Using Turnleaf Analytics inflation forecasts to trade FX

In this paper, we show how using the differential in Turnleaf Analytics inflation forecasts compared to consensus can be used to trade FX systematically. The idea is that the differential in inflation forecasts can be a proxy for relative monetary policy expectations, which impact FX. We extend our previous work by looking at a wider universe of currency pairs and applying more dynamic portfolio allocation rules.

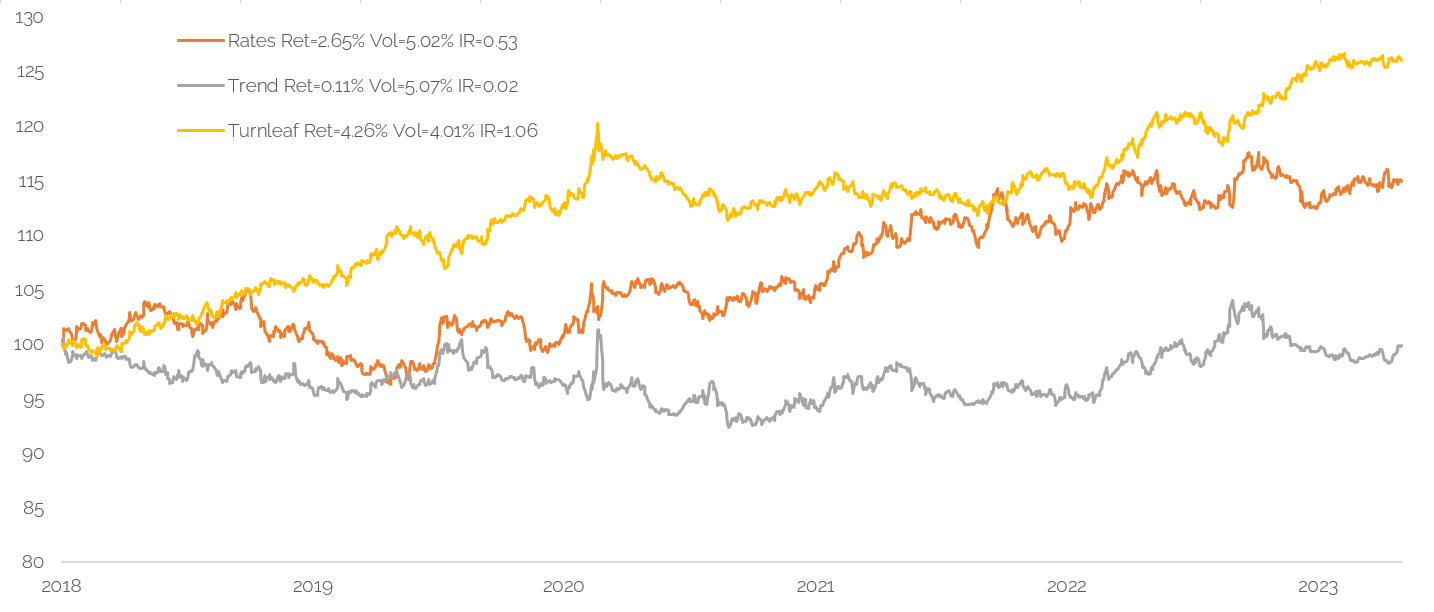

In a historical sample from 2018 onwards, our Turnleaf Analytics inflation strategy for trading FX has risk adjusted returns of 1.06 and annualised returns of 4.26%. By comparison, trend and rates based strategies for trading FX, which can be considered as a benchmark, have risk adjusted returns of 0.53 and 0.02 respectively, underperforming the Turnleaf Analytics strategy.