2025 Colombia CPI YoY Above Consensus Due to Global Inflation Pressures

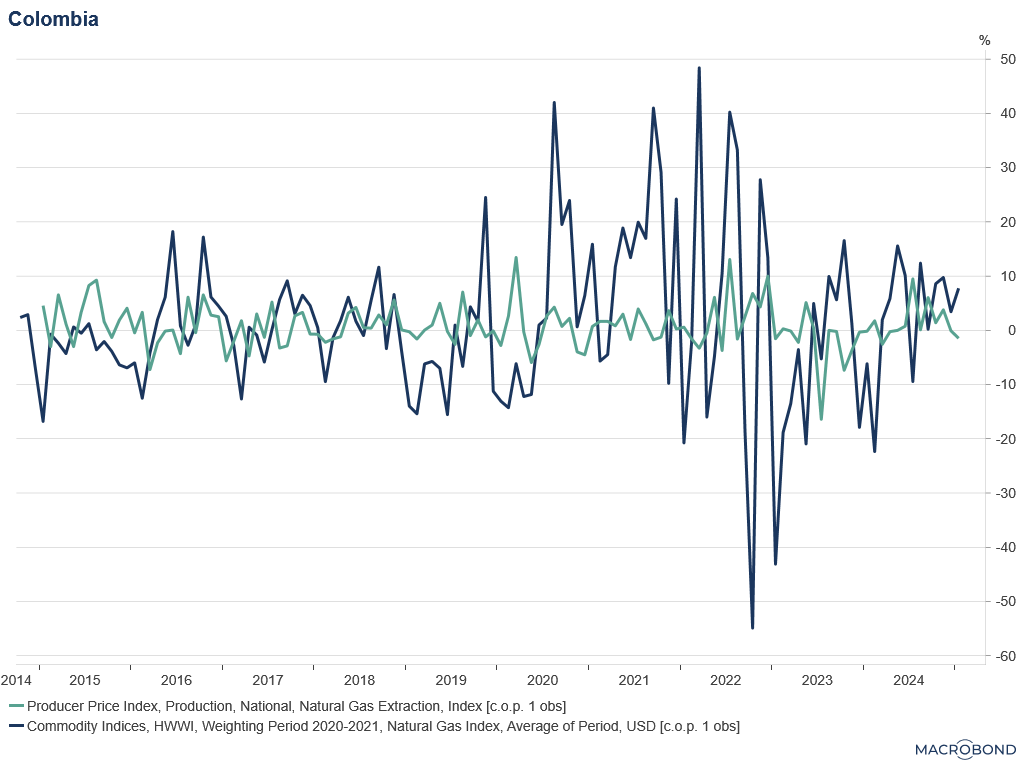

Turnleaf’s CPI YoY model projects Colombia inflation well above consensus 12 months out, as it more aggressively captures global inflation linkages, particularly through energy costs and external debt pressures. The gap between Turnleaf’s estimate and consensus is more pronounced in our headline forecast than in the core measure, indicating that the divergence is largely driven by a renewed upward trend in energy prices.

