Headline inflation for Eurozone was released today (8.5%) and it came as a surprise against the short-term consensus (9%). Our prediction for this reading (8.8%) published one month ago came much closer to the realized inflation figure. The market from yesterday was pricing 8.86%.

The cumulative base of Eurozone CPI MoM for the past 11 months was 8.88%, so a high level to start with, and the consensus which was 9% was implying a CPI MoM price increase, contrary to our forecast of a CPI MoM decrease.

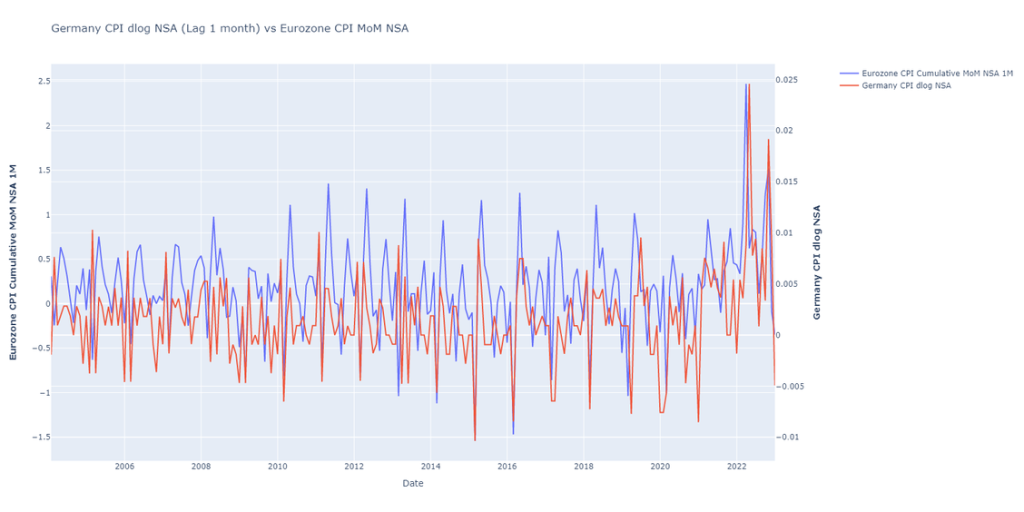

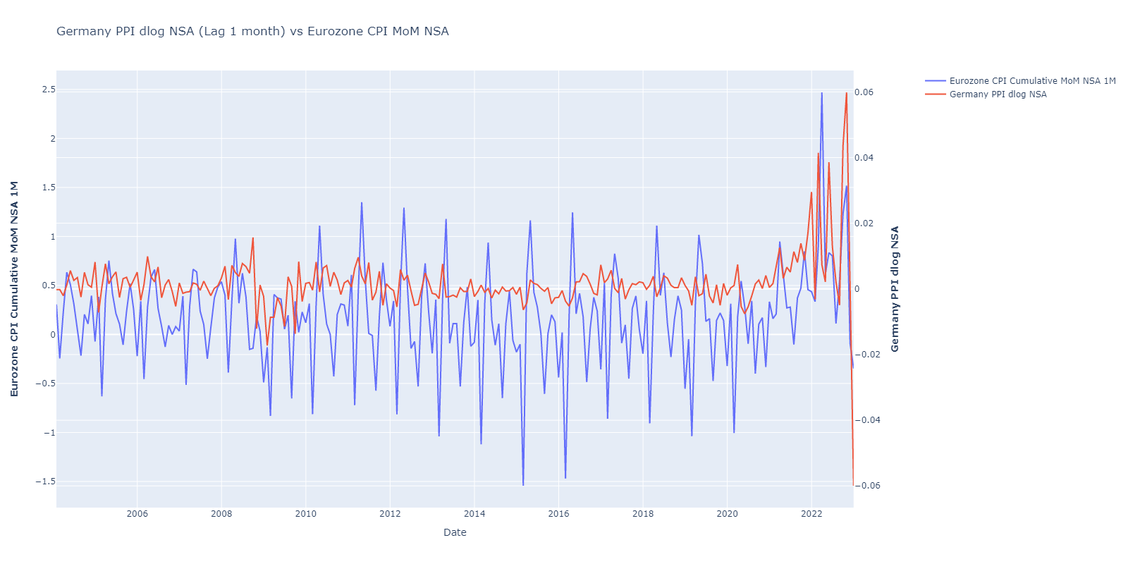

Our Eurozone model leverages around 6,000 variables to make a prediction. Two of the variables that heavily influenced our model’s output this month are log changes of PPI and CPI for Germany which both declined in the last month. Historically, both appear to be a strong leading indicator for Eurozone CPI one month ahead, with 31% and 40% correlations respectively.