Featured Blog

Macroeconomic Insights: Rising Costs Hit Germany Where It Can’t Afford It—Manufacturing

Germany, long regarded as Europe’s economic powerhouse, owes much of its success to its export-driven industrial base. However, recent years have seen this foundation weaken under the weight of declining global demand, shifting supply chain dynamics, and rising...

Macroeconomic Insights: Rising Costs Hit Germany Where It Can’t Afford It—Manufacturing

Germany, long regarded as Europe’s economic powerhouse, owes much of its success to its export-driven industrial base. However, recent years have seen this foundation weaken under the weight of declining global demand, shifting supply chain dynamics, and rising competition from emerging markets like China. The war in Ukraine has exacerbated this slowdown by driving up energy costs, particularly as Germany cut its reliance on Russian gas. Together, stagnating exports and elevated energy prices have led to a mix of low economic growth and rising prices—pressuring both businesses and households.

Germany’s economic slowdown has been further compounded by its constitutional “debt brake” policy, which limits public borrowing. This has restricted the government’s ability to invest in renewable energy, infrastructure, and public projects critical for long-term economic resilience. Without the fiscal flexibility to address these challenges, the German economy risks falling further behind in adapting to global economic shifts.

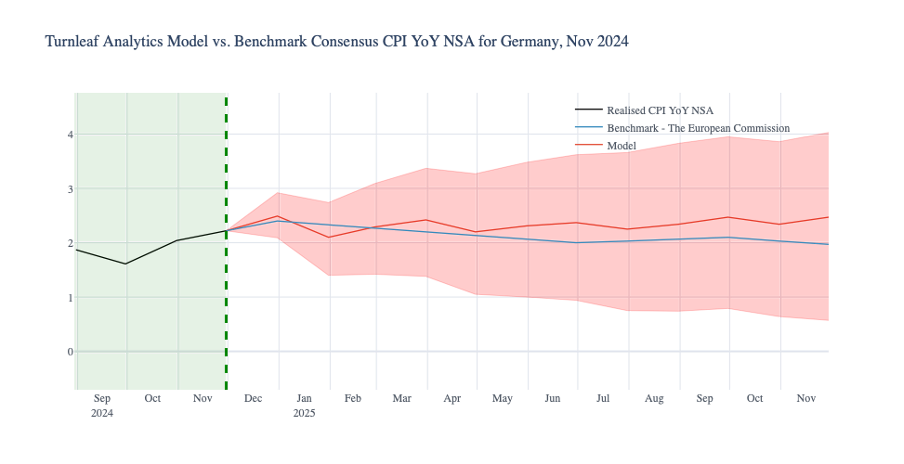

In this context, Turnleaf expects Germany’s CPI to remain within the 2-3% corridor through 2025. Factors driving price increases—particularly energy and input costs—remain deeply embedded in the structure of Germany’s economy.

Industrial Weakness and Rising Costs

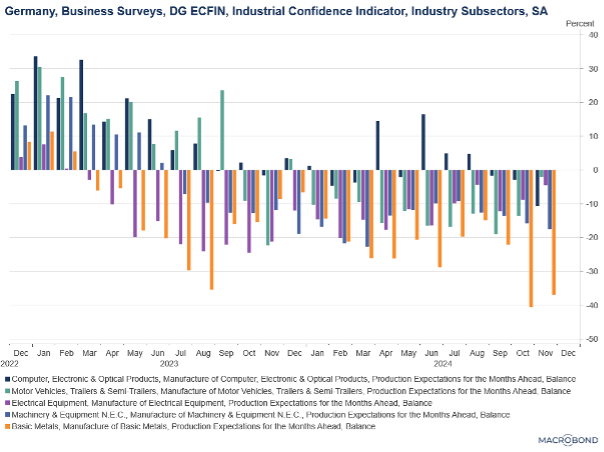

The decline in Germany’s industrial confidence has been stark. In November 2024, the industrial confidence indicator fell 35.47% YoY, with 27.5% more businesses pessimistic about the sector’s outlook compared to the prior year. Capacity utilization in manufacturing dropped to 76.1% in Q3 2024, down from 77.7% in Q2, signaling reduced production activity. This contraction points to lower investment levels, potential layoffs, and a slower pace of industrial recovery.

Certain industries, including basic metals and machinery, are experiencing particularly severe challenges. By late 2024, confidence in these sectors fell below -40% and 15%, respectively, reflecting rising costs, global competition, and weak demand. The automotive and electrical equipment industries also remain under strain, with high energy prices and structural inefficiencies contributing to sustained negative sentiment.

Input costs have become a major obstacle for German manufacturers, as demonstrated by a 10.47% YoY rise in Germany’s industrial raw materials index in November 2024. Heavy reliance on China as both a supplier and competitor amplifies these pressures. The basic metals subsector, vital to Germany’s industrial economy, has been particularly affected, with 48% more firms expecting production declines. Copper, a key import, rose 13.03% YoY in November, underscoring how rising global commodity prices and uncertainty surrounding U.S. trade policies are adding to production challenges.