Key Drivers Behind Our Higher Inflation Forecast

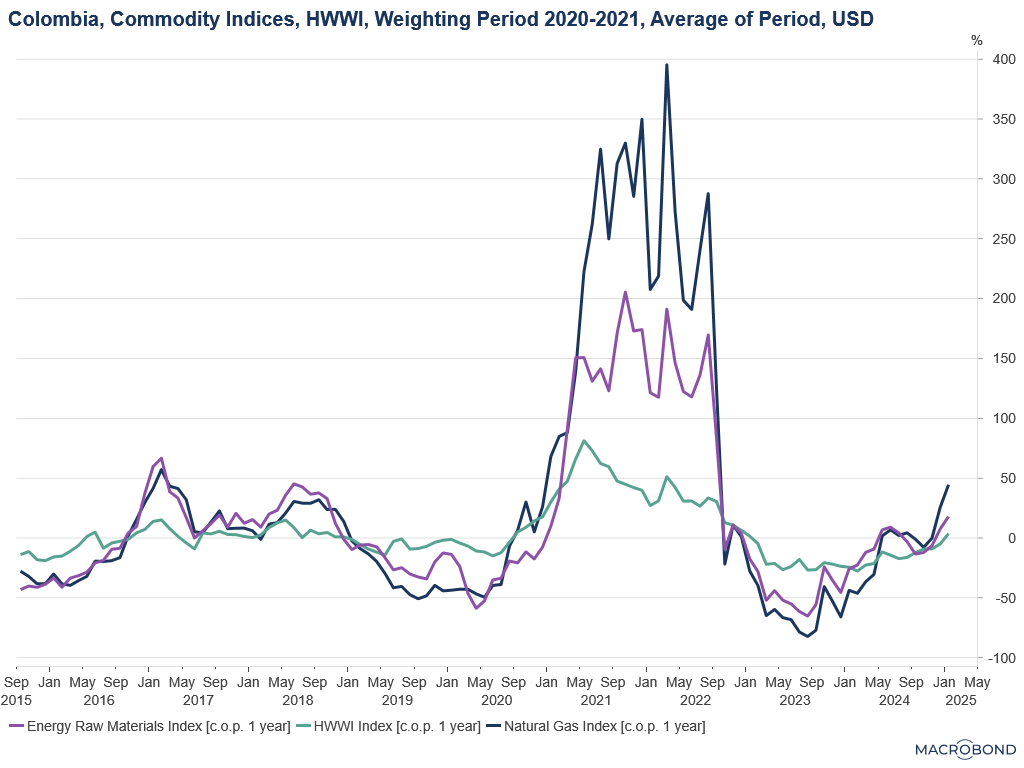

1. Increase in Energy Prices: Rising geopolitical tensions have pushed global energy prices higher, as reflected in the Energy Raw Materials Index (+17.96%) YoY and the Natural Gas Index (+44.48% YoY) (Figure 1). We have already accounted for a significant increase in natural gas bills starting February 2025, with hikes of up to 36%, depending on the region and provider.

