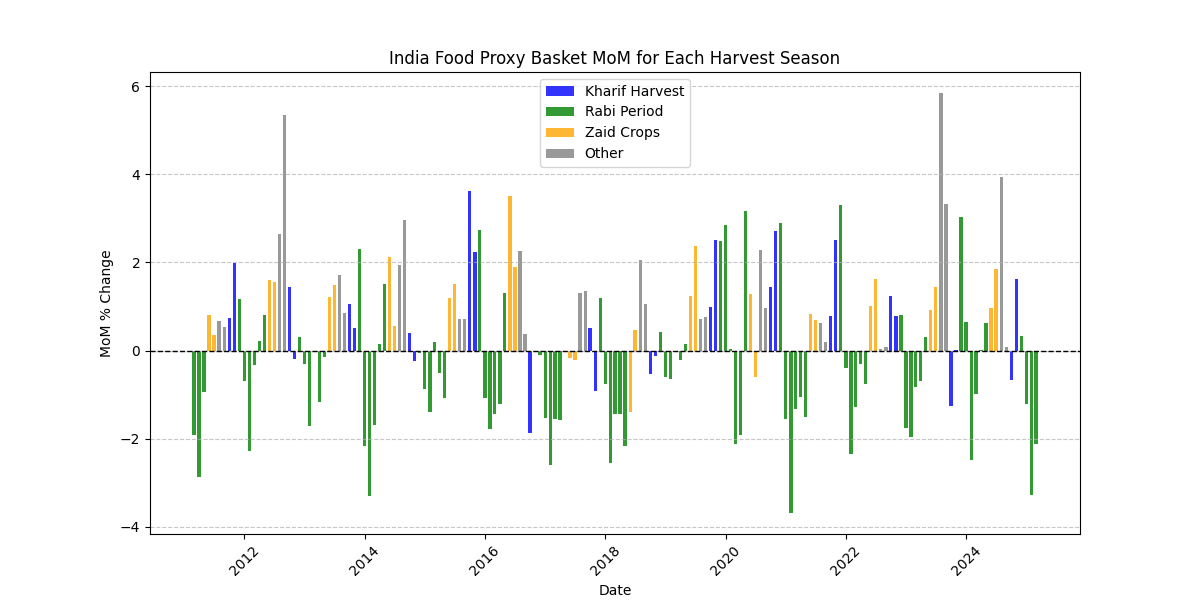

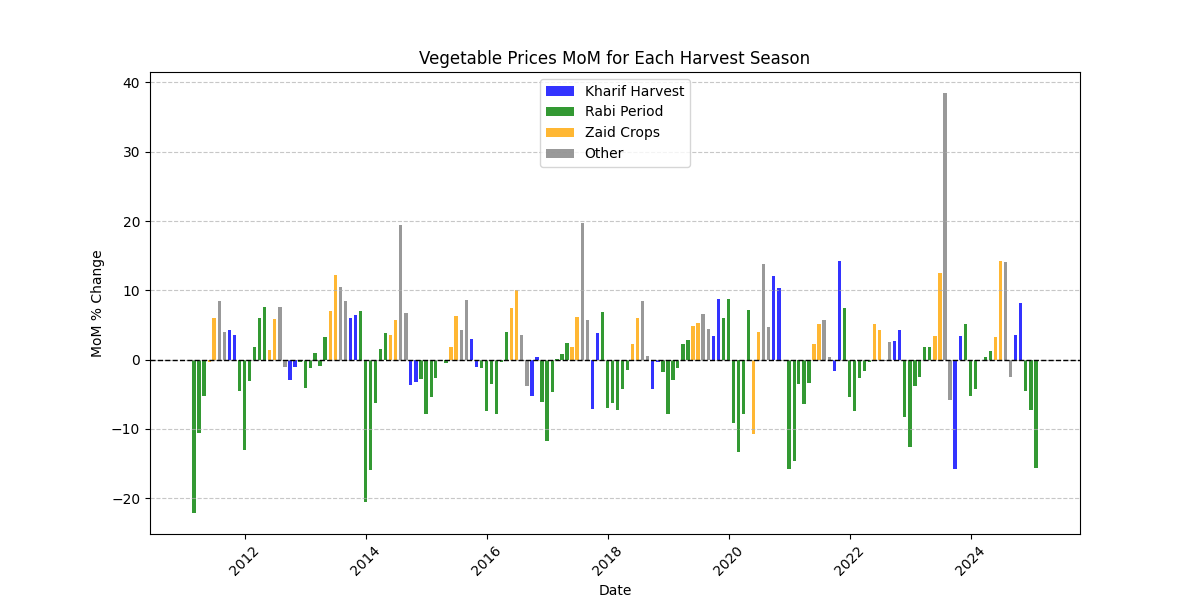

Figures 1a and 1b illustrate how Turnleaf’s MoM India food proxy basket compared with actual MoM vegetable prices across different harvesting periods. Our model captured the overall trend well, demonstrating a high correlation with realized vegetable prices. However, two key deviations occurred:

Rabi Season: We slightly underestimated the extent of price softening, as our seasonality measure placed greater upward pressure on prices than realized.

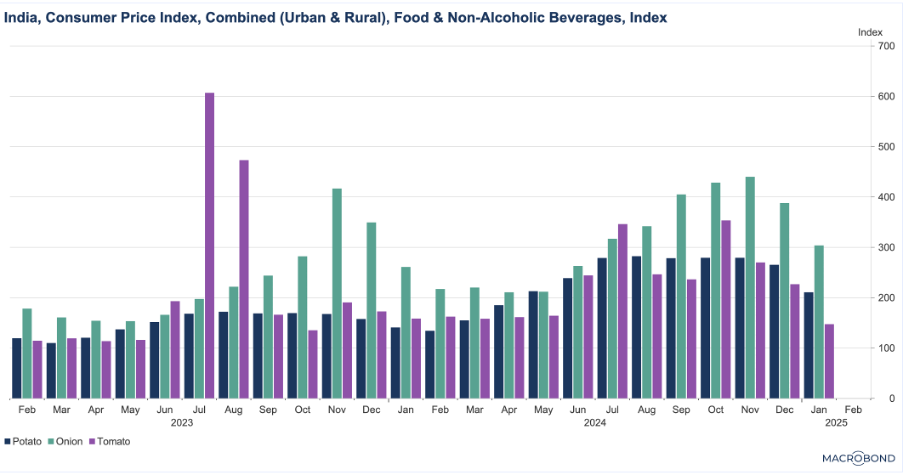

Kharif Season: Our model underestimated the magnitude of the price increase, reflecting the difficulty of capturing short-term supply shocks that raised TOP (tomato, onion, and potatoes) prices higher during this time (Figure 2).

Figure 1a

Figure 1b

Figure 2

As inflation stabilizes in India and the central bank strengthens its credibility, we anticipate these seasonal anomalies will diminish, barring unexpected weather shocks or trade disruptions. Despite these short-term discrepancies, the strong correlation between vegetable prices and our food proxy basket, alongside high-frequency indicators on harvest output and weather conditions, continues to provide valuable insights into India’s inflation trajectory.