Energy Prices and Inflationary Pressures

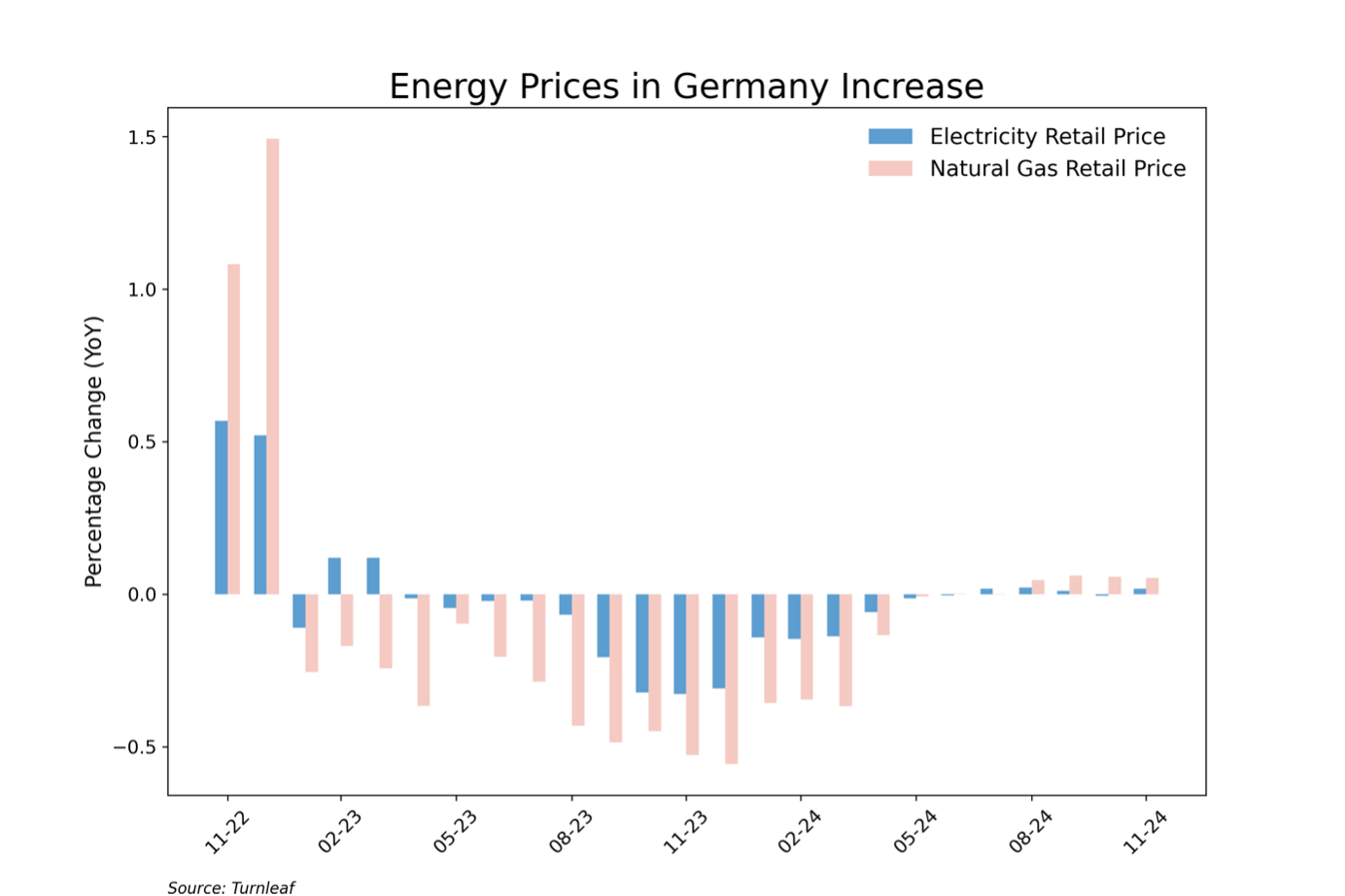

Germany’s reliance on Russian gas prior to the war in Ukraine left the country vulnerable to energy price increases. In 2023, natural gas accounted for 26% of Germany’s energy mix, and the sharp price hikes following the war created significant inflationary pressures. While YoY declines in natural gas prices throughout 2023 reflected high base effects from 2022, the modest rebound in late 2024 highlights ongoing risks, particularly for energy-intensive industries and households.

Electricity prices remain elevated, further increasing production costs and straining household budgets. Any additional supply disruptions or seasonal demand spikes could worsen inflationary pressures, especially as energy is a key input for Germany’s industrial sector.