Figure 1

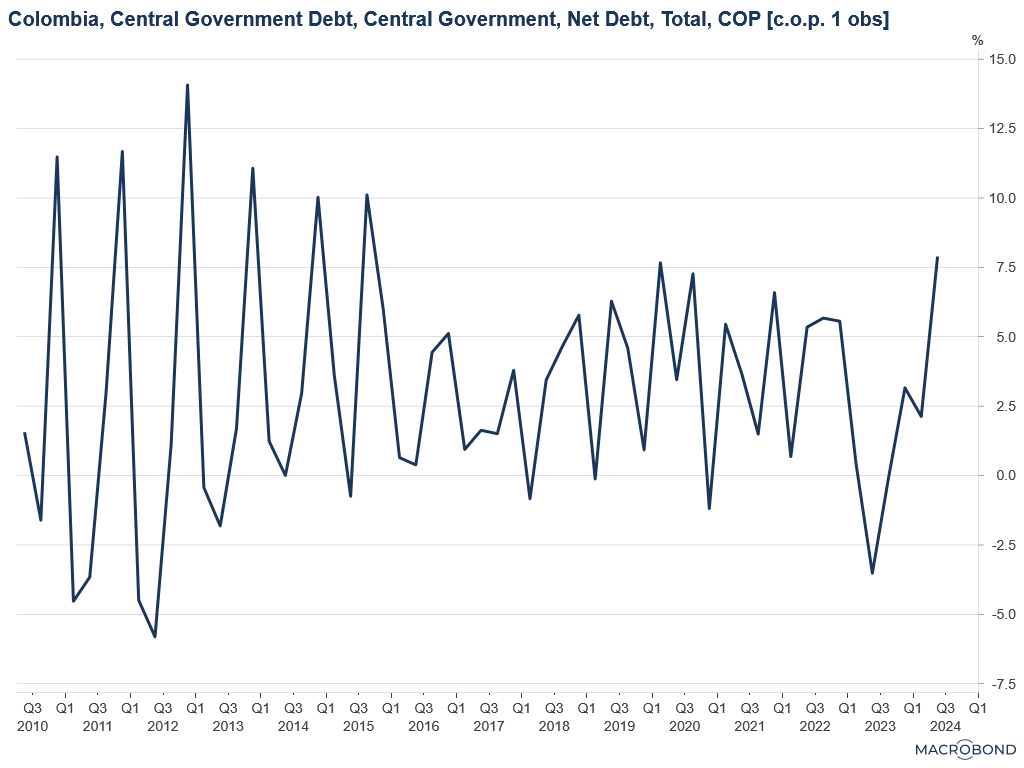

Despite a 20% YoY increase in natural gas extraction in January 2025, recent gas tariff hikes could be due to declines in the MoM rate of extraction in recent months (Figure 2). Colombian energy providers have decided to increase tariffs perhaps as inflation expectations in the global market persist and domestic supply abates. Therefore, these dynamics serve as a leading indicator of broader energy price increases, signalling sustained cost pressures ahead.

Figure 2

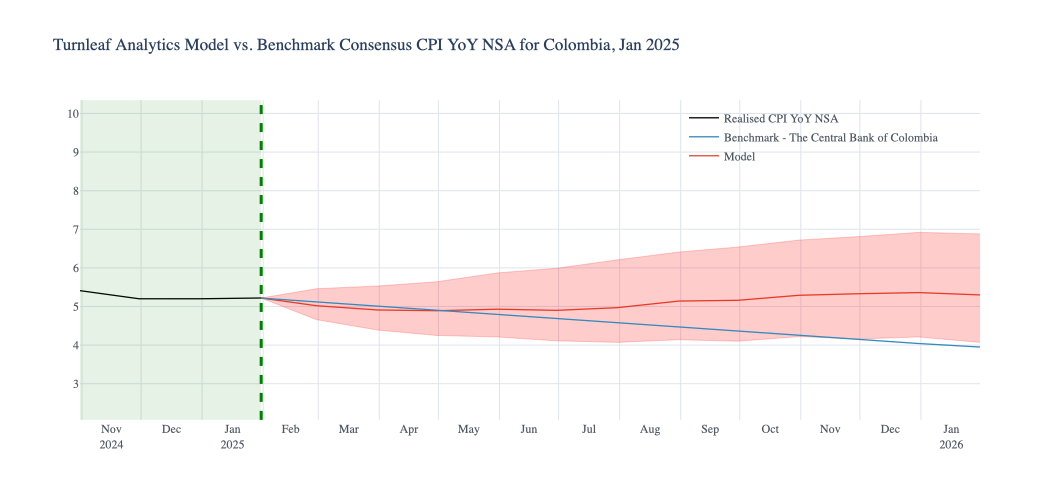

2. External Debt on the Rise: Since 2023, external debt has been trending upward, with Q3 2024 seeing an approximate 8% quarter-over-quarter increase (Figure 3). Recently, our models have identified external debt as a critical driver of inflation.

Figure 3

As global tariff threats and an evolving energy crisis drive renewed price pressures, central banks have responded by pausing or slowing anticipated rate cuts, reinforcing inflation expectations. A key factor to monitor is the real interest rate differential between Colombia and major industrial economies.

Given the Eurozone’s free trade partnership with Colombia, financial linkages between the two regions could deepen further amid recent U.S. tariff threats. As a result, monetary policy shifts in the Eurozone may increasingly influence Colombian inflation, particularly in the context of Colombia’s growing external debt.

For instance, a higher Eurozone interest rate could prompt capital outflows from Colombia, leading to peso depreciation (Figure 4). This currency weakening would, in turn, raise the cost of servicing external debt, further fueling inflationary pressures.

Figure 4

With rising energy costs, geopolitical risks, and external debt feeding into Colombia’s price dynamics, our model is capturing inflationary pressures that consensus may be underestimating. We continue to monitor global inflation linkages, currency effects, and commodity price movements to refine our forecasts.

2025 Hungary CPI YoY Forecast – Market Underestimated Inflation

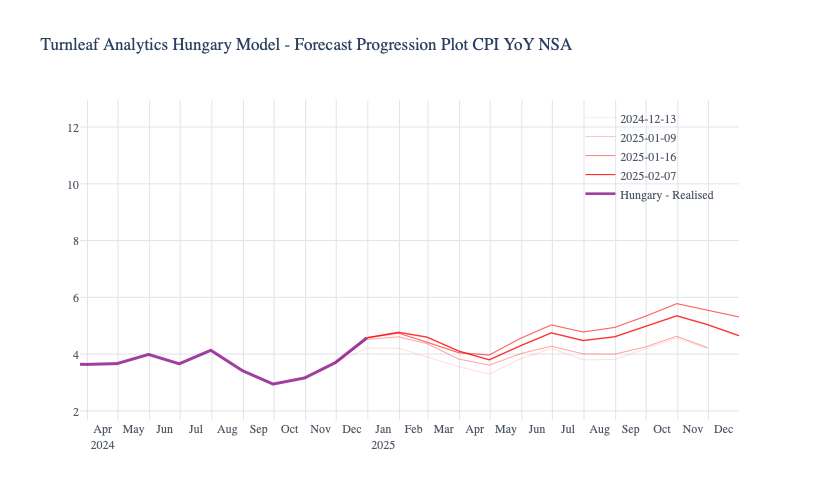

For January 2025, Turnleaf forecasted Hungary’s CPI at 4.77% YoY for headline inflation and 4.84% YoY for core inflation, both of which came in below the realized 5.5% and 5.8%, respectively. This outcome reflects a broader market underestimation of inflationary pressures.

Notably, food prices accelerated from 5.4% YoY to 6%, and service costs surged to 8.5% YoY from 6.8%, pushing inflation above expectations. While our model effectively captured food price dynamics, the market—including our forecast—underestimated the extent and speed of service price pass-through, particularly at the start of the year.

A key challenge remains quantifying the pass-through effects of new inflation-linked taxes, including:

- Excise duty on motor fuels

- Taxes on alcoholic beverages

- Car tax

- The increased property acquisition duty on vehicles

While we incorporated these elements into our forecast, the realized inflation impact exceeded initial expectations. This highlights the complexity of modeling pass-through effects, which remain inherently uncertain due to a lack of real-time data and the unpredictable timing of price adjustments across sectors.

Importantly, our model began reflecting an upward inflationary trajectory several forecasts ago, as seen in the progression of our CPI estimates (Figure 5). This reinforces that while near-term adjustments were necessary, the overall inflation trend was correctly identified well in advance. Given the uncertainties in tax pass-through dynamics, there was no clear, data-backed method to precisely quantify their full impact. In this regard, our forecasts remained well-aligned with the most informed market estimates. To enhance our forecasting approach, we are integrating additional high-frequency data sources that better capture service price dynamics, further strengthening our ability to anticipate inflation shifts in a rapidly evolving environment.

Figure 5

To enhance our forecasting approach, we are integrating additional high-frequency data sources that better capture service price dynamics, further strengthening our ability to anticipate inflation shifts in a rapidly evolving environment.

To enhance our forecasting approach, we are integrating additional high-frequency data sources that better capture service price dynamics, further strengthening our ability to anticipate inflation shifts in a rapidly evolving environment.

We remain committed to delivering data-driven, forward-looking insights as inflation surprises continue to challenge market expectations.