Employment Challenges and Structural Risks

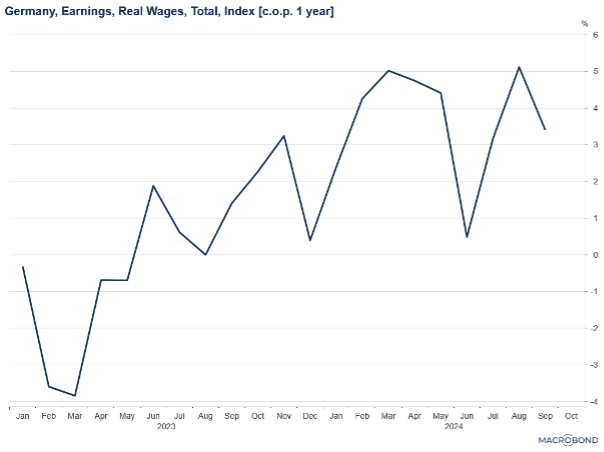

Germany’s pandemic-era savings provided temporary relief for households facing inflation, but this buffer is depleting. In Q3 2024, total savings in the economy dropped 5.94% YoY, as rising living costs forced households to draw on reserves. Wages rose 3.4% YoY in November 2024, offering some support for consumer spending, but real wage growth has started to fade, highlighting the financial strain on households.

The industrial slowdown has also begun to impact employment. Rising input costs and subdued demand contributed to a 7.63% QoQ rise in unemployment in Q3 2024. The automotive sector, a pillar of Germany’s economy, is at the forefront of these challenges. Weaker global demand and increased competition in EVs, particularly from China, have forced manufacturers like Volkswagen to consider closing three plants in Germany, potentially resulting in tens of thousands of job losses.

Union negotiations and worker strikes have delayed these decisions, with talks set to resume in December 2024. However, years of poor performance in the automotive sector suggest that substantial wage increases are unlikely, regardless of the outcome.

Turnleaf’s Inflation Insights

Germany’s inflation outlook will hinge on how effectively the country addresses its structural and economic challenges. The March 2025 elections may bring reforms to the “debt brake” policy, potentially enabling greater fiscal investment to stimulate domestic demand and support long-term growth.

While Turnleaf expects inflation to stabilize within the 2-3% range, underlying pressures remain significant. Rising energy and input costs, weak industrial output, and limited fiscal flexibility continue to present risks to Germany’s economic resilience. These challenges, coupled with global trade dynamics and intensifying competition, will require coordinated policy measures to avoid prolonged economic stagnation.

Subscribers can gain insights into the key drivers influencing Turnleaf’s CPI forecasts by examining our Word Cloud. Each term represents an economic indicator’s relative importance in our CPI model. The size of each word reflects its contribution magnitude to overall inflation predictions, helping subscribers quickly identify the most influential factors. The color coding further clarifies each indicator’s impact direction: blue words represent indicators with a disinflationary effect on CPI, while red words highlight inflationary factors. For instance, words or phrases that are large, indicating their significant weight in the model, while their color suggests whether they contribute to higher or lower inflation trends. This Word Cloud enables a quick, visual analysis of the complex landscape of inflationary and disinflationary influences in our forecasting model.

Blog Archive

Macroeconomic Insights: U.S. Inflation Outlook Under Another Trump Presidency

As U.S. economic conditions continue to evolve, Turnleaf will actively monitor inflation trends and publish regular updates to keep you informed. Our focus remains on leading indicators that provide real-time insights into market sentiment on inflation, delivering...

Macroeconomic Insights: Turkey’s Two-Front Fight with Inflation and the Lira

Turkey’s central bank has adopted a stringent monetary policy to combat inflation, a stark departure from previous unorthodox strategies. With borrowing costs now at a benchmark high of 50% since March 2024—the highest since 2002—this hawkish approach is beginning to...

Inflation Outlook for Canada in October 2024- Producer Optimism, Consumer Pains

Canada’s inflation outlook is shaped by a complex mix of declining energy costs, rising food prices, and evolving trade dynamics. At Turnleaf Analytics, we’re closely tracking these factors to provide our clients with a clear view of CPI trends and their potential...

How Bad is Too Bad? Japan’s Reckoning with Inflation and New Leadership

Japan’s battle with inflation has become a key issue, reshaping public sentiment and influencing recent election results. With the Liberal Democratic Party (LDP)–Komeito coalition losing its majority in the recent elections, Turnleaf is watching how economic...

Turnleaf’s Inflation Outlook for Brazil: Rising Costs Amid Currency Pressures

Turnleaf’s Brazil’ inflation outlook for the next 12 months has undergone an upward revision, driven by several significant factors. While shipping costs have eased, inflationary pressures are resurfacing due to both structural and recent developments in the economy....

Turnleaf’s October 2024 Economic Forecast: Deflationary Pressures Persist in China

Turnleaf Analytics’ forecast for YoY NSA CPI published in October 2024 suggests an inflation trajectory expected to remain well below 2% over the coming 12 months. Specifically, our model projects a 0.74% YoY NSA CPI increase for October, underscoring persistent...